If Jeremy Corbyn becomes leader of the UK Labour Party, one positive consequence will be the ensuing discussion of the monetary policy transmission mechanism.

It all started with his presentation on “The Economy in 2020” given on July 22:

Much of the commentary has been negative — former Bank of England economist Tony Yates concluded, for example, that “People’s QE” would be “the first step along the road to undermining the social usefulness of money” — although Chris Dillow gave an intelligent defense.

We don’t understand the negativity. Some of the specific arguments justifying the proposal may be flawed, but the core idea is sound and possesses an impressive intellectual pedigree. In fact, it could help solve one of the most troublesome questions in central banking: how policymakers can accomplish their objectives using the tools at their disposal, without producing too many unpleasant side effects.

One of the oddities of “monetary policy” is that it has almost no direct impact on how much money there is to go around.

Virtually all of what we commonly think of and use as money is actually short-term debt issued and retired at will by private financial firms. Monetary policymakers can affect the incentives of these profit-seeking entities but they have little control over the amount of nominal spending occurring in the economy. Nudging the unsecured overnight interbank lending rate up and down can encourage lenders to adjust their leverage, but good luck tying that to the traditional price stability mandate. (Also, a friendly reminder that the level of interest rates is basically irrelevant for corporate investment.)

Then there’s QE. Central banks across the rich world have been “printing money” — trillions! — without producing a large and obvious impact on inflation or real growth. That’s because, contrary to popular belief and the misleading language of too many commentators, they haven’t been “printing” anything at all. What’s actually happened is that policymakers have been finding people with extremely liquid assets and buying those assets at market prices. Giving someone $100 in exchange for an easy-to-sell bond currently trading at $100 has some impact but it’s much less exciting than “printing money”. As Mark Dow put it, “if we all understood monetary policy better, the Fed’s policies would be working far less well.”

The existing monetary policy tools also have the unseemly property of appearing to work mainly by making the rich richer and hoping that some of the extra wealth gets spent. Even if it’s true that the rest of society benefits from this, because otherwise they’d be unemployed, this is trickle-down monetary policy. The Bank of England admitted that “in practice, the benefits from these wealth effects will accrue to those households holding most financial assets”.

Cutting out the middle men is the most obvious way to improve the transmission of central banker desires into economic reality. If policymakers want people to spend, they shouldn’t try to juice share and home prices, or fiddle about with borrowing costs at the margin, but actually give people money.

(This, by the way, was the core insight of the “Capitol Hill Baby Sitting Co-op Crisis” made famous by Professor Krugman. There was no “monetary policy” as conventionally understood, just fiscal policy paired with monetisation of deficits. We highly recommend reading the original article in full, but the short version is that budget surpluses caused by excessive taxation led to a shrinking money supply and an unwillingness of the co-op’s members to use their increasingly-valuable scrip to purchase time away from the kids. Fiscal stimulus — a one-time tax rebate plus permanent tax cuts — solved the initial problem, but wasn’t executed well, so the co-op soon started suffering from a surfeit of scrip and too many people wanting to go out on the town.)

Our preferred approach would be direct deposits into household accounts offered at the central bank. It’s simple and doesn’t require any political debate about how best to spend the newly created money.

But Corbyn’s plan to have the Bank of England fund government-directed investment in infrastructure could also work, especially if the pace of investment were adjusted according to the condition of the economy. In fact, Adam Posen supported something similar when he was on the Monetary Policy Committee of the Bank of England, except that he focused on small businesses.

Compare what Posen said back in 2011:

You could oppose the policy because you think the government will make bad investments, but by that logic you’re really just against any government-led infrastructure spending. You could also object to the idea that the government is effectively using the central bank to finance its deficit spending and undermining the shibboleth of “central bank independence”, but you would have to contend with the arguments of, among others, Martin Wolf, Paul McCulley, and that old communist Milton Friedman.

The main concern about Corbynomics isn’t whether the monetary transmission mechanism needs an upgrade — it does — but whether the UK actually needs that much additional investment spending.

There’s a plausible case to be made that the existing budget and household debt forecasts imply an unsustainable household debt spiral, so any additional spending that doesn’t require the private sector to live far beyond its means should be welcome.

