From Wikipedia, the free encyclopedia

With Transfinancial Economics it would be possible to get a far more accurate understanding of Macroeconomics in Real-Time. This is revolutionary, and goes way beyond the limited claims of this Wikipedia article. http://www.p2pfoundation.net/Transfinancial_Economics RS

| Economics |

|---|

|

|

|

| By application |

|

| Lists |

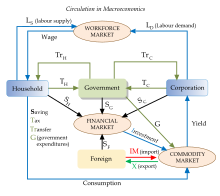

Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indexes to understand how the whole economy functions. Macroeconomists develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, investment, international trade and international finance. In contrast, microeconomics is primarily focused on the actions of individual agents, such as firms and consumers, and how their behavior determines prices and quantities in specific markets.

While macroeconomics is a broad field of study, there are two areas of research that are emblematic of the discipline: the attempt to understand the causes and consequences of short-run fluctuations in national income (the business cycle), and the attempt to understand the determinants of long-run economic growth (increases in national income). Macroeconomic models and their forecasts are used by governments to assist in the development and evaluation of economic policy.

Contents

[hide]Basic macroeconomic concepts[edit]

Macroeconomics encompasses a variety of concepts and variables, but there are three central topics for macroeconomic research.[3] Macroeconomic theories usually relate the phenomena of output, unemployment, and inflation. Outside of macroeconomic theory, these topics are also important to all economic agents including workers, consumers, and producers.Output and income[edit]

National output is the total value of everything a country produces in a given time period. Everything that is produced and sold generates income. Therefore, output and income are usually considered equivalent and the two terms are often used interchangeably. Output can be measured as total income, or, it can be viewed from the production side and measured as the total value of final goods and services or the sum of all value added in the economy.[4]Macroeconomic output is usually measured by Gross Domestic Product (GDP) or one of the other national accounts. Economists interested in long-run increases in output study economic growth. Advances in technology, accumulation of machinery and other capital, and better education and human capital all lead to increased economic output over time. However, output does not always increase consistently. Business cycles can cause short-term drops in output called recessions. Economists look for macroeconomic policies that prevent economies from slipping into recessions and that lead to faster long-term growth.

Unemployment[edit]

Main article: Unemployment

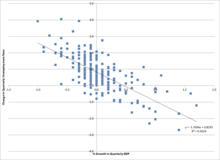

A chart using US data showing the relationship between economic growth and unemployment expressed by Okun's law. The relationship demonstrates cyclical unemployment. Economic growth leads to a lower unemployment rate.

Unemployment can be generally broken down into several types that are related to different causes.

- Classical unemployment occurs when wages are too high for employers to be willing to hire more workers.

- Consistent with classical unemployment, frictional unemployment occurs when appropriate job vacancies exist for a worker, but the length of time needed to search for and find the job leads to a period of unemployment.[5]

- Structural unemployment covers a variety of possible causes of unemployment including a mismatch between workers' skills and the skills required for open jobs.[6] Large amounts of structural unemployment can occur when an economy is transitioning industries and workers find their previous set of skills are no longer in demand. Structural unemployment is similar to frictional unemployment since both reflect the problem of matching workers with job vacancies, but structural unemployment covers the time needed to acquire new skills not just the short term search process.[7]

- While some types of unemployment may occur regardless of the condition of the economy, cyclical unemployment occurs when growth stagnates. Okun's law represents the empirical relationship between unemployment and economic growth.[8] The original version of Okun's law states that a 3% increase in output would lead to a 1% decrease in unemployment.[9]

Inflation and deflation[edit]

Central bankers, who control a country's money supply, try to avoid changes in price level by using monetary policy. Raising interest rates or reducing the supply of money in an economy will reduce inflation. Inflation can lead to increased uncertainty and other negative consequences. Deflation can lower economic output. Central bankers try to stabilize prices to protect economies from the negative consequences of price changes.

Changes in price level may be result of several factors. The quantity theory of money holds that changes in price level are directly related to changes in the money supply. Most economists believe that this relationship explains long-run changes in the price level.[10] Short-run fluctuations may also be related to monetary factors, but changes in aggregate demand and aggregate supply can also influence price level. For example, a decrease in demand because of a recession can lead to lower price levels and deflation. A negative supply shock, like an oil crisis, lowers aggregate supply and can cause inflation.

