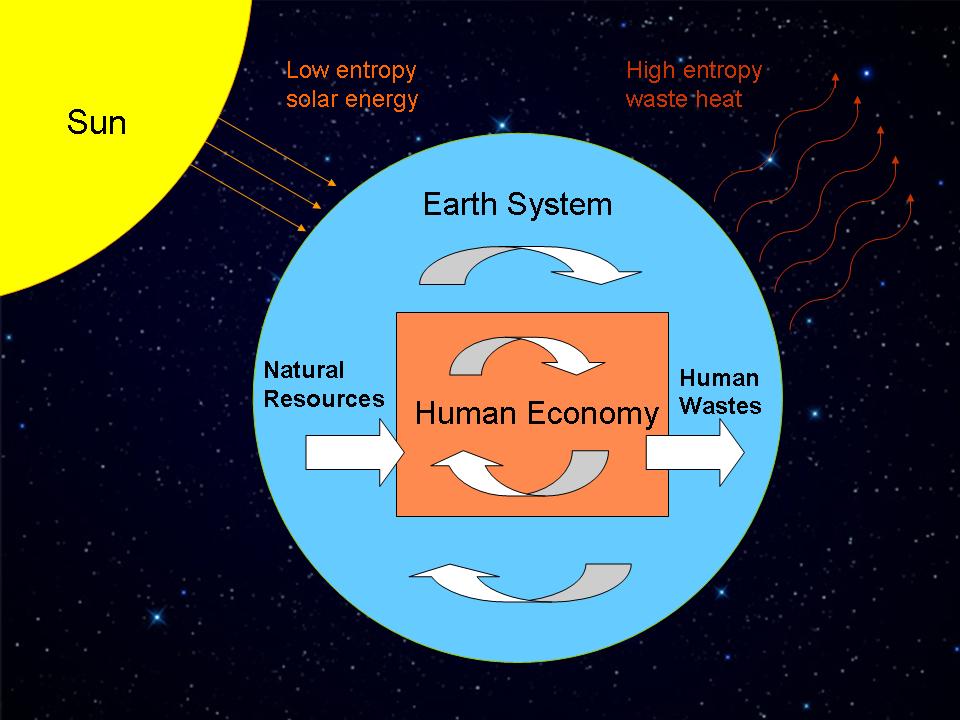

“Debts are subject to the laws of mathematics rather than physics. Unlike wealth, which is subject to the laws of thermodynamics, debts do not rot with old age and are not consumed in the process of living. On the contrary, they grow at so much per cent per annum, by the well-known mathematical laws of simple and compound interest … It is this underlying confusion between wealth and debt which has made such a tragedy of the scientific era.”What is debt and what is wealth? To a creditor, debts represent claims upon future wealth. While these claims can grow without limit, the payment of them is ultimately limited by what the biosphere provisions for the human economy – as John Ruskin once remarked “there is no wealth but life.” The economy is a sub-system of the biosphere, which ultimately derives its wealth from the abundant “organised” energy of the sun. This is indicated in my picture of “spaceship Earth” below (I explain what “entropy” is and its relevance to life on Earth here):

–- Frederick Soddy, in Wealth, Virtual Wealth and Debt (1926).

As supporters of groups like Positive Money well know, society currently issues its money as interest bearing debts to private banks. This has a very important implication for society as a whole: it means that, in order for us to enjoy permission to consume the goods and services of today (which is what money gives us after all – it is a claim upon social goods and services) we must produce more goods and services tomorrow (more future wealth) so as to repay today’s incurred debts. It seems to me that there can never be such thing as a sufficiency economy – no such thing as reaching “enough” and stopping – as long as money is created in this manner. Instead, our economy must produce tomorrow for permission to consume today.

