From Wikipedia, the free encyclopedia

Blogger Reference Link http://www.p2pfoundation.net/Transfinancial_Economics

For other uses, see Supply and demand (disambiguation).

| Part of a series on |

| Capitalism |

|---|

|

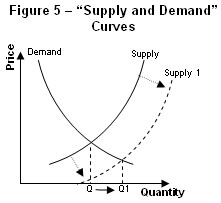

The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D). The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product.

The four basic laws of supply and demand are:[1]:37

- If demand increases and supply remains unchanged, a shortage occurs, leading to a higher equilibrium price.

- If demand decreases and supply remains unchanged, a surplus occurs, leading to a lower equilibrium price.

- If demand remains unchanged and supply increases, a surplus occurs, leading to a lower equilibrium price.

- If demand remains unchanged and supply decreases, a shortage occurs, leading to a higher equilibrium price.

Contents

[hide]Graphical representation of supply and demand[edit]

Although it is normal to regard the quantity demanded and the quantity supplied as functions of the price of the good, the standard graphical representation, usually attributed to Alfred Marshall, has price on the vertical axis and quantity on the horizontal axis, the opposite of the standard convention for the representation of a mathematical function.Since determinants of supply and demand other than the price of the good in question are not explicitly represented in the supply-demand diagram, changes in the values of these variables are represented by moving the supply and demand curves (often described as "shifts" in the curves). By contrast, responses to changes in the price of the good are represented as movements along unchanged supply and demand curves.

Supply schedule[edit]

A supply schedule is a table that shows the relationship between the price of a good and the quantity supplied.Under the assumption of perfect competition, supply is determined by marginal cost. Firms will produce additional output while the cost of producing an extra unit of output is less than the price they would receive.

By its very nature, conceptualizing a supply curve requires the firm to be a perfect competitor, namely requires the firm to have no influence over the market price. This is true because each point on the supply curve is the answer to the question "If this firm is faced with this potential price, how much output will it be able to and willing to sell?" If a firm has market power, its decision of how much output to provide to the market influences the market price, then the firm is not "faced with" any price, and the question is meaningless.

Economists distinguish between the supply curve of an individual firm and between the market supply curve. The market supply curve is obtained by summing the quantities supplied by all suppliers at each potential price. Thus, in the graph of the supply curve, individual firms' supply curves are added horizontally to obtain the market supply curve.

Economists also distinguish the short-run market supply curve from the long-run market supply curve. In this context, two things are assumed constant by definition of the short run: the availability of one or more fixed inputs (typically physical capital), and the number of firms in the industry. In the long run, firms have a chance to adjust their holdings of physical capital, enabling them to better adjust their quantity supplied at any given price. Furthermore, in the long run potential competitors can enter or exit the industry in response to market conditions. For both of these reasons, long-run market supply curves are flatter than their short-run counterparts.

The determinants of supply are:

- Production costs: how much a good costs to be produced. Production costs are the cost of the inputs, primarily labor, capital, energy and materials. Production costs depend on the technology used in production, and/or technological advances. See: Productivity

- Firms' expectations about future prices

- Number of suppliers

Demand schedule[edit]

A demand schedule, depicted graphically as the demand curve, represents the amount of some good that buyers are willing and able to purchase at various prices, assuming all determinants of demand other than the price of the good in question, such as income, tastes and preferences, the price of substitute goods, and the price of complementary goods, remain the same. Following the law of demand, the demand curve is almost always represented as downward-sloping, meaning that as price decreases, consumers will buy more of the good.[2]Just like the supply curves reflect marginal cost curves, demand curves are determined by marginal utility curves.[3] Consumers will be willing to buy a given quantity of a good, at a given price, if the marginal utility of additional consumption is equal to the opportunity cost determined by the price, that is, the marginal utility of alternative consumption choices. The demand schedule is defined as the willingness and ability of a consumer to purchase a given product in a given frame of time.

It is aforementioned, that the demand curve is generally downward-sloping, there may be rare examples of goods that have upward-sloping demand curves. Two different hypothetical types of goods with upward-sloping demand curves are Giffen goods (an inferior but staple good) and Veblen goods (goods made more fashionable by a higher price).

By its very nature, conceptualizing a demand curve requires that the purchaser be a perfect competitor—that is, that the purchaser has no influence over the market price. This is true because each point on the demand curve is the answer to the question "If this buyer is faced with this potential price, how much of the product will it purchase?" If a buyer has market power, so its decision of how much to buy influences the market price, then the buyer is not "faced with" any price, and the question is meaningless.

