From Wikipedia, the free encyclopedia

This article is about economic recession during the early twenty-first century. For background financial market events dating from 2007, see Financial crisis of 2007–2008.

| 2008–2012 global recession |

| 2007–2012 global economic crisis |

|---|

There are two senses of the word "recession": a less precise sense, referring broadly to "a period of reduced economic activity",[7] and the academic sense used most often in economics, which is defined operationally, referring specifically to the contraction phase of a business cycle, with two or more consecutive quarters of negative GDP growth. If one analyses the event using the economics-academic definition of the word, the recession ended in the U.S. in June or July 2009.[8][9] However, in the broader, lay sense of the word, many people use the term to refer to the ongoing hardship (in the same way that the term "Great Depression" is also popularly used).[10] In the U.S., for example, persistent high unemployment remains, along with low consumer confidence, the continuing decline in home values and increase in foreclosures and personal bankruptcies, an escalating federal debt crisis, inflation, and rising petroleum and food prices. In fact, a 2011 poll found that more than half of all Americans think the U.S. is still in recession or even depression, despite official data that shows a historically modest recovery.[11]

[edit] Overview

According to the U.S. National Bureau of Economic Research (the official arbiter of U.S. recessions) the recession began in December 2007 and ended in June 2009.[12][13] US mortgage-backed securities, which had risks that were hard to assess, were marketed around the world. A more broad based credit boom fed a global speculative bubble in real estate and equities, which served to reinforce the risky lending practices.[14][15] The precarious financial situation was made more difficult by a sharp increase in oil and food prices. The emergence of sub-prime loan losses in 2007 began the crisis and exposed other risky loans and over-inflated asset prices. With loan losses mounting and the fall of Lehman Brothers on September 15, 2008, a major panic broke out on the inter-bank loan market. As share and housing prices declined, many large and well established investment and commercial banks in the United States and Europe suffered huge losses and even faced bankruptcy, resulting in massive public financial assistance.A global recession has resulted in a sharp drop in international trade, rising unemployment and slumping commodity prices. In December 2008, the National Bureau of Economic Research (NBER) declared that the United States had been in recession since December 2007.[16] Several economists predicted that recovery might not appear until 2011 and that the recession would be the worst since the Great Depression of the 1930s.[17][18] Paul Krugman, who won the Nobel Memorial Prize in Economics, once commented on this as seemingly the beginning of "a second Great Depression."[19] The conditions leading up to the crisis, characterized by an exorbitant rise in asset prices and associated boom in economic demand, are considered a result of the extended period of easily available credit [20] and inadequate regulation and oversight.[21]

The recession has renewed interest in Keynesian economic ideas on how to combat recessionary conditions. Fiscal and monetary policies have been significantly eased to stem the recession and financial risks. Economists advise that the stimulus should be withdrawn as soon as the economies recover enough to "chart a path to sustainable growth".[22][23][24]

[edit] Pre-recession economic imbalances

The onset of the economic crisis took most people by surprise. A 2009 paper identifies twelve economists and commentators who, between 2000 and 2006, predicted a recession based on the collapse of the then-booming housing market in the U.S:[25] Dean Baker, Wynne Godley, Fred Harrison, Michael Hudson, Eric Janszen, Steve Keen, Jakob Brøchner Madsen, Jens Kjaer Sørensen, Kurt Richebächer, Nouriel Roubini, Peter Schiff and Robert Shiller.[25][edit] Housing bubble

Further information: Real estate bubble

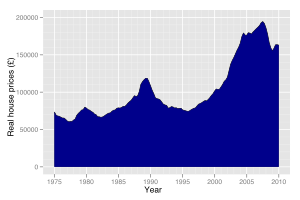

By 2007, real estate bubbles were still under way in many parts of the world,[26] especially in the United States,[27] France, United Kingdom, Italy, Spain, Australia, United Arab Emirates, New Zealand, Ireland, Poland,[28] South Africa, Israel, Greece, Bulgaria, Croatia,[29] Norway, Singapore, South Korea, Sweden, Finland, Argentina,[30] Baltic states, India, Romania, Russia, Ukraine and China.[31] U.S. Federal Reserve Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles".[32] The Economist magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history".[33] Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a housing price crash) that can result in many owners holding negative equity (a mortgage debt higher than the current value of the property).[edit] Causes

Main article: Causes of the late-2000s recession

The great asset bubble:[34]

- Central banks' gold reserves – $0.845 tn.

- M0 (paper money) – - $3.9 tn.

- traditional (fractional reserve) banking assets – $39 tn.

- shadow banking assets – $62 tn.

- other assets – $290 tn.

- Bail-out money (early 2009) – $1.9 tn.

Further information: Financial crisis of 2007–2008

The central debate about the origin has been focused on the respective parts played by the public monetary policy (in the US notably) and by the practices of private financial institutions. In the U.S., mortgage funding was unusually decentralized, opaque, and competitive, and it is believed that competition between lenders for revenue and market share contributed to declining underwriting standards and risky lending.[27]On October 15, 2008, Anthony Faiola, Ellen Nakashima, and Jill Drew wrote a lengthy article in The Washington Post titled, "What Went Wrong".[35] In their investigation, the authors claim that former Federal Reserve Board Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt vehemently opposed any regulation of financial instruments known as derivatives. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission, specifically under the leadership of Brooksley E. Born, when the Commission sought to initiate regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security, that triggered the economic crisis of 2008.

While Greenspan's role as Chairman of the Federal Reserve has been widely discussed (the main point of controversy remains the lowering of the Federal funds rate to 1% for more than a year which, according to Austrian theorists, allowed huge amounts of "easy" credit-based money to be injected into the financial system and thus create an unsustainable economic boom),[36] there is also the argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession caused by the bursting of the dot-com bubble—although by doing so he did not help avert the crisis, but only postpone it.[37][38]

Some economists have claimed that the ultimate point of origin of the financial crisis of 2007–2010 can be traced back to an extremely indebted US economy.[citation needed] High private debt levels also impact growth by making recessions deeper and the following recovery weaker.[39] In the US total debt now is about 350% of GDP and that number is among the highest ever recorded.[40] Robert Reich claims the amount of debt in the US economy can be traced to economic inequality, assuming that middle-class wages remained stagnant while wealth concentrated at the top, and households "pull equity from their homes and overload on debt to maintain living standards."[41]

Bank oversight had been largely carried out by states' attorney generals' offices until 2004 when John D. Hawke, Jr., Comptroller of the Currency's decision to ban states from monitoring and regulating banks ended this practice based upon the 1863 National Bank Act.[42] A crucial facilitating role in the disaster was played by hedge funds.[43]

[edit] Effects

Main article: Effects of the late-2000s recession

[edit] US Overview

International trade, 2000-2010. 2000=100.[44] A plunge in the volumes of exchanges can be seen as of the second half of 2008.

- Real gross domestic product (GDP) began contracting in the third quarter of 2008, and by early 2009 was falling at an annualized pace not seen since the 1950s.[46]

- Capital investment, which was in decline year-on-year since the final quarter of 2006, matched the 1957–58 post war record in the first quarter of 2009. The pace of collapse in residential investment picked up speed in the first quarter of 2009, dropping 23.2% year-on-year, nearly four percentage points faster than in the previous quarter.

- US Domestic demand, in decline for five straight quarters, is still three months shy of the 1974–75 record, but the pace – down 2.6% per quarter vs. 1.9% in the earlier period – is a record-breaker already.