Whilst debts, being mere accounting entries, can accumulate without limit, as Soddy pointed out wealth cannot: its generation is subject to the laws of thermodynamics. This implies a fundamental and broadening incompatibility between on the one hand a financial system founded upon unlimited creation of private debts and on the other hand a finite biosphere. Geologist M. King Hubbert (of the famous “Hubbert Peak” for oil extraction rates) made essentially this point back in 1981:

“The world’s present industrial civilization is handicapped by the coexistence of two universal, overlapping, and incompatible intellectual systems: the accumulated knowledge of the last four centuries of the properties and interrelationships of matter and energy; and the associated monetary culture which has evolved from folkways of prehistoric origin.But what is the relationship, if any, between economic growth and natural wealth extraction? I first note in passing that, under the current monetary system (and more broadly, I would argue, under capitalism itself, which is characterised by ongoing capital accumulation) economic growth is non-negotiable. As Barack Obama recently remarked:

“The first of these two systems has been responsible for the spectacular rise, principally during the last two centuries, of the present industrial system and is essential for its continuance. The second, an inheritance from the pre-scientific past, operates by rules of its own having little in common with those of the matter-energy system. Nevertheless, the monetary system, by means of a loose coupling, exercises a general control over the matter-energy system upon which it is superimposed.

“Despite their inherent incompatibilities, these two systems during the last two centuries have had one fundamental characteristic in common, namely, exponential growth, which has made a reasonably stable coexistence possible. But, for various reasons, it is impossible for the matter-energy system to sustain exponential growth for more than a few tens of doublings, and this phase is by now almost over. The monetary system has no such constraints, and, according to one of its most fundamental rules, it must continue to grow by compound interest.”

“All of us are going to have to work together in an effective way to figure out how we balance the imperative of economic growth with very real concerns about the effect we’re having on our planet. And ultimately I think this can be solved with technology.”Take note of the priority here: economic growth is an “imperative” – meaning absolutely necessary, unavoidable, non-negotiable – whilst threats to the ongoing survival of human civilization (exacerbated by ongoing economic growth) are merely “very real concerns”, which can be waved away with appeals to “technology”. Such prioritizing amongst world leaders, whilst it might look insane to an impartial alien observer of Earth, is perfectly understandable within an economic system which must grow tomorrow in order to subsist today.

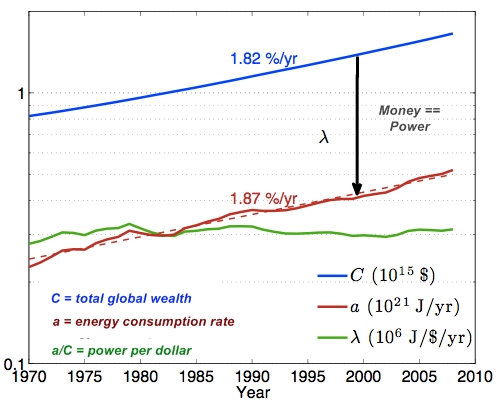

But for how much longer can (or should) economic growth continue? As Prof. Tim Garrett shows empirically on his website, there is a simple linear relationship between global (monetary) wealth and global energy consumption, summarised in the plot below:

As I’ve argued elsewhere on more theoretical grounds, we cannot expect economic growth to become decoupled from increased energy demands and environmental impacts. In my opinion, this is why the Cop18 talks and similar conferences before them have failed. World leaders recognize that to meaningfully reduce carbon emissions implies a parting with economic growth which, under present monetary systems, would entail the swift collapse of their nation’s economy. I believe that so long as we continue to create permission to consume today – money – alongside the obligation to produce tomorrow – debt – they will remain correct in this surmise ( I should point out here that it is still perfectly possible to have a growth economy under full reserve banking – just no longer mandatory. So any growth enthusiasts reading this need not withdraw their support for monetary reform on that basis).

Arguably, it will furthermore be necessary to move beyond a capitalist system of production – thought that is a more debatable and less immediately pressing proposition, and also one beyond Positive Money’s remit to pass judgment upon. Once again, it is perfectly possible to have a capitalist economy under full reserve banking and so fans of capitalism can consistently support it – as plenty do. My own personal intuition, for what it’s worth, says that given mounting social and ecological constraints it will be necessary to increasingly phase out “capitalism” as a system, moving away from autocratic management of production for shareholder profits and towards democratic management of production for stakeholder needs.