Like with supply curves, economists distinguish between the demand curve of an individual and the market demand curve. The market demand curve is obtained by summing the quantities demanded by all consumers at each potential price. Thus, in the graph of the demand curve, individuals' demand curves are added horizontally to obtain the market demand curve.

The determinants of demand are:

- Income

- Tastes and preferences

- Prices of related goods and services

- Consumers' expectations about future prices and incomes that can be checked

- Number of potential consumers

Microeconomics[edit]

Equilibrium[edit]

Equilibrium is defined to be the price-quantity pair where the quantity demanded is equal to the quantity supplied, represented by the intersection of the demand and supply curves.Market Equilibrium: A situation in a market when the price is such that the quantity that consumers demand is correctly balanced by the quantity that firms wish to supply.

Comparative static analysis: Examines the likely effect on the equilibrium of a change in the external conditions affecting the market.

Changes in market equilibrium: Practical uses of supply and demand analysis often center on the different variables that change equilibrium price and quantity, represented as shifts in the respective curves. Comparative statics of such a shift traces the effects from the initial equilibrium to the new equilibrium.

Demand curve shifts:

Main article: Demand curve

When consumers increase the quantity demanded at a given price, it is referred to as an increase in demand. Increased demand can be represented on the graph as the curve being shifted to the right. At each price point, a greater quantity is demanded, as from the initial curve D1 to the new curve D2. In the diagram, this raises the equilibrium price from P1 to the higher P2. This raises the equilibrium quantity from Q1 to the higher Q2. A movement along the curve is described as a "change in the quantity demanded" to distinguish it from a "change in demand," that is, a shift of the curve. there has been an increase in demand which has caused an increase in (equilibrium) quantity. The increase in demand could also come from changing tastes and fashions, incomes, price changes in complementary and substitute goods, market expectations, and number of buyers. This would cause the entire demand curve to shift changing the equilibrium price and quantity. Note in the diagram that the shift of the demand curve, by causing a new equilibrium price to emerge, resulted in movement along the supply curve from the point (Q1, P1) to the point (Q2, P2).If the demand decreases, then the opposite happens: a shift of the curve to the left. If the demand starts at D2, and decreases to D1, the equilibrium price will decrease, and the equilibrium quantity will also decrease. The quantity supplied at each price is the same as before the demand shift, reflecting the fact that the supply curve has not shifted; but the equilibrium quantity and price are different as a result of the change (shift) in demand.

Supply curve shifts:

Main article: Supply (economics)

When technological progress occurs, the supply curve shifts. For example, assume that someone invents a better way of growing wheat so that the cost of growing a given quantity of wheat decreases. Otherwise stated, producers will be willing to supply more wheat at every price and this shifts the supply curve S1 outward, to S2—an increase in supply. This increase in supply causes the equilibrium price to decrease from P1 to P2. The equilibrium quantity increases from Q1 to Q2 as consumers move along the demand curve to the new lower price. As a result of a supply curve shift, the price and the quantity move in opposite directions. If the quantity supplied decreases, the opposite happens. If the supply curve starts at S2, and shifts leftward to S1, the equilibrium price will increase and the equilibrium quantity will decrease as consumers move along the demand curve to the new higher price and associated lower quantity demanded. The quantity demanded at each price is the same as before the supply shift, reflecting the fact that the demand curve has not shifted. But due to the change (shift) in supply, the equilibrium quantity and price have changed.The movement of the supply curve in response to a change in a non-price determinant of supply is caused by a change in the y-intercept, the constant term of the supply equation. The supply curve shifts up and down the y axis as non-price determinants of demand change.

Partial equilibrium[edit]

Main article: Partial equilibrium

Partial equilibrium as the name suggests takes into consideration only a part of the market, ceteris paribus to attain equilibrium.Jain proposes (attributed to George Stigler): "A partial equilibrium is one which is based on only a restricted range of data, a standard example is price of a single product, the prices of all other products being held fixed during the analysis."[4]

The supply-and-demand model is a partial equilibrium model of economic equilibrium, where the clearance on the market of some specific goods is obtained independently from prices and quantities in other markets. In other words, the prices of all substitutes and complements, as well as income levels of consumers are constant. This makes analysis much simpler than in a general equilibrium model which includes an entire economy.