- A report in 2009 by Bloomberg states that $14.5 trillion of value of global companies has been erased since the crisis began.[47]

- For the majority, income levels have dropped substantially with the median male worker making $32,137 in 2010, and $32,844 in 1968.[48] While the headline unemployment never reached the levels of the early 1980s recession, this may be due to a change in reporting methodology in 1994, when the long term unemployed were dropped from the headline number. According to Shadowstats, adding back those workers increases the unemployment rate to over 20%, comparable to levels seen during the Great Depression.[49] The recession of 2007- 2009 is considered to be the worst economic downturn since the Great Depression.[50] and the subsequent economic recovery one of the weakest. The weak economic performance since 2000 has seen the percentage of working age adults actually employed drop from 64% to 58% (a number last seen in 1984), with most of that drop occurring since 2007.[51]

- 5.4 Million people have been added to federal disability rolls as discouraged workers give up looking for work and take advantage of the federal program.[52]

- The US has seen an increasing concentration of wealth to the detriment of the middle class and the poor with the younger generations being especially affected. The middle class dropped from 61% of the population in 1971 to 51% in 2011 as the upper class increased its take of the national income from 29% in 1970 to 46% in 2010. The share for the middle class dropped to 45%, down from 62% while total income for the poor dropped to 9% from 10%. Since the number of poor increased during this period the smaller piece of the pie (down to 9% from 10%) is spread over a greater portion of the population.[53] The portion of national wealth owned by the middle class and poor has also dropped as their portion of the national income has dropped, making it more difficult to accumulate wealth. The younger generation, which would be just starting their wealth accumulation, has been the most hard hit. Those under 35 are 68% less wealthy then they were in 1984, while those over 55 are 10% wealthier. [54] Much of this concentration has happened since the start of the Great Recession. In 2009, the wealthiest 20% of households controlled 87.2% of all wealth, up from 85.0% in 2007. The top 1% controlled 35.6% of all wealth, up from 34.6% in 2007.[55] The share of the bottom 80% fell from 15% to 12.8%, dropping 15%.

- Inflation-adjusted median household income in the US peaked in 1999 at $53,252 (at the peak of the Internet stock bubble), dropped to $51,174 in 2004, went up to 52,823 in 2007 (at the peak of the housing bubble), and has since trended downward to $49,445 in 2010. The last time median household income was at this level was in 1996 at $49,112, indicating that the recession of the early 2000s and the 2008–2012 global recession wiped out all middle class income gains for the last 15 years.[56] This income drop has caused a dramatic[citation needed] rise in people living under the poverty level and has hit suburbia particularly hard. Between 2000 and 2010, the number of suburban households below the poverty line increased by 53 percent, compared to a 23 percent increase in poor households in urban areas.[57]

[edit]

Beginning February 26, 2009 an Economic Intelligence Briefing was added to the daily intelligence briefings prepared for the President of the United States. This addition reflects the assessment of United States intelligence agencies that the global financial crisis presents a serious threat to international stability.[58]Business Week stated in March 2009 that global political instability is rising fast due to the global financial crisis and is creating new challenges that need managing.[59] The Associated Press reported in March 2009 that: United States "Director of National Intelligence Dennis Blair has said the economic weakness could lead to political instability in many developing nations."[60] Even some developed countries are seeing political instability.[61] NPR reports that David Gordon, a former intelligence officer who now leads research at the Eurasia Group, said: "Many, if not most, of the big countries out there have room to accommodate economic downturns without having large-scale political instability if we're in a recession of normal length. If you're in a much longer-run downturn, then all bets are off."[62]

Globally, mass protest movements have arisen in many countries as a response to the economic crisis. Additionally, in some countries, riots and even open revolts have occurred in relation to the economic crisis.

In January 2009 the government leaders of Iceland were forced to call elections two years early after the people of Iceland staged mass protests and clashed with the police due to the government's handling of the economy.[61] Hundreds of thousands protested in France against President Sarkozy's economic policies.[63] Prompted by the financial crisis in Latvia, the opposition and trade unions there organized a rally against the cabinet of premier Ivars Godmanis. The rally gathered some 10-20 thousand people. In the evening the rally turned into a Riot. The crowd moved to the building of the parliament and attempted to force their way into it, but were repelled by the state's police. In late February many Greeks took part in a massive general strike because of the economic situation and they shut down schools, airports, and many other services in Greece.[64] Police and protesters clashed in Lithuania where people protesting the economic conditions were shot with rubber bullets.[65] In addition to various levels of unrest in Europe, Asian countries have also seen various degrees of protest.[66] Communists and others rallied in Moscow to protest the Russian government's economic plans.[67] Protests have also occurred in China as demands from the west for exports have been dramatically reduced and unemployment has increased.[68] Beyond these initial protests, the protest movement has grown and continued in 2011. In late 2011, the Occupy Wall Street protest took place in the United States, spawning several offshoots that came to be known as the Occupy movement.

In 2012 the economic difficulties in Spain have caused support for secession movements to increase. In Catalonia support for the secession movement exceeded 50%, up from 25% in 2010. On September 11, a pro-independence march, which in the past has never drawn more than 50,000 people, pulled in a crowd estimated by city police at 1.5 million.[69]

[edit] Policy responses

See also: 2008–2009 Keynesian resurgence

The financial phase of the crisis led to emergency interventions in many national financial systems. As the crisis developed into genuine recession in many major economies, economic stimulus meant to revive economic growth became the most common policy tool. After having implemented rescue plans for the banking system, major developed and emerging countries announced plans to relieve their economies. In particular, economic stimulus plans were announced in China, the United States, and the European Union.[70] Bailouts of failing or threatened businesses were carried out or discussed in the USA, the EU, and India.[71] In the final quarter of 2008, the financial crisis saw the G-20 group of major economies assume a new significance as a focus of economic and financial crisis management.[edit] IMF recommendation

The IMF stated in September 2010 that the financial crisis would not end without a major decrease in unemployment as hundreds of millions of people were unemployed worldwide. The IMF urged governments to expand social safety nets and to generate job creation even as they are under pressure to cut spending. Governments should also invest in skills training for the unemployed and even governments of countries like Greece with major debt risk should first focus on long-term economic recovery by creating jobs.[72][edit] United States policy responses

The Federal Reserve, Treasury, and Securities and Exchange Commission took several steps on September 19 to intervene in the crisis. To stop the potential run on money market mutual funds, the Treasury also announced on September 19 a new $50 billion program to insure the investments, similar to the Federal Deposit Insurance Corporation (FDIC) program.[73][74] Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the Federal Reserve Board.[75] The Securities and Exchange Commission announced termination of short-selling of 799 financial stocks, as well as action against naked short selling, as part of its reaction to the mortgage crisis.[76][edit] Asia-Pacific policy responses

On September 15, 2008 China cut its interest rate for the first time since 2002. Indonesia reduced its overnight repo rate, at which commercial banks can borrow overnight funds from the central bank, by two percentage points to 10.25 percent. The Reserve Bank of Australia injected nearly $1.5 billion into the banking system, nearly three times as much as the market's estimated requirement. The Reserve Bank of India added almost $1.32 billion, through a refinance operation, its biggest in at least a month.[77] On November 9, 2008 the 2008 Chinese economic stimulus plan is a RMB¥ 4 trillion ($586 billion) stimulus package announced by the central government of the People's Republic of China in its biggest move to stop the global financial crisis from hitting the world's second largest economy. A statement on the government's website said the State Council had approved a plan to invest 4 trillion yuan ($586 billion) in infrastructure and social welfare by the end of 2010. The stimulus package will be invested in key areas such as housing, rural infrastructure, transportation, health and education, environment, industry, disaster rebuilding, income-building, tax cuts, and finance.China's export driven economy is starting to feel the impact of the economic slowdown in the United States and Europe, and the government has already cut key interest rates three times in less than two months in a bid to spur economic expansion. On November 28, 2008, the Ministry of Finance of the People's Republic of China and the State Administration of Taxation jointly announced a rise in export tax rebate rates on some labor-intensive goods. These additional tax rebates will take place on December 1, 2008.[78]

The stimulus package was welcomed by world leaders and analysts as larger than expected and a sign that by boosting its own economy, China is helping to stabilize the global economy. News of the announcement of the stimulus package sent markets up across the world. However, Marc Faber January 16 said that China according to him was in recession.