Note the word “needs”, in contrast to the perpetually manufactured “wants” of the present economy. I would argue that capitalist production is both incentivised and coerced towards this behavior and also towards various hugely wasteful and inefficient forms of “planned obsolescence”; both entailing social and ecological costs a planet home to 7 billion people can no longer afford to pay for. We ought instead, I think, to have a system that is at least structurally capable of deciding that “enough is enough” and simply enjoying the material fruits of its past labours, while continuing to develop morally and intellectually. This is the economic future that John Stuart Mill looked forward to in his book Principles of Political Economy and later John Maynard Keynes in his essay Economic Possibilities for our Grandchildren.

We currently bump up against or exceed the limits of planetary wealth extraction and waste absorption in several sectors, as the picture below summarises:

Plot of planetary boundaries according to table 1 of the paper “A safe operating space for humanity”. Nature 461, 472-475 | doi:10.1038/461472a

“An out-of-control financial sector is eating out the modern market economy from inside, just as a the larva of the spider wasp eats out the host in which it has been laid.”But more broadly, I would argue that the economic system itself has become a parasite upon the ecological systems that support it, and looks increasingly in danger of killing the host. As senior NASA climate scientist James Hansen has written in Storms of my Grandchildren:

“If we burn all the fossil fuels, the ice sheets almost surely will melt entirely, with the final sea level rise about 75 meters (250 feet), with most of that possibly occurring within a time scale of centuries. Methane hydrates are likely to be more extensive and vulnerable now than they were in the early Cenozoic. It is difficult to imagine how the methane clathrates could survive, once the ocean has had time to warm. In that event a PETM-like warming could be added on top of the fossil fuel warming.A new symbiosis of economy and ecology is thus required, if our grandchildren are to enjoy any sort of humane future. The alternative of ongoing parasitism could imply a grim downward spiral into police states, resource wars, potential nuclear conflicts – an increasingly desperate, violent, authoritarian struggle for survival in which many of the liberal political gains of the past several centuries would likely be lost and any hopes of advancing beyond these gains forgotten entirely.

After the ice is gone, would Earth proceed to the Venus syndrome, a runaway greenhouse effect that would destroy all life on the planet, perhaps permanently? While that is difficult to say based on present information, I’ve come to conclude that if we burn all reserves of oil, gas, and coal, there is a substantial chance we will initiate the runaway greenhouse. If we also burn the tar sands and tar shale, I believe the Venus syndrome is a dead certainty.”

To avoid this grim sketch of a possible future, we must cease eating the flesh of our children to cross the desert today – as one Buddhist sutra puts it. We must move beyond a monetary system which demands tomorrow’s production to enjoy today’s goods and services. And this entails, I believe and have argued here, the sorts of reforms that Positive Money is proposing. Whilst many changes above and beyond reformed global monetary systems are likely needed, I struggle to imagine a livable ecology emerging in the absence of such reforms. I see them as the first step and foundation towards building a sane, humanitarian and ecologically sound alternative to the present madness.

Nice quote from Martin Wolf (Financial times) Now what about an "Economy of Enough" investing using Balanced Economy "tweaks" (see MeggitBird) and diverting the savings into Solar Heat-Store floors and building Makeovers. For very little cost we at Greenwood Structures Birmingham UK give (worldwide) advice to those in need on a sliding scale according to their means. with the low-tech systems we offer (there is no electricity needed to drive it) heat gathered in summer can be gradually STORED - 2CENTRAL WARMING" warming lasting most of the winter in northern climes. That helps to stabilise against fossil fuel depletion. And reduced fossil-fuel use can work the world away from the alternative tipping point scenario Mr Hansen does not describe in your extract.

ReplyDeleteThat is: it could help prevent possible shift of the Gulf Stream, which could surely trigger a quicker and maybe greater calamity for the North - an ICE AGE potentially cobering the north of EU/US so storing solar heat is win-win.

Mr Hansen might be interested in that because our measures could suppress the use of fossil fuels on a massive scale (as it spreads to each building) while we work on Stephen Salter's solar-powered machines to throw up the sea-water to refreeze the Arctic to give our global village a platform to work on rather than allowing oil exploration to completely melt the thick floating ice. Thus with such work we could as a global village be maintaining the global conveyor in the oceans and the remaining mountain ice which is so essential for water supplies.

nice blog post

ReplyDelete3d printed products

3d printing materials

3d printer filament