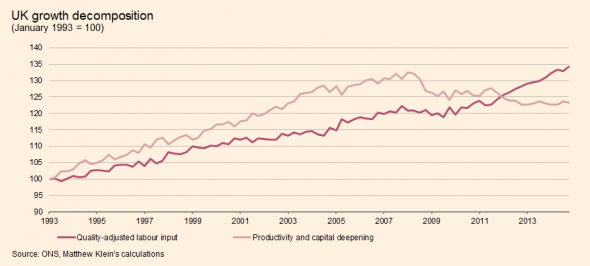

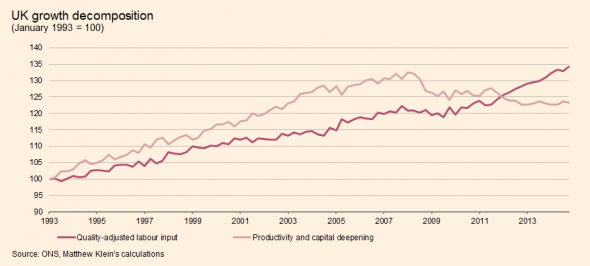

Suppose you reject this analysis and prefer traditional guides to macro policy. A quick look at employment and hours worked suggests the economy is on fire and could use some rate hikes. But if you separate out the extra work effort from what’s happened with real incomes, the implication is that UK productivity growth has been abysmal:

If Corbyn’s preferred investments are useful, they could help restore some of the lost ground in productivity and lead to higher real wages for Britons. And by expanding capacity, this extra investment spending may not even end up being inflationary. (The actual amounts in question, according to Murphy, are quite small relative to the size of the UK economy.)

“People’s QE” is far from an obviously wrong idea. Implemented properly, it could even improve the Bank of England’s ability to fulfill its mandate without needing to goose house prices or get into contentious debates about helping the rich at the expense of pensioners.

Related links:Corbyn and the People’s Bank of England — Jo Michell

Iceland’s grand monetary experiment? — FT Alphaville

Central banking: just when you understand it, it changes — FT Alphaville

It all started with his presentation on “The Economy in 2020” given on July 22:

The ‘rebalancing’ I have talked about here today means rebalancing away from finance towards the high-growth, sustainable sectors of the future. How do we do this? One option would be for the Bank of England to be given a new mandate to upgrade our economy to invest in new large scale housing, energy, transport and digital projects: Quantitative easing for people instead of banks. Richard Murphy has been one of many economists making that case.That passage seems to have been mostly ignored until August 3, when Chris Leslie, Labour’s shadow chancellor, attacked the policy, which in turn led to a detailed response from the aforementioned Richard Murphy (see also here and here), at which point what seems like the bulk of the British economics commentariat erupted. Just search the internet for “Corbynomics” if you don’t believe us.

Much of the commentary has been negative — former Bank of England economist Tony Yates concluded, for example, that “People’s QE” would be “the first step along the road to undermining the social usefulness of money” — although Chris Dillow gave an intelligent defense.

We don’t understand the negativity. Some of the specific arguments justifying the proposal may be flawed, but the core idea is sound and possesses an impressive intellectual pedigree. In fact, it could help solve one of the most troublesome questions in central banking: how policymakers can accomplish their objectives using the tools at their disposal, without producing too many unpleasant side effects.

One of the oddities of “monetary policy” is that it has almost no direct impact on how much money there is to go around.

Virtually all of what we commonly think of and use as money is actually short-term debt issued and retired at will by private financial firms. Monetary policymakers can affect the incentives of these profit-seeking entities but they have little control over the amount of nominal spending occurring in the economy. Nudging the unsecured overnight interbank lending rate up and down can encourage lenders to adjust their leverage, but good luck tying that to the traditional price stability mandate. (Also, a friendly reminder that the level of interest rates is basically irrelevant for corporate investment.)

Then there’s QE. Central banks across the rich world have been “printing money” — trillions! — without producing a large and obvious impact on inflation or real growth. That’s because, contrary to popular belief and the misleading language of too many commentators, they haven’t been “printing” anything at all. What’s actually happened is that policymakers have been finding people with extremely liquid assets and buying those assets at market prices. Giving someone $100 in exchange for an easy-to-sell bond currently trading at $100 has some impact but it’s much less exciting than “printing money”. As Mark Dow put it, “if we all understood monetary policy better, the Fed’s policies would be working far less well.”

The existing monetary policy tools also have the unseemly property of appearing to work mainly by making the rich richer and hoping that some of the extra wealth gets spent. Even if it’s true that the rest of society benefits from this, because otherwise they’d be unemployed, this is trickle-down monetary policy. The Bank of England admitted that “in practice, the benefits from these wealth effects will accrue to those households holding most financial assets”.

Cutting out the middle men is the most obvious way to improve the transmission of central banker desires into economic reality. If policymakers want people to spend, they shouldn’t try to juice share and home prices, or fiddle about with borrowing costs at the margin, but actually give people money.

(This, by the way, was the core insight of the “Capitol Hill Baby Sitting Co-op Crisis” made famous by Professor Krugman. There was no “monetary policy” as conventionally understood, just fiscal policy paired with monetisation of deficits. We highly recommend reading the original article in full, but the short version is that budget surpluses caused by excessive taxation led to a shrinking money supply and an unwillingness of the co-op’s members to use their increasingly-valuable scrip to purchase time away from the kids. Fiscal stimulus — a one-time tax rebate plus permanent tax cuts — solved the initial problem, but wasn’t executed well, so the co-op soon started suffering from a surfeit of scrip and too many people wanting to go out on the town.)