In Taiwan, the central bank on September 16, 2008 said it would cut its required reserve ratios for the first time in eight years. The central bank added $3.59 billion into the foreign-currency interbank market the same day. Bank of Japan pumped $29.3 billion into the financial system on September 17, 2008 and the Reserve Bank of Australia added $3.45 billion the same day.[79]

In developing and emerging economies, responses to the global crisis mainly consisted in low-rates monetary policy (Asia and the Middle East mainly) coupled with the depreciation of the currency against the dollar. There were also stimulus plans in some Asian countries, in the Middle East and in Argentina. In Asia, plans generally amounted to 1 to 3% of GDP, with the notable exception of China, which announced a plan accounting for 16% of GDP (6% of GDP per year).

[edit] European policy responses

Until September 2008, European policy measures were limited to a small number of countries (Spain and Italy). In both countries, the measures were dedicated to households (tax rebates) reform of the taxation system to support specific sectors such as housing. The European Commission proposed a €200 billion stimulus plan to be implemented at the European level by the countries. At the beginning of 2009, the UK and Spain completed their initial plans, while Germany announced a new plan.On September 29, 2008 the Belgian, Luxembourg and Dutch authorities partially nationalized Fortis. The German government bailed out Hypo Real Estate.

On 8 October 2008 the British Government announced a bank rescue package of around £500 billion[80] ($850 billion at the time). The plan comprises three parts. The first £200 billion would be made in regard to the banks in liquidity stack. The second part will consist of the state government increasing the capital market within the banks. Along with this, £50 billion will be made available if the banks needed it, finally the government will write away any eligible lending between the British banks with a limit to £250 billion.

In early December German Finance Minister Peer Steinbrück indicated a lack of belief in a "Great Rescue Plan" and reluctance to spend more money addressing the crisis.[81] In March 2009, The European Union Presidency confirmed that the EU was at the time strongly resisting the US pressure to increase European budget deficits.[82]

[edit] Global responses

Most political responses to the economic and financial crisis has been taken, as seen above, by individual nations. Some coordination took place at the European level, but the need to cooperate at the global level has led leaders to activate the G-20 major economies entity. A first summit dedicated to the crisis took place, at the Heads of state level in November 2008 (2008 G-20 Washington summit).The G-20 countries met in a summit held on November 2008 in Washington to address the economic crisis. Apart from proposals on international financial regulation, they pledged to take measures to support their economy and to coordinate them, and refused any resort to protectionism.

Another G-20 summit was held in London on April 2009. Finance ministers and central banks leaders of the G-20 met in Horsham on March to prepare the summit, and pledged to restore global growth as soon as possible. They decided to coordinate their actions and to stimulate demand and employment. They also pledged to fight against all forms of protectionism and to maintain trade and foreign investments. They also committed to maintain the supply of credit by providing more liquidity and recapitalizing the banking system, and to implement rapidly the stimulus plans. As for central bankers, they pledged to maintain low-rates policies as long as necessary. Finally, the leaders decided to help emerging and developing countries, through a strengthening of the IMF.

[edit] Countries maintaining growth or technically avoiding recession

Poland is the only member of the European Union to have avoided a decline in GDP, meaning that in 2009 Poland has created the most GDP growth in the EU. As of December 2009 the Polish economy had not entered recession nor even contracted, while its IMF 2010 GDP growth forecast of 1.9 per cent is expected to be upgraded.[83][84][85] Analysts have identified several causes: Extremely low levels of bank lending and a relatively very small mortgage market; the relatively recent dismantling of EU trade barriers and the resulting surge in demand for Polish goods since 2004; the receipt of direct EU funding since 2004; lack of over-dependence on a single export sector; a tradition of government fiscal responsibility; a relatively large internal market; the free-floating Polish zloty; low labour costs attracting continued foreign direct investment; economic difficulties at the start of the decade which prompted austerity measures in advance of the world crisis.[citation needed]While China, India and Iran have experienced slowing growth, they have not entered recession.

South Korea narrowly avoided technical recession in the first quarter of 2009.[86] The International Energy Agency stated in mid September that South Korea could be the only large OECD country to avoid recession for the whole of 2009.[87] It was the only developed economy to expand in the first half of 2009.

Australia avoided a technical recession after experiencing only one quarter of negative growth in the fourth quarter of 2008, with GDP returning to positive in the first quarter of 2009.[88][89]

[edit] Raising interest rates

The Bank of Israel was the first to raise interest rates after the global recession began.[90] It increased rates in August 2009.[90]On October 6, 2009, Australia became the first G20 country to raise its main interest rate, with the Reserve Bank of Australia moving rates up from 3.00% to 3.25%.[91]

The Norges Bank of Norway and the Reserve Bank of India raised interest rates in March 2010.[92]

[edit] Countries in economic recession or depression

Main article: Timeline of the late 2000s recession

Many countries experienced recession in 2008.[93]Denmark went into recession in the first quarter of 2008, but came out again in the second quarter.[94] Iceland fell into an economic depression in 2008 following the collapse of its banking system. (see 2008–2012 Icelandic financial crisis) By mid-2012 Iceland is regarded as one of Europe's recovery success stories largely as a result of a currency devaluation that has effectively reduced wages by 50%--making exports more competitive.[95]

The following countries went into recession in the second quarter of 2008: Greece, Estonia,[96] Latvia,[97] Ireland[98] and New Zealand.[99]

The following countries/territories went into recession in the third quarter of 2008: Japan,[100] Sweden,[101] Hong Kong,[102] Singapore,[103] Italy,[104] Turkey[93] and Germany.[105] As a whole the fifteen nations in the European Union that use the Euro went into recession in the third quarter,[106] and the United Kingdom. In addition, the European Union, the G7, and the OECD all experienced negative growth in the third quarter.[93]

The following countries/territories went into technical recession in the fourth quarter of 2008: United States, Switzerland,[107] Spain,[108] and Taiwan.[109]

South Korea "miraculously" avoided recession with GDP returning positive at a 0.1% expansion in the first quarter of 2009.[110]

Of the seven largest economies in the world by GDP, only China and France avoided a recession in 2008. France experienced a 0.3% contraction in Q2 and 0.1% growth in Q3 of 2008. In the year to the third quarter of 2008 China grew by 9%. Until recently Chinese officials considered 8% GDP growth to be required simply to create enough jobs for rural people moving to urban centres.[111] This figure may more accurately be considered to be 5–7% now that the main growth in working population is receding. Growth of between 5%–8% could well have the type of effect in China that a recession has elsewhere. Ukraine went into technical depression in January 2009 with a nominal annualized GDP growth of −20%.[112]

Japan was in recovery in the middle of the decade 2000s but slipped back into recession and deflation in 2008.[113] The recession in Japan intensified in the fourth quarter of 2008 with a nominal annualized GDP growth of −12.7%,[114] and deepened further in the first quarter of 2009 with a nominal annualized GDP growth of −15.2%.[115]

[edit] Official forecasts

| Wikinews has related news: US Fed chairman Bernanke says recession could end this year |

The EU commission in Brussels updated their earlier predictions on January 19, 2009, expecting Germany to contract −2.25% and −1.8% on average for the 27 EU countries.[119] According to new forecasts by Deutsche Bank (end of November 2008), the economy of Germany will contract by more than 4% in 2009.[120]