Here the dynamic process is that prices adjust until supply equals demand. It is a powerfully simple technique that allows one to study equilibrium, efficiency and comparative statics. The stringency of the simplifying assumptions inherent in this approach make the model considerably more tractable, but may produce results which, while seemingly precise, do not effectively model real world economic phenomena.

Partial equilibrium analysis examines the effects of policy action in creating equilibrium only in that particular sector or market which is directly affected, ignoring its effect in any other market or industry assuming that they being small will have little impact if any.

Hence this analysis is considered to be useful in constricted markets.

Léon Walras first formalized the idea of a one-period economic equilibrium of the general economic system, but it was French economist Antoine Augustin Cournot and English political economist Alfred Marshall who developed tractable models to analyze an economic system.

Other markets[edit]

The model of supply and demand also applies to various specialty markets.The model is commonly applied to wages, in the market for labor. The typical roles of supplier and demander are reversed. The suppliers are individuals, who try to sell their labor for the highest price. The demanders of labor are businesses, which try to buy the type of labor they need at the lowest price. The equilibrium price for a certain type of labor is the wage rate.[5]

A number of economists (for example Pierangelo Garegnani,[6] Robert L. Vienneau,[7] and Arrigo Opocher & Ian Steedman[8]), building on the work of Piero Sraffa, argue that this model of the labor market, even given all its assumptions, is logically incoherent. Michael Anyadike-Danes and Wyne Godley[9] argue, based on simulation results, that little of the empirical work done with the textbook model constitutes a potentially falsifying test, and, consequently, empirical evidence hardly exists for that model.

This criticism of the application of the model of supply and demand generalizes, particularly to all markets for factors of production.

In both classical and Keynesian economics, the money market is analyzed as a supply-and-demand system with interest rates being the price. The money supply may be a vertical supply curve, if the central bank of a country chooses to use monetary policy to fix its value regardless of the interest rate; in this case the money supply is totally inelastic. On the other hand,[10] the money supply curve is a horizontal line if the central bank is targeting a fixed interest rate and ignoring the value of the money supply; in this case the money supply curve is perfectly elastic. The demand for money intersects with the money supply to determine the interest rate.[11]

Empirical estimation[edit]

Demand and supply relations in a market can be statistically estimated from price, quantity, and other data with sufficient information in the model. This can be done with simultaneous-equation methods of estimation in econometrics. Such methods allow solving for the model-relevant "structural coefficients," the estimated algebraic counterparts of the theory. The Parameter identification problem is a common issue in "structural estimation." Typically, data on exogenous variables (that is, variables other than price and quantity, both of which are endogenous variables) are needed to perform such an estimation. An alternative to "structural estimation" is reduced-form estimation, which regresses each of the endogenous variables on the respective exogenous variables.Macroeconomic uses of demand and supply[edit]

Demand and supply have also been generalized to explain macroeconomic variables in a market economy, including the quantity of total output and the general price level. The Aggregate Demand-Aggregate Supply model may be the most direct application of supply and demand to macroeconomics, but other macroeconomic models also use supply and demand. Compared to microeconomic uses of demand and supply, different (and more controversial) theoretical considerations apply to such macroeconomic counterparts as aggregate demand and aggregate supply. Demand and supply are also used in macroeconomic theory to relate money supply and money demand to interest rates, and to relate labor supply and labor demand to wage rates.History[edit]

According to Hamid S. Hosseini, the power of supply and demand was understood to some extent by several early Muslim scholars, such as fourteenth-century Mamluk scholar Ibn Taymiyyah, who wrote: "If desire for goods increases while its availability decreases, its price rises. On the other hand, if availability of the good increases and the desire for it decreases, the price comes down."[12]| “ | If desire for goods increases while its availability decreases, its price rises. On the other hand, if availability of the good increases and the desire for it decreases, the price comes down. | ” |

The phrase "supply and demand" was first used by James Denham-Steuart in his Inquiry into the Principles of Political Oeconomy, published in 1767. Adam Smith used the phrase in his 1776 book The Wealth of Nations, and David Ricardo titled one chapter of his 1817 work Principles of Political Economy and Taxation "On the Influence of Demand and Supply on Price".[14]

In The Wealth of Nations, Smith generally assumed that the supply price was fixed but that its "merit" (value) would decrease as its "scarcity" increased, in effect what was later called the law of demand also. Ricardo, in Principles of Political Economy and Taxation, more rigorously laid down the idea of the assumptions that were used to build his ideas of supply and demand. Antoine Augustin Cournot first developed a mathematical model of supply and demand in his 1838 Researches into the Mathematical Principles of Wealth, including diagrams.