Macroeconomic models[edit]

Aggregate demand–aggregate supply[edit]

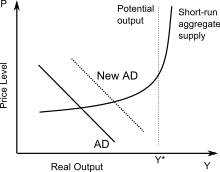

The AD-AS model has become the standard textbook model for explaining the macroeconomy.[11] This model shows the price level and level of real output given the equilibrium in aggregate demand and aggregate supply. The aggregate demand curve's downward slope means that more output is demanded at lower price levels.[12] The downward slope is the result of three effects: the Pigou or real balance effect, which states that as real prices fall, real wealth increases, so consumers demand more goods; the Keynes or interest rate effect, which states that as prices fall the demand for money declines causing interest rates to decline and borrowing for investment and consumption to increase; and the net export effect, which states that as prices rise, domestic goods become comparatively more expensive to foreign consumers and thus exports decline.[12]In the conventional Keynesian use of the AS-AD model, the aggregate supply curve is horizontal at low levels of output and becomes inelastic near the point of potential output, which corresponds with full employment.[11] Since the economy cannot produce beyond more than potential output, any AD expansion will lead to higher price levels instead of higher output.

IS–LM[edit]

The IS–LM model represents the equilibrium in interest rates and output given by the equilibrium in the goods and money markets.[15] The goods market is represented by the equilibrium in investment and saving (IS), and the money market is represented by the equilibrium between the money supply and liquidity preference.[16] The IS curve consists of the points where investment, given the interest rate, is equal to savings, given output.[17]The IS curve is downward sloping because output and the interest rate have an inverse relationship in the goods market: As output increases more money is saved, which means interest rates must be lower to spur enough investment to match savings.[17] The LM curve is upward sloping because interest rates and output have a positive relationship in the money market. As output increases, the demand for money increases, and interest rates increase.[18]

Growth models[edit]

The neoclassical growth model of Robert Solow has become a common textbook model for explaining economic growth in the long-run. The model begins with a production function where national output is the product of two inputs: capital and labor. The Solow model assumes that labor and capital are used at constant rates without the fluctuations in unemployment and capital utilization commonly seen in business cycles.[19]An increase in output, economic growth, can only occur because of an increase in the capital stock, a larger population, or technological advancements that lead to higher productivity (Total factor productivity). An increase in the savings rate leads to a temporary increase as the economy creates more capital, which adds to output. However, eventually the depreciation rate will limit the expansion of capital: Savings will be used up replacing depreciated capital, and no savings will remain to pay for an additional expansion in capital. Solow's model suggests that economic growth in terms of output per capita depends solely on technological advances that enhance productivity.[20]

In the 1980s and 1990s endogenous growth theory arose to challenge neoclassical growth theory. This group of models explains economic growth through other factors, like increasing returns to scale for capital and learning-by-doing, that are endogenously determined instead of the exogenous technological improvement used to explain growth in Solow's model.[21]

Macroeconomic policy[edit]

Macroeconomic policy is usually implemented through two sets of tools: fiscal and monetary policy. Both forms of policy are used to stabilize the economy, which usually means boosting the economy to the level of GDP consistent with full employment.[22]Monetary policy[edit]

Further information: Monetary policy

Central banks implement monetary policy by controlling the money supply through several mechanisms. Typically, central banks take action by issuing money to buy bonds (or other assets), which boosts the supply of money and lowers interest rates, or, in the case of contractionary monetary policy, banks sell bonds and takes money out of circulation. Usually policy is not implemented by directly targeting the supply of money.Banks continuously shift the money supply to maintain a fixed interest rate target. Some banks allow the interest rate to fluctuate and focus on targeting inflation rates instead. Central banks generally try to achieve high output without letting loose monetary policy create large amounts of inflation.

Conventional monetary policy can be ineffective in situations such as a liquidity trap. When interest rates and inflation are near zero, the central bank cannot loosen monetary policy through conventional means. Central banks can use unconventional monetary policy such as quantitative easing to help increase output. Instead of buying government bonds, central banks implement quantitative easing by buying other assets such as corporate bonds, stocks, and other securities.

This allows lowers interest rates for broader class of assets beyond government bonds. In another example of unconventional monetary policy, the United States Federal Reserve recently made an attempt at such as policy with Operation Twist. Unable to lower current interest rates, the Federal Reserve lowered long-term interest rates by buying long-term bonds and selling short-term bonds to create a flat yield curve.

Fiscal policy[edit]

Further information: Fiscal policy

Fiscal policy is the use of government's revenue and expenditure as instruments to influence the economy. Examples of such tools are expenditure, taxes, debt.For example, if the economy is producing less than potential output, government spending can be used to employ idle resources and boost output. Government spending does not have to make up for the entire output gap. There is a multiplier effect that boosts the impact of government spending. For example, when the government pays for a bridge, the project not only adds the value of the bridge to output, it also allows the bridge workers to increase their consumption and investment, which also help close the output gap.