On November 3, 2008, according to all newspapers, the European Commission in Brussels predicted for 2009 only an extremely low increase by 0.1% of the GDP, for the countries of the Euro zone (France, Germany, Italy, etc.).[121] They also predicted negative numbers for the UK (−1.0%), Ireland, Spain, and other countries of the EU. Three days later, the IMF at Washington, D.C., predicted for 2009 a worldwide decrease, −0.3%, of the same number, on average over the developed economies (−0.7% for the US, and −0.8% for Germany).[122] On April 22, 2009, the German ministers of finance and that of economy, in a common press conference, corrected again their numbers for 2009 downwards: this time the "prognosis" for Germany was a decrease of the GDP of at least −5%,[123] in agreement with a recent prediction of the IMF.[124]

On June 11, 2009, the World Bank Group predicted for 2009 for the first time a global contraction of the economic power, precisely by −3%.[125]

[edit] Comparisons with the Great Depression

On April 17, 2009, the then head of the IMF Dominique Strauss-Kahn said that there was a chance that certain countries may not implement the proper policies to avoid feedback mechanisms that could eventually turn the recession into a depression. "The free-fall in the global economy may be starting to abate, with a recovery emerging in 2010, but this depends crucially on the right policies being adopted today." The IMF pointed out that unlike the Great Depression, this recession was synchronized by global integration of markets. Such synchronized recessions were explained to last longer than typical economic downturns and have slower recoveries.[126]The chief economist of the IMF, Dr. Olivier Blanchard, stated that the percentage of workers laid off for long stints has been rising with each downturn for decades but the figures have surged this time. "Long-term unemployment is alarmingly high: in the US, half the unemployed have been out of work for over six months, something we have not seen since the Great Depression." The IMF also stated that a link between rising inequality within Western economies and deflating demand may exist. The last time that the wealth gap reached such skewed extremes was in 1928–1929.[127]

Concerning unemployment, during the 1980–1982 recession, unemployment peaked at nearly 11% (10.8%) in November 1982 and remained above 10% from September 1982 through June 1983. Unemployment remained over 8% through January 1984 before dipping lower. By contrast, unemployment peaked at 10% in October 2009 for one month, before declining to below 10% after that, although remaining high at above 8% through April 2012. Unemployment numbers at the beginning of both recessions were at similar levels, around 6% in early-1980 and around 5% in early-2008.

In regards to inflation, the 1980–1982 recession inflation rate peaked at 14.76% in March 1980 and remained over 10% through October 1981, before dropping in early-to-mid 1982. By comparison, inflation during the 2008–2009 recession was practically non-existent, with a peak of nearly 5.6% inflation in July 2008 before dropping to .09% by December 2008. Deflation occurred in 2009, specifically between March–October, “troughing” at negative (-) 2.10% in July 2009 before going positive to 2.72% in December 2009. Inflation remains low, standing at 2.65% as of March 2012.

In a related debilitating category, the Prime Lending Rate (PLR) stood at 20% in early-1980 in order to combat high inflation. The PLR fluctuated somewhat but hit 20% again in late-1980, again in early-1981, and yet again in late-1981, remaining at around 15% through mid-1982 before dropping below 10% by the end of 1982. By contrast, during the 2008–2009 recession the PLR has remained flat at around 1% since late in 2008, practically speaking during the entire period.

Although the banking industry and housing sector were hit hard in the 1980–1982 recession, the housing sector was hit harder in the 2008–2009 recession due to the housing bubble bursting in 2006–2007. This is the only category that is clearly worse in the 2008–2009 recession from a US perspective.

[edit] Job losses and unemployment rates

Main article: Job losses caused by the late-2000s recession

Many jobs have been lost worldwide following the onset of a recession in 2007.So far, the job losses have been demonstrably less than during the Great Depression of the 1930s, when US unemployment peaked at 25% of the labour force.[128] The United States entered into recession in December 2007[129] when job losses began. Unemployment increased drastically starting in September 2008 following the bankruptcy of Lehman Brothers.[130] In March 2009, U-S unemployment had risen to 8.7%.[131] In October 2009 the unemployment rate peaked at 10.0%, and then began to decline. In March 2009, statistician[132] John Williams argued that "measurement changes implemented over the years make it impossible to compare the current unemployment rate with that seen during the Great Depression".[132] By December 2010, the official U.S. unemployment rate was at 9.4%. Even at the peak of the recession, the unemployment rate never reached levels of the early 1980s recession. As of January 2012, the unemployment rate was 8.3%, and although the headline unemployment rate declined slightly over the next few months, by July 2012, it had risen again to 8.3% with a U6 unemployment rate of 15%. High energy prices and a depressed housing market are factors cited for bringing economic growth to a halt.[133]

Mass unemployment has also affected the United Kingdom since the recession began. In late 2007, unemployment stood at around 1.6million.[134] However, by early 2009 that figure had increased to more than 2 million and a year later it rose past the 2.5million mark. The peak in unemployment, however, came some two years after the recession, in December 2011, with close to 2.7million unemployed, accounting for 8.4% - marginally higher than the unemployment rate in the United States.[135]

Greece and Spain have been two of the hardest hit nations, with Greece's ongoing economic contraction increasing the unemployment rate to 21.9% in March 2012, while the unemployment rate in Spain was reported to be 24.6% for May 2012.[136] Portugal also faces tough economic times and high unemployment, with the Prime Minister proposing that one solution would be for Portuguese to emigrate and find work in other countries.[137]

[edit] Risk of second recession

As recovery stalled and stagnation set in, several observers warned of the possibility of a second recession. United States observers often cite the recession of 1937–1938 as a model.[138] :In his article “On the Possibilities to Forecast the Current Crisis and its Second Wave” (with Askar Akaev and Andrey Korotayev) in the Russian academic journal “Ekonomicheskaya politika” (December 2010. Issue 6. Pages 39–46 [139]) the Rector of the Moscow State University Viktor Sadovnichiy published "a forecast of the second wave of the crisis, which suggested that it might start in July — August, 2011".[140] A September 14, 2011 Reuters Poll indicated that economists thought the probability of another recession was at 31%, up from 25% the month before.[141] Since the US economy has not fully recovered from the last recession, any resumption would be considerably more painful.[142]

[edit] See also

[edit] References

- ^ *Wessel, David (2010-04-08). "Did 'Great Recession' Live Up to the Name?". The Wall Street Journal. http://online.wsj.com/article/SB10001424052702303591204575169693166352882.html.

- Evans-Pritchard, Ambrose (2010-09-13). "IMF fears 'social explosion' from world jobs crisis". The Daily Telegraph (London). http://www.telegraph.co.uk/finance/financetopics/financialcrisis/8000561/IMF-fears-social-explosion-from-world-jobs-crisis.html.

- Zuckerman, Mortimer (2011-06-20). "Why the jobs situation is worse than it looks". US News (New York). http://www.usnews.com/opinion/mzuckerman/articles/2011/06/20/why-the-jobs-situation-is-worse-than-it-looks.

- ^ "Krugman Coins a Phrase: "The Lesser Depression"". http://news.firedoglake.com/2011/07/22/krugman-coins-a-phrase-the-lesser-depression/. Retrieved 3 September 2011.

- ^ "The Long Recession In Hiring". http://thinkprogress.org/yglesias/2011/09/12/317166/the-long-recession-in-hiring//. Retrieved 12 September 2011.

- ^ "Countries throughout the world will experience an economic slowdown this year as the sovereign debt crisis in Europe continues to unfold"

- ^ "Retail sales fell in June for the third straight month, knocking down economic growth projections"

- ^ Story by Reuters "China's growth rate slowed for a sixth successive quarter to its slackest pace in more than three years"

- ^ Merriam-Webster, "headword "recession"", Merriam-Webster Collegiate Dictionary online, http://www.merriam-webster.com/dictionary/recession.

- ^ Daniel Gross, The Recession Is... Over?, Newsweek, July 14, 2009.

- ^ a b V.I. Keilis-Borok et al., Pattern of Macroeconomic Indicators Preceding the End of an American Economic Recession. Journal of Pattern Recognition Research, JPRR Vol.3 (1) 2008.