Our preferred approach would be direct deposits into household accounts offered at the central bank. It’s simple and doesn’t require any political debate about how best to spend the newly created money.

But Corbyn’s plan to have the Bank of England fund government-directed investment in infrastructure could also work, especially if the pace of investment were adjusted according to the condition of the economy. In fact, Adam Posen supported something similar when he was on the Monetary Policy Committee of the Bank of England, except that he focused on small businesses.

Compare what Posen said back in 2011:

I would suggest that the Government set up two new public institutions to address the investment gap by increasing the availability of credit to SMEs and to new firms. One would be a public bank or authority for lending to small business…The other institution I would encourage the Government to set up would be an entity to bundle and securitize loans made to SMEs. Essentially, we need a good version of Fannie Mae and Freddie Mac to create a more liquid and deep market for illiquid securities which can then be sold off of bank(s) balance sheets……to Richard Murphy’s description of “People’s Quantitative Easing”:

And this is where the Bank of England comes in. Both of these entities, the new SME lender(s) and Bennie, would need an initial infusion of capital…By announcing a commitment to lending the initial (gilt-backed) capital for these proposed entities, assuring all that such entities if well managed can have liquidity from the central bank as needed, and publicly supporting their creation, the Bank can do a lot to fill financing and investment gap in the UK…

More explicit and active cooperation between monetary policy and governmental programs to rectify our resulting investment shortfall is not only good policy, but likely to enhance the credibility and viability of our monetary regime. Our current credit allocation problems and resulting investment shortfall is one of the biggest specific barriers to recovery and to sustainable price stability in Britain. Monetary policy in the form of more QE will address this shortfall. The Bank of England, however, can and should go further than just doing more QE to remove this barrier to investment and growth in new and smaller businesses.

People’s quantitative easing is…a highly directed process where the debt that is repurchased has been deliberately created and issued either by a green investment bank or by local authorities, health trusts and other such agencies for the specific purpose of funding new investment in the economy at the time when big business and financial markets are completely failing to deliver the scale of investment that is needed to get the UK working again and to restore our financial prosperity.And again:

No one is saying that this puts the BoE in charge of investment policy. It is just the purchaser of debts, as is the ECB right now to the tune of €60 billion a month. The decisions on how the money is used will rest solely with the government. The BoE is simply acting as a bank, providing funding for that purpose in a way that Mark Carney and Mario Draghi have both said is technically and legally possible.Posen thought that private lenders weren’t providing credit where he believed it was needed, so he recommended creating new public investment banks that could originate and securitise loans into bonds that could then be purchased by the Bank of England, thereby funding new business investment. Corbyn/Murphy want specialised “green” investment banks, housing authorities, and local governments to be able to finance infrastructure investment secure in the knowledge that the Bank of England will be there to provide funding support. We fail to see a significant difference.

You could oppose the policy because you think the government will make bad investments, but by that logic you’re really just against any government-led infrastructure spending. You could also object to the idea that the government is effectively using the central bank to finance its deficit spending and undermining the shibboleth of “central bank independence”, but you would have to contend with the arguments of, among others, Martin Wolf, Paul McCulley, and that old communist Milton Friedman.

The main concern about Corbynomics isn’t whether the monetary transmission mechanism needs an upgrade — it does — but whether the UK actually needs that much additional investment spending.

There’s a plausible case to be made that the existing budget and household debt forecasts imply an unsustainable household debt spiral, so any additional spending that doesn’t require the private sector to live far beyond its means should be welcome.

Suppose you reject this analysis and prefer traditional guides to macro policy. A quick look at employment and hours worked suggests the economy is on fire and could use some rate hikes. But if you separate out the extra work effort from what’s happened with real incomes, the implication is that UK productivity growth has been abysmal:

If Corbyn’s preferred investments are useful, they could help restore some of the lost ground in productivity and lead to higher real wages for Britons. And by expanding capacity, this extra investment spending may not even end up being inflationary. (The actual amounts in question, according to Murphy, are quite small relative to the size of the UK economy.)

“People’s QE” is far from an obviously wrong idea. Implemented properly, it could even improve the Bank of England’s ability to fulfill its mandate without needing to goose house prices or get into contentious debates about helping the rich at the expense of pensioners.

Related links:Corbyn and the People’s Bank of England — Jo Michell

Iceland’s grand monetary experiment? — FT Alphaville

Central banking: just when you understand it, it changes — FT Alphaville

No comments:

Post a Comment