During the late 19th century the marginalist school of thought emerged. This field mainly was started by Stanley Jevons, Carl Menger, and Léon Walras. The key idea was that the price was set by the most expensive price, that is, the price at the margin. This was a substantial change from Adam Smith's thoughts on determining the supply price.

In his 1870 essay "On the Graphical Representation of Supply and Demand", Fleeming Jenkin in the course of "introduc[ing] the diagrammatic method into the English economic literature" published the first drawing of supply and demand curves therein,[15] including comparative statics from a shift of supply or demand and application to the labor market.[16] The model was further developed and popularized by Alfred Marshall in the 1890 textbook Principles of Economics.[14]

Criticisms[edit]

At least two assumptions are necessary for the validity of the standard model: first, that supply and demand are independent; second, that supply is "constrained by a fixed resource". If these conditions do not hold, then the Marshallian model cannot be sustained. Sraffa's critique focused on the inconsistency (except in implausible circumstances) of partial equilibrium analysis and the rationale for the upward slope of the supply curve in a market for a produced consumption good.[17] The notability of Sraffa's critique is also demonstrated by Paul A. Samuelson's comments and engagements with it over many years, for example:- "What a cleaned-up version of Sraffa (1926) establishes is how nearly empty are all of Marshall's partial equilibrium boxes. To a logical purist of Wittgenstein and Sraffa class, the Marshallian partial equilibrium box of constant cost is even more empty than the box of increasing cost.".[18]

The model of prices being determined by supply and demand assumes perfect competition. But:

- "economists have no adequate model of how individuals and firms adjust prices in a competitive model. If all participants are price-takers by definition, then the actor who adjusts prices to eliminate excess demand is not specified".[20]

- "If we mistakenly confuse precision with accuracy, then we might be misled into thinking that an explanation expressed in precise mathematical or graphical terms is somehow more rigorous or useful than one that takes into account particulars of history, institutions or business strategy. This is not the case. Therefore, it is important not to put too much confidence in the apparent precision of supply and demand graphs. Supply and demand analysis is a useful precisely formulated conceptual tool that clever people have devised to help us gain an abstract understanding of a complex world. It does not—nor should it be expected to—give us in addition an accurate and complete description of any particular real world market."[21]

See also[edit]

- Alpha consumer

- Artificial demand

- Barriers to entry

- Cambridge capital controversy

- Consumer theory

- Deadweight loss

- Demand chain

- Demand forecasting

- Demand shortfall

- Demand vacuum

- Economic surplus

- Effective demand

- Effect of taxes and subsidies on price

- Elasticity

- Excess demand function

- Externality

- History of economic thought

- Induced demand

- "invisible hand"

- Inverse demand function

- Labor shortage

- Law of supply

- Neoclassical economics

- Producer's surplus

- Protectionism

- Profit

- Rationing

- Real prices and ideal prices

- Say's Law

- "Supply creates its own demand"

- Supply shock

References[edit]

- Jump up ^ Braeutigam, Ronald (2010). Microeconomics (4th ed.). Wiley.

- Jump up ^ Note that unlike most graphs, supply & demand curves are plotted with the independent variable (price) on the vertical axis and the dependent variable (quantity supplied or demanded) on the horizontal axis.

- Jump up ^ "Marginal Utility and Demand". Retrieved 2007-02-09.

- Jump up ^ Jain, T.R. (2006–07). Microeconomics and Basic Mathematics. New Delhi: VK Publications. p. 28. ISBN 81-87140-89-5.

- Jump up ^ Kibbe, Matthew B. "The Minimum Wage: Washington's Perennial Myth". Cato Institute. Retrieved 2007-02-09.

- Jump up ^ P. Garegnani, "Heterogeneous Capital, the Production Function and the Theory of Distribution", Review of Economic Studies, V. 37, N. 3 (Jul. 1970): 407–436

- Jump up ^ Robert L. Vienneau, "On Labour Demand and Equilibria of the Firm", Manchester School, V. 73, N. 5 (Sep. 2005): 612–619

- Jump up ^ Arrigo Opocher and Ian Steedman, "Input Price-Input Quantity Relations and the Numeraire", Cambridge Journal of Economics, V. 3 (2009): 937–948

- Jump up ^ Michael Anyadike-Danes and Wyne Godley, "Real Wages and h Employment: A Sceptical View of Some Recent Empirical Work", Manchester School, V. 62, N. 2 (Jun. 1989): 172–187

- Jump up ^ Basij J. Moore, Horizontalists and Verticalists: The Macroeconomics of Credit Money, Cambridge University Press, 1988

- Jump up ^ Ritter, Lawrence S.; Silber, William L.; Udell, Gregory F. (2000). Principles of Money, Banking, and Financial Markets (10th ed.). Addison-Wesley, Menlo Park C. pp. 431–438, 465–476. ISBN 0-321-37557-2.