- ^ http://www.bendbulletin.com/article/20110629/NEWS0107/106290353/

- Rutenberg, Jim; Thee-Brenan, Megan (2011-04-21). "Nation's Mood at Lowest Level in Two Years, Poll Shows". The New York Times. http://www.nytimes.com/2011/04/22/us/22poll.html.

- http://www.usnews.com/opinion/mzuckerman/articles/2011/04/26/the-national-debt-crisis-is-an-existential-threat

- http://mrzine.monthlyreview.org/2011/baker260411.html

- http://www.google.com/hostednews/ap/article/ALeqM5gFezCtSywiNkvFr_NvDabFTBui3g?docId=b6871d68f23d4b4fae96f3be1f814a9b

- Wingfield, Brian (2010-09-20). "The End Of The Great Recession? Hardly". Forbes. http://blogs.forbes.com/brianwingfield/2010/09/20/the-end-of-the-great-recession-hardly/?partner=contextstory.

- Evans-Schaefer, Steve (2010-09-20). "Street Rallies Around Official Recession End". Forbes. http://www.forbes.com/2010/09/20/briefing-markets-recession-over-stocks-rally.html?boxes=Homepagechannels.

- ^ "Most Americans say U.S. in recession despite data: poll". Reuters. 2011-04-28. http://www.reuters.com/article/2011/04/28/us-usa-economy-gallup-idUSTRE73R3WW20110428?feedType=RSS&feedName=domesticNews.

- ^ US Business Cycle Expansions and Contractions, NBER, accessed August 9, 2012.

- ^ "NBER Makes It Official: Recession Started in December 2007". The Wall Street Journal. 2008-12-01. http://blogs.wsj.com/economics/2008/12/01/nber-makes-it-official-recession-started-in-december-2007/.

- ^ Foldvary, Fred E. (September 18, 2007) (PDF). The Depression of 2008. The Gutenberg Press. ISBN 0-9603872-0-X. http://www.foldvary.net/works/dep08.pdf. Retrieved 2009-01-04.

- ^ Nouriel Roubini (January 15, 2009). "A Global Breakdown Of The Recession In 2009". Forbes. http://www.forbes.com/2009/01/14/global-recession-2009-oped-cx_nr_0115roubini.html.

- ^ Isidore, Chris (2008-12-01). "It's official: Recession since Dec '07". CNN Money. http://money.cnn.com/2008/12/01/news/economy/recession/index.htm?postversion=2008120112. Retrieved 2009-04-10.

- ^ Congressional Budget Office compares downturn to Great Depression. By David Lightman. McClatchy Washington Bureau. January 27, 2009.

- ^ Finch, Julia (2009-01-26). "Twenty-five people at the heart of the meltdown ...". London: The Guardian. http://www.guardian.co.uk/business/2009/jan/26/road-ruin-recession-individuals-economy. Retrieved 2009-04-10.

- ^ Krugman, Paul (2009-01-04). ""Fighting Off Depression"". The New York Times.. http://www.nytimes.com/2009/01/05/opinion/05krugman.html.

- ^ Wearden, Graeme (2008-06-03). "Oil prices: George Soros warns that speculators could trigger stock market crash". London: The Guardian. http://www.guardian.co.uk/business/2008/jun/03/commodities. Retrieved 2009-04-10.

- ^ Andrews, Edmund L. (2008-10-24). "Greenspan Concedes Error on Regulation". New York Times. http://www.nytimes.com/2008/10/24/business/economy/24panel.html?_r=1&partner=permalink&exprod=permalink. Retrieved 2009-04-18.

- ^ "IMF World Economic Outlook, April 2009: "Exit strategies will be needed to transition fiscal and monetary policies from extraordinary short-term support to sustainable medium-term frameworks." (p.38)" (PDF). http://www.imf.org/external/pubs/ft/weo/2009/01/pdf/c1.pdf. Retrieved 2010-01-21.

- ^ "Olivier Blanchard, the chief economist of the International Monetary Fund, "is advising officials around the world to keep economic stimulus programs in place no longer than necessary to chart a path to sustainable growth."". Bloomberg.com. 2005-05-30. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aMK3Z_HHbYM8. Retrieved 2010-01-21.

- ^ Cooke, Kristin (2009-08-21). "U.S deficit poses potential systemic risk: Taylor". Reuters.com. http://www.reuters.com/article/newsOne/idUKTRE57K5IV20090821?virtualBrandChannel=11611. Retrieved 2010-01-21.

- ^ a b Dirk J Bezemer: "No One Saw This Coming" Understanding Financial Crisis Through Accounting Models, available via: MPRA, esp. p. 9 and appendix.

- ^ "From the subprime to the terrigenous: Recession begins at home". Land Values Research Group. June 2, 2009. http://lvrg.org.au/blog/2009/06/from-subprime-to-terrigenous-recession.html. (A survey of recessions or expected recessions in 40 countries, 33 of which arguably had property bubbles.)

- ^ a b Michael Simkovic, Competition and Crisis in Mortgage Securitization

- ^ "The end of Poland's house price boom". Global Property Guide. August 25, 2008. http://www.globalpropertyguide.com/Europe/Poland/Price-History.

- ^ "Real estate prices in Adriatic Coast up, Zagreb down". Global Property Guide. August 19, 2008. http://www.globalpropertyguide.com/Europe/Croatia/Price-History.

- ^ "The good times are here again". Global Property Guide. February 28, 2008. http://www.globalpropertyguide.com/Latin-America/Argentina/Price-History.

- ^ "Looming housing slump in China". Global Property Guide. September 1, 2008. http://www.globalpropertyguide.com/Asia/China/Price-History.

- ^ Monica Davey (December 25, 2005). "2005: In a Word". New York Times. http://www.nytimes.com/2005/12/25/weekinreview/25track.ready.html?ei=5070&en=0b11f24f470ec7da&ex=1136610000&pagewanted=print.

- ^ "The global housing boom". The Economist. June 16, 2005. http://www.economist.com/opinion/displaystory.cfm?story_id=4079027.

- ^ Allen, Paddy (2009-01-29). "Global recession – where did all the money go?". London: The Guardian. http://www.guardian.co.uk/business/dan-roberts-on-business-blog/interactive/2009/jan/29/financial-pyramid. Retrieved 2009-04-10.

- ^ "What Went Wrong". The Washington Post. 2008-10-15. http://www.washingtonpost.com/wp-dyn/content/article/2008/10/14/AR2008101403343.html?hpid=topnews&sid=ST2008101403344&s_pos=. Retrieved 2009-04-10.

- ^ Polleit, Thorsten (2007-12-13). "Manipulating the Interest Rate: a Recipe for Disaster". Mises Institute. http://mises.org/story/2810. Retrieved 2009-01-04.

- ^ Pettifor, Ann (16 September 2008). "America's financial meltdown: lessons and prospects". openDemocracy. http://www.opendemocracy.net/article/america-s-financial-meltdown-lessons-and-prospects. Retrieved 2009-01-04.

- ^ Karlsson, Stefan (2004-11-08). "America's Unsustainable Boom". Mises Institute. http://www.mises.org/story/1670. Retrieved 2009-01-04.

- ^ http://www.eestipank.info/pub/en/dokumendid/publikatsioonid/seeriad/uuringud/_2011/_10_2011/index_wp1011.html?ok=1 THE IMPACT OF PRIVATE DEBT ON ECONOMIC GROWTH Martti Randveer, Lenno Uusküla, Liina Kulu "Both theoretical and empirical evidence show that recessions are steeper in countries with high levels of private debt and/or credit booms." and "We find that a higher level of debt before a recession is correlated with smaller economic growth after the economic slowdown has finished."

- ^ chart titled "Anyone See Deleveraging?"

