In Transfinancial Economics tracking goods, and services plays a vital role. Blogger Link http://www.p2pfoundation.net/Transfinancial_Economics

Exclusive: Premise, a data technology company that is tracking macroeconomic and human development trends in real-time, is announcing an $11 million Series B round led by Social+Capital Partnership, with existing investors Harrison Metal, Google Ventures and Bowery Capital participating. This brings the startup’s funding to $16.5 million. Former Facebook exec Chamath Palihapitiya, founder of Social+Capital Partnership, is joining Premise’s board.

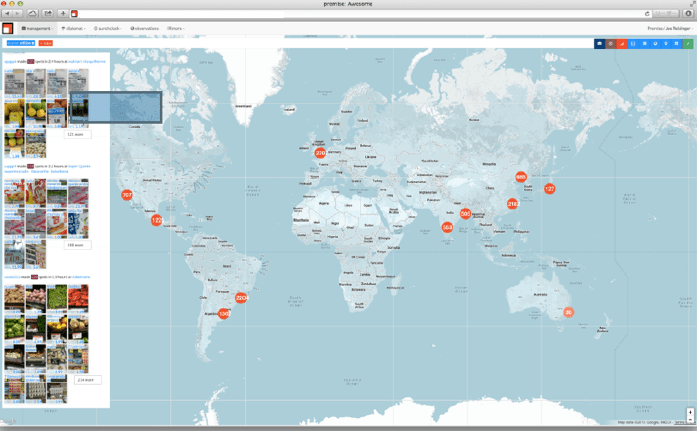

Premise monitors the price, quality, availability, and other metrics of goods and services, from online and on-the-ground sources. This data includes price, MSRP/list price, discount, in-stock, and ratings information for food, grocery items, clothing and much more. Data is drawn from two sources: online and on-the-ground. The online data draws from 20,000 e-commerce websites.

But the most interesting part of what Premise is doing is in the offline world. The startup has enabled a workforce of ordinary citizens in each location to take pictures of food and other staples. These individuals get paid to take pictures of items at grocery stores, food markets and more via a proprietary mobile app for both Android and iOS, and these images are uploaded to Premise’s platform with data such as price, location, the exact grocery store/market in which the food was pictured in, date and time and more. Many of these mobile workers are making $20 to $40 per week on the side to take these photos, says Soloff.

As Soloff explained to me, his team is “building a distributed global mobile workforce that lets customers understand what’s actually happening on the ground in hard-to-reach places.”

For example, if a consumer packaged goods manufacturer wants to consider selling a product in India, it would distribute a task via Premise around taking photos of similar goods being sold by competitors, what area of the store in which they are sold, placement on the shelf and more. Many financial services companies are paying for data around the price increases of goods.

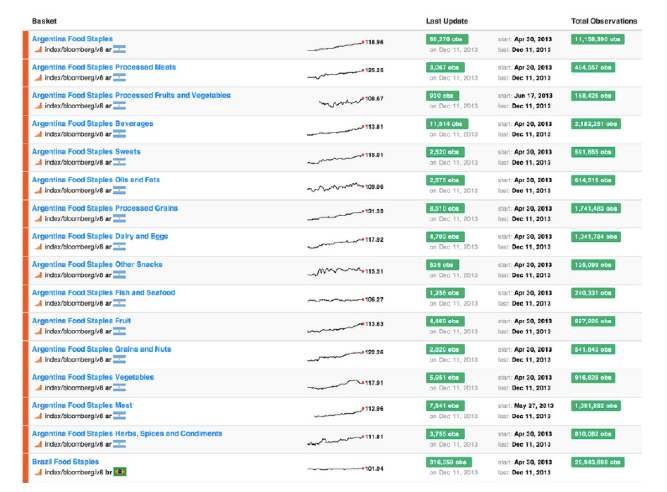

Premise is tracking 25 food staples in 25 cities in India, China, Brazil and other developing countries.

The startup has built indexes around each food item so that customers, which include Bloomberg, can see the increase/decrease, and volatility in price of grains, beverages, sweets, oils and fats, dairy and eggs. Many customers are using Premise and its data to predict inflation, adds Soloff. And Premise could also be able to identify imbalances of food, water and other resources as they start to happen, allowing governments and organizations to respond in a more timely manner.

So where did this data come from previously? Much of the food data was from internal government indices, but there was no assurance around how accurate this was. Soloff and Premise have created a new, real-time way to assure that these indices around food inflation and pricing are real.

And financial services companies and corporations are signing on. Premise can’t disclose many of its customers, but as mentioned above, Bloomberg redistributes Premise data via its terminals and is a customer of the startup.

In terms of recruiting on-the-ground coverage, Premise has focused on outreach to connectors, such as university students, in the cities. The company also employs city managers and country managers in local teams. As Soloff puts it, the startup is taking the Uber growth model and applying it to its own operations.

The company is also running various experiments, such as additional incentives for people to contribute to the platform. Premise also offers an API, and is hopeful more developers will build apps off of Premise.

Karim Faris, general partner at Google Ventures, is particularly excited about what Premise is doing. “The core of what they are building is a global data-capture network,” he tells us. “And the company makes sure the network is breathable and cost efficient for all parties.”

In the future, Soloff has a vision bigger than just providing economic data. He sees opportunities to create a social utility around what people are doing on the ground. This of course will require scale. But that’s something that Palihapitiya is familiar with — he helped grow Facebook.

He agrees with Soloff on the social potential:

Whether they are collecting data to help steer economic decisions of others, getting competitive intelligence for one company on another or simply being part of a real-time, information market to answer any real-time request the application is being set up for scale. Over time, people will want to be part of this network for economic reasons, for social ranking, to help organizations they support, and to be on the right side of social justice. Regardless of the incentives the company can build a massive information marketplace and monetize this through companies and institutions paying for ‘ground truth.’ We can then turn around and return some of that value back to the network so they see the value in being part of the premise community.There’s something very powerful in what Soloff is trying to do–there are of course challenges in creating a marketplace with a workforce. But as he explained, if he can scale the platform both in terms of data inputted and the expansion of the workforce, Premise could be more than a financial data source–it could be part of a social movement.

8 PERMAINAN DALAM 1 USER ID DENGAN RATE KEMENANGAN JUDI POKER PEMAIN MENCAPAI 90% !!

ReplyDeleteHUBUNGI KAMI !!

WA: 0812.2222.996

BBM : PKRVITA1 (HURUF BESAR)

Wechat: pokervitaofficial

Line: vitapoker

GAME POKER ONLINE INDONESIA