The effects of fiscal policy can be limited by crowding out. When government takes on spending projects, it limits the amount of resources available for the private sector to use. Crowding out occurs when government spending simply replaces private sector output instead of adding additional output to the economy. Crowding out also occurs when government spending raises interest rates which limits investment. Defenders of fiscal stimulus argue that crowding out is not a concern when the economy is depressed, plenty of resources are left idle, and interest rates are low.

Fiscal policy can be implemented through automatic stabilizers. Automatic stabilizers do not suffer from the policy lags of discretionary fiscal policy. Automatic stabilizers use conventional fiscal mechanisms but take effect as soon as the economy takes a downturn: spending on unemployment benefits automatically increases when unemployment rises and, in a progressive income tax system, the effective tax rate automatically falls when incomes decline.

Comparison[edit]

Economists usually favor monetary over fiscal policy because it has two major advantages. First, monetary policy is generally implemented by independent central banks instead of the political institutions that control fiscal policy. Independent central banks are less likely to make decisions based on political motives.[22] Second, monetary policy suffers shorter inside lags and outside lags than fiscal policy. Central banks can quickly make and implement decisions while discretionary fiscal policy may take time to pass and even longer to carry out.[22]Development[edit]

Main article: History of macroeconomic thought

Origins[edit]

Macroeconomics descended from the once divided fields of business cycle theory and monetary theory.[23] The quantity theory of money was particularly influential prior to World War II. It took many forms including the version based on the work of Irving Fisher:Austrian School[edit]

Ludwig Von Mises work Theory of Money and Credit published in 1912 was one of the first books from the Austrian School to deal with macroeconomic topics.Keynes and his followers[edit]

Macroeconomics, at least in its modern form,[24] began with the publication of John Maynard Keynes's General Theory of Employment, Interest and Money.[23][25] When the Great Depression struck, classical economists had difficulty explaining how goods could go unsold and workers could be left unemployed. In classical theory, prices and wages would drop until the market cleared, and all goods and labor were sold. Keynes offered a new theory of economics that explained why markets might not clear, which would evolve (later in the 20th century) into a group of macroeconomic schools of thought known as Keynesian economics – also called Keynesianism or Keynesian theory.In Keynes's theory, the quantity theory broke down because people and businesses tend to hold on to their cash in tough economic times, a phenomenon he described in terms of liquidity preferences. Keynes also explained how the multiplier effect would magnify a small decrease in consumption or investment and cause declines throughout the economy. Keynes also noted the role uncertainty and animal spirits can play in the economy.[24]

The generation following Keynes combined the macroeconomics of the General Theory with neoclassical microeconomics to create the neoclassical synthesis. By the 1950s, most economists had accepted the synthesis view of the macro economy.[24] Economists like Paul Samuelson, Franco Modigliani, James Tobin, and Robert Solow developed formal Keynesian models, and contributed formal theories of consumption, investment, and money demand that fleshed out the Keynesian framework.[26]

Monetarism[edit]

Milton Friedman updated the quantity theory of money to include a role for money demand. He argued that the role of money in the economy was sufficient to explain the Great Depression and aggregate demand oriented explanations were not necessary. Friedman argued that monetary policy was more effective than fiscal policy; however, Friedman doubted the government has ability to "fine-tune" the economy with monetary policy. He generally favored a policy of steady growth in money supply instead of frequent intervention.[27]Friedman also challenged the Phillips curve relationship between inflation and unemployment. Friedman and Edmund Phelps (who was not a monetarist) proposed an "augmented" version of the Phillips curve that excluded the possibility of a stable, long-run tradeoff between inflation and unemployment. When the oil shocks of the 1970s created a high unemployment and high inflation, Friedman and Phelps were vindicated. Monetarism was particularly influential in the early 1980s. Monetarism fell out of favor when central banks found it difficult to target money supply instead of interest rates as monetarists recommended. Monetarism also became politically unpopular when the central banks created recessions in order to slow inflation.