- ^ McCarthy, Ryan (2010-10-22). "How American Income Inequality Hit Levels Not Seen Since The Depression". huffingtonpost.com. http://www.huffingtonpost.com/2010/10/22/income-inequality-america_n_772687.html?page=2. Retrieved 2010-10-24.

- ^ Berner, Robert (2008-10-09). "They Warned Us About the Mortgage Crisis". Businessweek.com. http://www.businessweek.com/magazine/content/08_42/b4104036827981.htm. Retrieved 2012-05-15.

- ^ Photis Lysandrou (1 April 2012). "The real role of hedge funds in the crisis". FT.com. http://www.ft.com/cms/s/0/e83f9c52-6910-11e1-9931-00144feabdc0.html. Retrieved 9 April 2012. "On the eve of the crisis at end-2006, hedge funds held about 47 per cent of the $3tn worth of CDOs while the banks held 25 per cent and insurance companies and asset managers held the remaining 28 per cent."

- ^ Source: World trade Monitor[dead link]

- ^ "News Release: Gross Domestic Product". Bea.gov. 2009-12-22. http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm. Retrieved 2010-01-21.

- ^ "U.S. Department of Commerce. Bureau of Economic Analysis". Bea.gov. 2009-12-22. http://www.bea.gov/national/nipaweb/TableView.asp?SelectedTable=1&Freq=Qtr&FirstYear=2007&LastYear=2009. Retrieved 2010-01-21.

- ^ "U.S. Taxpayers Risk $9.7 Trillion on Bailout Programs (Update1)". Bloomberg. 2009-02-09. http://www.bloomberg.com/apps/news?pid=washingtonstory&sid=aGq2B3XeGKok. Retrieved 2011-04-18.

- ^ "according to Table P-5 of the Census report of (Lack of) Income, the median male is now worse on a gross, inflation adjusted basis, than he was in... 1968! While back then, the median income of male workers was $32,844, it has since declined to $32,137 as of 2010."

- ^ SGS Alternate Unemployment Rate

- ^ "The United States went through its longest, and by most measures worst economic recession since the Great Depression between December 2007 and June 2009."

- ^ Chart: US Employment to Population ratio.

- ^ "A record 5.4 million workers and their dependents have signed up to collect federal disability checks since President Obama took office, according to the latest official government data, as discouraged workers increasingly give up looking for jobs and take advantage of the federal program."

- ^ Pew Research http://pewresearch.org/pubs/2332/middle-class-optimism-income-barack-obama-mitt-romney-congress-wealth-income-lost-decade-worst

- ^ http://www.businessinsider.com/how-baby-boomers-destroyed-the-economy-2012-10 Another Pew report shows that those ages 55 to 64 are 10 percent wealthier today, even after the Great Recession, than Americans of that age bracket were in 1984. Those younger than 35 are 68 percent less wealthy than the same bracket was in 1984.

- ^ http://www.epi.org/press/news_from_epi_th_great_recession_exacerbated_existing_wealth_disparities_in/ In 2009, the wealthiest 20% of households controlled 87.2% of all wealth, up from 85.0% in 2007. The top 1% controlled 35.6% of all wealth, up from 34.6% in 2007.

- ^ "Median Household Income History in the United States". Davemanuel.com. http://www.davemanuel.com/median-household-income.php. Retrieved 2012-05-15.

- ^ Your Money Contributors (2011-12-27). "Between 2000 and 2010, the number of suburban households below the poverty line increased by 53 percent, compared to a 23 percent increase in poor households in urban areas, according to a Brookings Institution analysis of census data.". Businessinsider.com. http://www.businessinsider.com/guess-americas-best-kept-housing-secret-2011-12?nr_email_referer=1&utm_source=Triggermail&utm_medium=email&utm_term=Business%20Insider%20Select&utm_campaign=BI%20Select%20Recurring%202011-12-27. Retrieved 2012-05-15.

- ^ "CIA Adds Economy To Threat Updates White House Given First Daily Briefing" article by Joby Warrick, Washington Post Staff Writer, Thursday, February 26, 2009

- ^ Business Week article "Economic Woes Raising Global Political Risk" by Jack Ewing published March 10, 2009

- ^ The Associated Press article "Experts: Financial crisis threatens US security" by STEPHEN MANNING published March 11, 2009

- ^ a b "Europe | Iceland protest ends in clashes". BBC News. 2008-11-23. http://news.bbc.co.uk/2/hi/europe/7744355.stm. Retrieved 2012-05-15.

- ^ NPR article "Economic Crisis Poses Threat To Global Stability" by Tom Gjelten

- ^ The New York Times - Breaking News, World News & Multimedia

- ^ Maltezou, Renee (2009-02-25). "Greeks shut airports, services to protest economy". Reuters. http://www.reuters.com/article/newsOne/idUSLP45582720090225. Retrieved 2012-05-15.

- ^ January 17, 2009 (2009-01-17). "Protests spread in Europe amid economic crisis - Los Angeles Times". Latimes.com. http://www.latimes.com/news/nationworld/world/la-fg-baltic-protests17-2009jan17,1,5418868.story. Retrieved 2012-05-15.

- ^ Ian Traynor, Europe editor (2009-01-31). "Governments across Europe tremble as effects of global recession prompt angry people to take to the streets | Business". London: The Guardian. http://www.guardian.co.uk/business/2009/jan/31/global-recession-europe-protests. Retrieved 2012-05-15.

- ^ The New York Times - Breaking News, World News & Multimedia

- ^ Brown, David. The Times (London). http://business.timesonline.co.uk/tol/business/economics/article5627687.ece.

- ^ Abend, Lisa (11 September 2012). "Barcelona Warns Madrid: Pay Up, or Catalonia Leaves Spain". TIME ("A pro-independence march, which in the past has never drawn more than 50,000 people, pulled in a crowd estimated by city police at 1.5 million." and "As late as 2010, a poll conducted by Catalonia’s Center for Opinion Studies found that only 25.2% of the population favored independence."). http://world.time.com/2012/09/11/barcelona-warns-madrid-pay-up-or-catalonia-leaves-spain/. Retrieved 16 September 2012.

- ^ "EU Proposes €200 Billion Stimulus Plan". Businessweek.com. 2008-11-26. http://www.businessweek.com/globalbiz/content/nov2008/gb20081126_365422.htm. Retrieved 2010-01-21.

- ^ Bailout Binge[dead link]

- ^ New York Times, 2010 Sept. 13, "I.M.F. Calls for Focus on Creating Jobs," http://www.nytimes.com/2010/09/14/business/global/14euro.html?_r=1&ref=global-home

- ^ Gullapalli, Diya and Anand, Shefali. "Bailout of Money Funds Seems to Stanch Outflow", The Wall Street Journal, September 20, 2008.

- ^ Bull, Alister. "Fed says to make loans to aid money market funds", Reuters, September 19, 2008.

- ^ (Press Release) FRB: Board Approves Two Interim Final Rules, Federal Reserve Bank, September 19, 2008.

- ^ Boak, Joshua (Chicago Tribune). "SEC temporarily suspends short selling", San Jose Mercury News, September 19, 2008.

- ^ "Asian central banks spend billions to prevent crash". International Herald Tribune. 2008-09-16. http://www.iht.com/articles/2008/09/16/business/cbanks.php. Retrieved 2008-09-21.

- ^ "Chinese pharmaceutical exporters to benefit from latest tax rebates increases". Asia Manufacturing Pharma. 2008-12-01. http://www.asia-manufacturing.com/news-232-chinesepharmaceutical-exporters-taxrebates-increases.html. Retrieved 2008-12-01.

- ^ "Germany Rescues Hypo Real Estate". Deutsche Welle. 2008-10-06. http://www.dw-world.de/dw/article/0,2144,3692522,00.html.