- ^ Jump up to: a b Hosseini, Hamid S. (2003). "Contributions of Medieval Muslim Scholars to the History of Economics and their Impact: A Refutation of the Schumpeterian Great Gap". In Biddle, Jeff E.; Davis, Jon B.; Samuels, Warren J. A Companion to the History of Economic Thought. Malden, MA: Blackwell. pp. 28–45 [28 & 38]. doi:10.1002/9780470999059.ch3. ISBN 0-631-22573-0. (citing Hamid S. Hosseini, 1995. "Understanding the Market Mechanism Before Adam Smith: Economic Thought in Medieval Islam," History of Political Economy, Vol. 27, No. 3, 539–61).

- Jump up ^ John Locke (1691) Some Considerations on the consequences of the Lowering of Interest and the Raising of the Value of Money

- ^ Jump up to: a b Thomas M. Humphrey, 1992. "Marshallian Cross Diagrams and Their Uses before Alfred Marshall," Economic Review, Mar/Apr, Federal Reserve Bank of Richmond, pp. 3–23.

- Jump up ^ A.D. Brownlie and M. F. Lloyd Prichard, 1963. "Professor Fleeming Jenkin, 1833–1885 Pioneer in Engineering and Political Economy," Oxford Economic Papers, NS, 15(3), p. 211.

- Jump up ^ Fleeming Jenkin, 1870. "The Graphical Representation of the Laws of Supply and Demand, and their Application to Labour," in Alexander Grant, ed., Recess Studies, Edinburgh. ch. VI, pp. 151–85. Edinburgh. Scroll to chapter link.

- Jump up ^ Avi J. Cohen, "'The Laws of Returns Under Competitive Conditions': Progress in Microeconomics Since Sraffa (1926)?", Eastern Economic Journal, V. 9, N. 3 (Jul.-Sep.): 1983)

- Jump up ^ Paul A. Samuelson, "Reply" in Critical Essays on Piero Sraffa's Legacy in Economics (edited by H. D. Kurz) Cambridge University Press, 2000

- Jump up ^ Alan Kirman, "The Intrinsic Limits of Modern Economic Theory: The Emperor has No Clothes", The Economic Journal, V. 99, N. 395, Supplement: Conference Papers (1989): pp. 126–139

- Jump up ^ Alan P. Kirman, "Whom or What Does the Representative Individual Represent?" Journal of Economic Perspectives, V. 6, N. 2 (Spring 1992): pp. 117–136

- Jump up ^ Goodwin, N, Nelson, J; Ackerman, F & Weissskopf, T: Microeconomics in Context 2d ed. Sharpe 2009 ISBN 978-0-7656-2301-0

Further reading[edit]

- Ehrbar, Al (2008). "Supply". In David R. Henderson. Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Henderson, David R. (2008). "Demand". Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Foundations of Economic Analysis by Paul A. Samuelson

- Price Theory and Applications by Steven E. Landsburg ISBN 0-538-88206-9

- An Inquiry into the Nature and Causes of the Wealth of Nations, Adam Smith, 1776 [1]

- Supply and Demand book by Hubert D. Henderson at Project Gutenberg.

External links[edit]

| Wikimedia Commons has media related to Supply and demand curves. |

| Look up supply or demand in Wiktionary, the free dictionary. |

- Nobel Prize Winner Prof. William Vickrey: 15 fatal fallacies of financial fundamentalism – A Disquisition on Demand Side Economics

- "Marshallian Cross Diagrams and Their Uses before Alfred Marshall: The Origins of Supply and Demand Geometry" by Thomas Humphrey (via the Richmond Fed)

- By what is the price of a commodity determined?, a brief statement of Karl Marx's rival account

- Supply and Demand by Fiona Maclachlan and Basic Supply and Demand by Mark Gillis, Wolfram Demonstrations Project.

No comments:

Post a Comment