New classicals[edit]

New classical macroeconomics further challenged the Keynesian school. A central development in new classical thought came when Robert Lucas introduced rational expectations to macroeconomics. Prior to Lucas, economists had generally used adaptive expectations where agents were assumed to look at the recent past to make expectations about the future. Under rational expectations, agents are assumed to be more sophisticated. A consumer will not simply assume a 2% inflation rate because that has been the average the past few years; she will look at current monetary policy and economic conditions to make an informed forecast. When new classical economists introduced rational expectations into their models, they showed that monetary policy could only have a limited impact.Lucas also made an influential critique of Keynesian empirical models. He argued that forecasting models based on empirical relationships would keep producing the same predictions even as the underlying model generating the data changed. He advocated models based on fundamental economic theory that would, in principle, be structurally accurate as economies changed. Following Lucas's critique, new classical economists, led by Edward C. Prescott and Finn E. Kydland created real business cycle (RBC) models of the macroeconomy.[28]

RBC models were created by combining fundamental equations from neo-classical microeconomics. In order to generate macroeconomic fluctuations, RBC models explained recessions and unemployment with changes in technology instead changes in the markets for goods or money. Critics of RBC models argue that money clearly plays an important role in the economy, and the idea that technological regress can explain recent recessions is also implausible.[29] However, technological shocks are only the more prominent of a myriad of possible shocks to the system that can be modeled. Despite questions about the theory behind RBC models, they have clearly been influential in economic methodology.

New Keynesian response[edit]

New Keynesian economists responded to the new classical school by adopting rational expectations and focusing on developing micro-founded models that are immune to the Lucas critique. Stanley Fischer and John B. Taylor produced early work in this area by showing that monetary policy could be effective even in models with rational expectations when contracts locked-in wages for workers. Other new Keynesian economists expanded on this work and demonstrated other cases where inflexible prices and wages led to monetary and fiscal policy having real effects.Like classical models, new classical models had assumed that prices would be able to adjust perfectly and monetary policy would only lead to price changes. New Keynesian models investigated sources of sticky prices and wages due to imperfect competition,[30] which would not adjust, allowing monetary policy to impact quantities instead of prices.

By the late 1990s economists had reached a rough consensus. The rigidities of new Keynesian theory were combined with rational expectations and the RBC methodology to produce dynamic stochastic general equilibrium (DSGE) models. The fusion of elements from different schools of thought has been dubbed the new neoclassical synthesis. These models are now used by many central banks and are a core part of contemporary macroeconomics.[31]

New Keynesian economics: which developed partly in response to new classical economics, strives to provide microeconomic foundations to Keynesian economics by showing how imperfect markets can justify demand management.

See also[edit]

Notes[edit]

- Jump up ^ Blaug, Mark (1985), Economic theory in retrospect, Cambridge, UK: Cambridge University Press, ISBN 0-521-31644-8

- Jump up ^ Sullivan, Arthur; Steven M. Sheffrin (2003), Economics: Principles in action, Upper Saddle River, New Jersey 07458: Pearson Prentice Hall, p. 57, ISBN 0-13-063085-3

- Jump up ^ Blanchard (2011), 32.

- Jump up ^ Blanchard (2011), 22.

- Jump up ^ Dwivedi, 443.

- Jump up ^ Freeman (2008). http://www.dictionaryofeconomics.com/article?id=pde2008_S000311.

- Jump up ^ Dwivedi, 444–445.

- Jump up ^ Dwivedi, 445–446.

- Jump up ^ Neely, Christopher J. "Okun's Law: Output and Unemployment. Economic Synopses. Number 4. 2010. http://research.stlouisfed.org/publications/es/10/ES1004.pdf.

- Jump up ^ Mankiw 2014, p. 634.

- ^ Jump up to: a b Healey 2002, p. 12.

- ^ Jump up to: a b Healey 2002, p. 13.

- Jump up ^ Healey 2002, p. 14.

- Jump up ^ Colander 1995, p. 173.

- ^ Jump up to: a b c d Durlauf & Hester 2008.

- Jump up ^ Peston 2002, p. 386-387.

- ^ Jump up to: a b Peston 2002, p. 387.

- Jump up ^ Peston 2002, p. 387-388.

- Jump up ^ Solow 2002, p. 518-519.

- Jump up ^ Solow 2002, p. 519.

- Jump up ^ Blaug 2002, p. 202-203.

- ^ Jump up to: a b c Mayer, 495.

- ^ Jump up to: a b Dimand (2008).

- ^ Jump up to: a b c Blanchard (2011), 580.

- Jump up ^ Snowdon, Brian; Wane, Howard R. (2005). Modern Macroeconomics - Its origins, development and current state. Edward Elgar. ISBN 1 84542 208 2.

- Jump up ^ Blanchard (2011), 581.

- Jump up ^ Blanchard (2011), 582–583.

- Jump up ^ Blanchard (2011), 587.

- Jump up ^ Blanchard (2011), 587.