- ^ "Gordon Brown should say 'sorry'". London: Telegraph.co.uk. 2009-03-09. http://www.telegraph.co.uk/news/newstopics/politics/gordon-brown/4961897/Gordon-Brown-should-say-sorry-over-economy-minister-says.html. Retrieved 2009-03-09.[dead link]

- ^ "It Doesn't Exist!". Newsweek.com. 2008-12-06. http://www.newsweek.com/id/172613. Retrieved 2008-12-15.

- ^ Waterfield, Bruno (2009-03-25). "EU resists deficits". London: Telegraph.co.uk. http://www.telegraph.co.uk/finance/financetopics/financialcrisis/5048291/EU-presidency-US-and-UK-economic-recovery-plans-are-a-way-to-hell.html. Retrieved 2010-01-21.

- ^ "Central Europe Risks Downgrades on Worsening Finances (Update1)". Bloomberg.com. 2009-09-21. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=apz_BEuHrNpI. Retrieved 2010-01-21.

- ^ "Zloty to Gain, Says LBBW, Most Accurate Forecaster (Update1)". Bloomberg.com. 2009-10-09. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a7k1g_PkuROs#. Retrieved 2010-01-21.

- ^ "Poland's Economic Outlook May Be Raised by IMF, PAP Reports". Bloomberg.com. 2009-12-15. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aQfKOAzdLHwc. Retrieved 2010-01-21.

- ^ "Business | S Korea avoids entering recession". BBC News. 2009-04-24. http://news.bbc.co.uk/2/hi/business/8015918.stm. Retrieved 2010-01-21.

- ^ [1][dead link]

- ^ Zappone, Chris (2009-06-03). "Australia dodges recession". The Sydney Morning Herald. http://business.smh.com.au/business/australia-dodges-recession-20090603-buyq.html.

- ^ . http://wotnews.com.au/like/australias_economy_shrank_in_last_quarter_of_2008/3124793/.

- ^ a b "Israel rate cut suggests more emerging market cuts - Emerging Markets Report". MarketWatch. http://www.marketwatch.com/story/israels-surprise-rate-cut-may-mean-other-em-cuts-2011-09-26. Retrieved 2012-05-15.

- ^ "Business | Australia raises interest rates". BBC News. 2009-10-06. http://news.bbc.co.uk/2/hi/business/8291968.stm. Retrieved 2010-01-21.

- ^ "India's Central Bank Raises Interest Rates". The New York Times. 2010-03-19. http://www.nytimes.com/2010/03/20/business/global/20rupee.html.

- ^ a b c Quarterly National Accounts

- ^ "Denmark". Oxford Economic Country Briefings (Findarticles.com). September 17, 2008. http://findarticles.com/p/articles/mi_qa5299/is_/ai_n30923226. Retrieved 2009-01-04.[dead link]

- ^ Charles Forelle (May 19, 2012). "In European Crisis, Iceland Emerges as an Island of Recovery". Wall Street Journal. http://online.wsj.com/article/SB10001424052702304203604577396171007652042.html?mod=ITP_pageone_0.

- ^ Mardiste, David (2008-08-13). "UPDATE 3-Estonia follows Denmark into recession in Q2". TALLINN: Reuters. http://www.reuters.com/article/rbssBanks/idUSLD17989220080813. Retrieved 2009-01-04.

- ^ "Latvia". Oxford Economic Country Briefings (Findarticles.com). September 26, 2008. http://findarticles.com/p/articles/mi_qa5299/is_20080926/ai_n30923365. Retrieved 2009-01-04.[dead link]

- ^ Evans-Pritchard, Ambrose (2008-09-25). "Ireland leads eurozone into recession". London: Telegraph. http://www.telegraph.co.uk/finance/economics/3079522/Ireland-leads-eurozone-into-recession.html. Retrieved 2009-01-04.

- ^ "New Zealand falls into recession". BBC News. 2008-09-26. http://news.bbc.co.uk/2/hi/asia-pacific/7637143.stm. Retrieved 2009-01-04.

- ^ "HIGHLIGHTS: Crisis sends Japan into first recession in 7 years". TOKYO: Reuters. 2008-11-17. http://www.reuters.com/article/GCA-Economy/idUSTRE4AG0I720081117. Retrieved 2009-01-04.

- ^ "Sweden stumbles into recession". The Local. 2008-11-28. http://www.thelocal.se/15998/20081128/. Retrieved 2009-04-10.

- ^ "HK shares may fall; exporters may drop". HONG KONG: Reuters. 2008-11-16. http://www.reuters.com/article/rbssInvestmentServices/idUSHKG29364920081117. Retrieved 2009-01-04.

- ^ Dunkley, Jamie (10 October 2008). "Singapore slides into recession". London: Telegraph. http://www.telegraph.co.uk/finance/economics/3171412/Singapore-slides-into-recession.html. Retrieved 2009-01-04.

- ^ "OECD area GDP down 0.1% in the third quarter of 2008". OECD. 2008-11-20. http://www.oecd.org/dataoecd/53/27/41700068.pdf. Retrieved 2009-04-10.

- ^ Fitzgibbons, Patrick (2008-11-14). "TOPWRAP 10-Germany, China, US feel pain of global downturn". NEW YORK: Reuters. http://www.reuters.com/article/naturalResources/idUSLD70564520081114. Retrieved 2009-01-04.

- ^ Strupczewski, Jan (2008-11-14). "Euro zone in recession, December rate cut expected". BRUSSELS: Reuters.com. http://www.reuters.com/article/ousivMolt/idUSTRE4AD29220081114. Retrieved 2009-01-04.

- ^ "SECO - Gross Domestic Product in Q2 2009". Seco.admin.ch. 2009-11-25. http://www.seco.admin.ch/themen/00374/00456/index.html?lang=en. Retrieved 2010-01-21.

- ^ "Spain's economy enters recession". BBC News. 2009-01-28. http://news.bbc.co.uk/2/hi/business/7856080.stm. Retrieved 2009-04-10.

- ^ "Taiwan in recession". 2009-02-18. http://www.straitstimes.com/Breaking%2BNews/Asia/Story/STIStory_339980.html. Retrieved 2009-04-10.

- ^ By In-Soo Nam (2009-04-24). "South Korea Economy Avoids Recession, Grows 0.1% - WSJ.com". Online.wsj.com. http://online.wsj.com/article/SB124053088380050309.html. Retrieved 2010-01-21.

- ^ "Reflating the dragon". Beijing: The Economist. November 13, 2008. http://www.economist.com/world/asia/displaystory.cfm?story_id=12606998. Retrieved 2009-01-04.

- ^ "National Bank estimate: Ukraine GDP down 20 percent in January". Kyiv Post. 2009-02-17. http://www.kyivpost.com/business/35635. Retrieved 2009-04-10.

- ^ http://irps.ucsd.edu/assets/001/500904.pdf

- ^ Alford, Peter (2009-02-16). "Japan headed for longest, deepest post-war recession". The Australian. http://www.theaustralian.news.com.au/business/story/0,28124,25061452-20142,00.html. Retrieved 2009-04-10.

- ^ 8:16 p.m. ET (2009-05-19). "Japanese GDP falls at biggest rate since 1955 - World business- msnbc.com". MSNBC. http://www.msnbc.msn.com/id/30833967/. Retrieved 2010-01-21.

- ^ Aversa, Jeannine (2009-03-16). "Bernanke: Recession could end in '09". The Washington Times. http://www.washingtontimes.com/news/2009/mar/16/bernanke-recession-could-end-2009/. Retrieved 2009-04-10.

- ^ "AFP: Bernanke sees 'green shoots' of US recovery". Google.com. 2009-03-15. http://www.google.com/hostednews/afp/article/ALeqM5h0_BVHNrjlYOoncy63c6fZFuXLag. Retrieved 2010-01-21.

- ^ "Fed cuts 2009 economic forecast". BBC News. 2009-02-18. http://news.bbc.co.uk/1/hi/business/7898223.stm. Retrieved 2009-04-10.

