Blogger Ref http://www.p2pfoundation.net/Transfinancial_Economics

In Transfinancial Economics what is referred to as QE for the People is Primary Stage TFE.

It is only the BEGINNING in which new money could be gradually phased in, and virtually every transaction is subjected into instant electronic inflation checks by super-flexible controls to insure inflation cannot get out of control.

“We propose that the government legislates to empower the Bank with the ability to make payments directly to the household sector”, reads the Guardian article, on 21st May 2015

The authors, Mark Blyth, Eastman Professor of Political Economy at Brown University, Eric Lonergan, Fund manager, M&G Investments and Simon Wren-Lewis, Professor of Economic Policy at the Blavaynik School of Government, Oxford University warn, that more of the same – negative interest rates or further bouts of quantitative easing (QE) – may cause more problems than they solve. They argue that the Bank of England should be given a new tool.

The empirical evidence from analogous policies – such as tax rebates in the US – suggests that transfers to the household sector would have a far greater impact on demand at a fraction of the size of QE. Consumers appear to quickly spend between a third and a half of any cash windfalls. So to increase consumption by 1% of GDP, you would need a transfer of 3% of GDP. UK QE currently stands at about 20% of annual GDP. The Bank of England estimates this raised GDP by 3%. Further QE would likely have less effect. So cash transfers to consumers are a far more effective stimulus than that provided by more QE for a lower spend.They further explain why the common objection that “this is fiscal policy, and should not be the remit of the monetary policy” is misleading and also why the concerns about the inflation are not legitimate.

Consistent with operational independence of the Bank of England, the size of payments and their timing should be solely under its control, and subject to the inflation target. Parliament needs to equip the Bank with the infrastructure to administer payments, and determine in advance the recipients. An equal payment to all households is likely to be the least controversial rule. It would have an immediate impact on spending and it is transparent and fair – favouring neither borrowers nor savers, rich nor poor, nor one demographic over another.

It is difficult to see why printing money on a far smaller scale than under QE should have a pernicious effect on inflation if the much larger costs associated with QE have failed to do so.You can read the full article here.

The authors are not alone in proposing “Quantitative Easing for the People”. In March this year 19 prominent economists have signed a letter letter published in Financial Times calling for the European Central Bank and eurozone central banks to bypass the financial system and work with governments to inject newly created money directly into the real economy.

And there are many more prominent economists today who propose a style of Quantitative Easing aimed at the real economy, one that would be relayed away from the banking sector and speculators and towards consumers, non-financial businesses and low income earners – and one that could directly back investment projects, rather than create risky asset price bubbles.

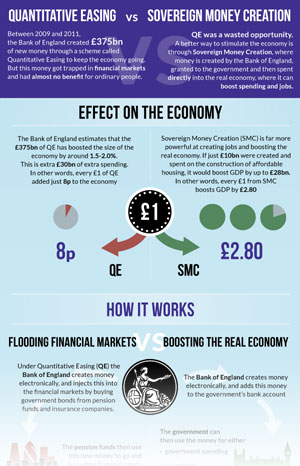

This infographic shows how QE was ineffective, and how the creation of sovereign money by the state would have been up to 37 times more effective in creating jobs and boosting the economy. View now…

This infographic shows how QE was ineffective, and how the creation of sovereign money by the state would have been up to 37 times more effective in creating jobs and boosting the economy. View now…

No comments:

Post a Comment