- Jump up ^ The role of imperfect competition in new Keynesian economics, Chapter 4 of Surfing Economics by Huw Dixon

- Jump up ^ Blanchard (2011), 590.

References[edit]

| Library resources about Macroeconomics |

- Blanchard, Olivier (2000), Macroeconomics, Prentice Hall, ISBN 0-13-013306-X.

- Blanchard, Olivier (2011). Macroeconomics Updated (5th ed.). Englewood Cliffs: Prentice Hall. ISBN 978-0-13-215986-9.

- Blaug, Mark (1986), Great Economists before Keynes, Brighton: Wheatsheaf.

- Blaug, Mark (2002). "Endogenous growth theory". In Snowdon, Brian; Vane, Howard. An Encyclopedia of Macroeconomics. Northhampton, Massachusetts: Edward Elgar Publishing. ISBN 978-1-84542-180-9.

- Boettke, Peter (2001), Calculation and Coordination: Essays on Socialism and Transitional Political Economy, Routledge, ISBN 0-415-77109-9.

- Bouman, John: Principles of Macroeconomics – free fully comprehensive Principles of Microeconomics and Macroeconomics texts. Columbia, Maryland, 2011

- Dimand, Robert W. (2008). "Macroeconomics, origins and history of". In Durlauf, Steven N.; Blume, Lawrence E. The New Palgrave Dictionary of Economics (Palgrave Macmillan). doi:10.1057/9780230226203.1009.

- Durlauf, Steven N.; Hester, Donald D. (2008). "IS–LM". In Durlauf, Lawrence E.; Blume. The New Palgrave Dictionary of Economics (Second ed.). Palgrave Macmillan. doi:10.1057/9780230226203.0855. Retrieved 5 June 2012.

- Dwivedi, D.N. (2001). Macroeconomics : theory and policy. New Delhi: Tata McGraw-Hill. ISBN 978-0-07-058841-7.

- Friedman, Milton (1953), Essays in Positive Economics, London: University of Chicago Press, ISBN 0-226-26403-3.

- Haberler, Gottfried (1937), Prosperity and depression, League of Nations.

- Leijonhufvud, Axel The Wicksell Connection: Variation on a Theme. UCLA. November, 1979.

- Healey, Nigel M. (2002). "AD-AS model". In Snowdon, Brian; Vane, Howard. An Encyclopedia of Macroeconomics. Northhampton, Massachusetts: Edward Elgar Publishing. pp. 11–18. ISBN 978-1-84542-180-9.

- Heijdra, B. J.; Ploeg, F. van der (2002), Foundations of Modern Macroeconomics, Oxford University Press, ISBN 0-19-877617-9 .

- Mankiw, N. Gregory (2014), Principles of Economics, Cengage Learning, ISBN 9781305156043

- Mises, Ludwig Von (1912), Theory of Money and Credit, Yale University Press.

- Mayer, Thomas (2002). "Monetary polic: role of". In Snowdon, Brian; Vane, Howard. An Encyclopedia of Macroeconomics. Northhampton, Massachusetts: Edward Elgar Publishing. pp. 495–499. ISBN 978-1-84542-180-9.

- Mishkin, Frederic S. (2004), The Economics of Money, Banking, and Financial Markets, Boston: Addison-Wesley, p. 517

- Peston, Maurice (2002). "IS-LM model: closed economy". In Snowdon, Brian; Vane, Howard R. An Encyclopedia of Macroeconomics. Edward Elgar.

- Solow, Robert (2002). "Neoclassical growth model". In Snowdon, Brian; Vane, Howard. An Encyclopedia of Macroeconomics. Northhampton, Massachusetts: Edward Elgar Publishing. ISBN 978-1-84542-180-9.

- Snowdon, Brian, and Howard R. Vane, ed. (2002). An Encyclopedia of Macroeconomics, Description & scroll to Contents-preview links.

- Snowdon, Brian; , Howard R. Vane (2005), Modern Macroeconomics: Its Origins, Development And Current State, Edward Elgar Publishing, ISBN 1-84376-394-X .

- Gärtner, Manfred (2006), Macroeconomics, Pearson Education Limited, ISBN 978-0-273-70460-7.

- Warsh, David (2006), Knowledge and the Wealth of Nations, Norton, ISBN 978-0-393-05996-0.

- Levi, Maurice (2014). The Macroeconomic Environment of Business (Core Concepts and Curious Connections). New Jersey, USA: World Scientific Publishing. ISBN 978-981-4304-34-4.

| ||||||||||||||||||||||||||||||

No comments:

Post a Comment