- ^ "German Economy Could Improve by the End of 2009". Spiegel. 2009-01-22. http://www.spiegel.de/international/business/0,1518,602866,00.html. Retrieved 2009-04-10.

- ^ Von Thomas Schmid (2008-12-07). "Abschwung: Vielleicht bald wieder sechs Millionen Arbeitslose" (in German). WELT ONLINE. http://www.welt.de/wirtschaft/article2841343/Vielleicht-bald-wieder-sechs-Millionen-Arbeitslose.html. Retrieved 2009-01-04.

- ^ "Economic Forecast autumn 2008: growth comes to a standstill in the wake of the financial crisis". European Commission: Economic and Financial Affairs. 2008-11-03. http://ec.europa.eu/economy_finance/thematic_articles/article13288_en.htm. Retrieved 2009-04-10.

- ^ "World Economic Outlook Update – Rapidly Weakening Prospects Call for New Policy Stimulus". International Monetary Fund. 2008-11-06. http://www.imf.org/external/pubs/ft/weo/2008/update/03/index.htm. Retrieved 2009-04-10.

- ^ "See e.g. the radio news at the following German address". Dradio.de. 2009-04-22. http://www.dradio.de/nachrichten/200904221800/1. Retrieved 2010-01-21.

- ^ "press conference from 21 April 2009". Imf.org. 2009-04-21. http://www.imf.org/external/np/tr/2009/tr042109.htm. Retrieved 2010-01-21.

- ^ "As Global Slump is Set to Continue, Poor Countries Need More Help". http://web.worldbank.org/WBSITE/EXTERNAL/NEWS/0,,contentMDK:22209360~menuPK:34463~pagePK:34370~piPK:34424~theSitePK:4607,00.html. Retrieved 2009-08-23.

- ^ Evans, Ambrose (2009-04-16). "IMF warns over parallels to Great Depression". London: Telegraph.co.uk. http://www.telegraph.co.uk/finance/financetopics/recession/5166956/IMF-warns-over-parallels-to-Great-Depression.html. Retrieved 2010-01-21.

- ^ The Telegraph (UK), 2010 Sept. 14, "IMF Fears 'Social Explosion' From World Jobs Crisis: America and Europe face the worst jobs crisis since the 1930s and risk 'an explosion of social unrest' unless they tread carefully, the International Monetary Fund has warned," http://www.telegraph.co.uk/finance/financetopics/financialcrisis/8000561/IMF-fears-social-explosion-from-world-jobs-crisis.html

- ^ [2][dead link]

- ^ Font size Print E-mail Share 97 Comments (2008-12-01). "It's Official: U.S. In Yearlong Recession". CBS News. http://www.cbsnews.com/stories/2008/12/01/national/main4640509.shtml. Retrieved 2010-01-21.

- ^ "Unemployment Spike – September 2008". Laidoffnation.com. http://laidoffnation.com/2009/06/recession-2008-2009/. Retrieved 2010-01-21.

- ^ "Table A-12. Alternative measures of labor underutilization". Bls.gov. 2010-01-08. http://www.bls.gov/news.release/empsit.t12.htm. Retrieved 2010-01-21.

- ^ a b "Statician says US joblessness near Depression highs". Reuters. 2009-03-09. http://www.reuters.com/article/marketsNews/idUSN0944970920090309. Retrieved 2010-01-21.

- ^ Sicilia, David. "A brief history of U.S. unemployment". Washington Post. http://www.washingtonpost.com/wp-srv/special/business/us-unemployment-rate-history/. Retrieved 2012-04-21.

- ^ "UK unemployment continues to fall". BBC News. 2007-12-12. http://news.bbc.co.uk/1/hi/business/7140069.stm.

- ^ "Economy tracker". BBC News. 2012-03-14. http://www.bbc.co.uk/news/10604117.

- ^ http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/3-02072012-AP/EN/3-02072012-AP-EN.PDF

- ^ Portugal’s prime minister has been free with his advice to the legions of young and unemployed in his country. They should “show more effort” and “leave their comfort zone” by looking for work abroad."

- ^ Paul Krugman (January 3, 2010). "That 1937 Feeling" (Op-ed). The New York Times. http://www.nytimes.com/2010/01/04/opinion/04krugman.html. Retrieved June 6, 2012.

- ^ "Клиодинамика - Successful Forecast Of The Second Wave Of The World Financial Economic Crisis". Cliodynamics.ru. http://cliodynamics.ru/index.php?option=com_content&task=view&id=295&Itemid=1. Retrieved 2012-05-15.

- ^ Askar Akaev, Viktor Sadovnichiy, and Andrey Korotayev. On the Possibilities to Forecast the Current Crisis and its Second Wave. “Ekonomicheskaya politika”. December 2010. Issue 6. Pages 39-46.; see also Askar Akaev, Viktor Sadovnichiy, and Andrey Korotayev. Huge rise in gold and oil prices as a precursor of a global financial and economic crisis. Doklady Mathematics. 2011. Volume 83, Number 2, 243-246.

- ^ "Reuters Poll: Economists Warn of Second Recession". Moneynews. Newsmax Media. 14 September 2011. http://www.moneynews.com/Economy/Economists-Risk-Recession/2011/09/14/id/410946.

- ^ “It would be disastrous if we entered into a recession at this stage, given that we haven’t yet made up for the last recession,” said Conrad DeQuadros, senior economist at RDQ Economics.

[edit] Further reading

- Cohan, William D., The Last Tycoons. The Secret History of Lazard Frères & Co.. New York, Broadway Books (Doubleday), 2007. ISBN 9780385521772

- Cohan, William D., House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, [a novel]. New York, Doubleday, 2009. ISBN 9780385528269

- Fengbo Zhang: 1.Perspective on the United States Sub-prime Mortgage Crisis , 2.Accurately Forecasting Trends of the Financial Crisis , 3.Stop Arguing about Socialism versus Capitalism .

- Funnell, Warwick N. In government we trust: market failure and the delusions of privatisation / Warwick Funnell, Robert Jupe and Jane Andrew. Sydney: University of New South Wales Press, 2009. ISBN 9780868409665 (pbk.)

- Harman, Chris Zombie Capitalism: Global Crisis and the Relevance of Marx / London: Bookmarks Publications 2009. ISBN 9781905192533

- Paulson, Hank, On the Brink. London, Headline, 2010. ISBN 9780755360543

- Read, Colin. Global financial meltdown: how we can avoid the next economic crisis / Colin Read. New York: Palgrave Macmillan, c2009. ISBN 9780230222182

- Woods, Thomas E. Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse / Washington DC: Regnery Publishing 2009. ISBN 1596985879

[edit] External links

| Wikimedia Commons has media related to: Economic crisis from 2007 |

| Wikinews has related news: |

| Wikiversity has learning materials about 2008–2012 global recession at |

- Tracking the Global Recession accurate and useful information from the Federal Reserve Bank of St. Louis

- Federal Reserve Bank of St. Louis, "What Caused the Crisis", collection of papers

- Economic Crisis and Stimulus from University of Colorado at Boulder Libraries GovPubs

- Stimulus Watch – U.S. government responses to the financial and economic crisis

- Global Outlook, Uri Dadush, "International Economics Bulletin", June 2009.

- Global Recession ongoing coverage from BBC News

- Global Recession ongoing coverage from The Guardian

- ILO Job Crisis Observatory

- UN DESA - Financial and economic crisis

- Financial Transmission of the Crisis: What’s the Lesson? Shimelse Ali, Uri Dadush, Lauren Falcao, "International Economics Bulletin, June 2009.

- A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis.

- The Second Wave of the Global Crisis? On mathematical analyses of some dynamic series

| ||||||||||||||||||||||||||||||||

| ||

Best content & valuable as well. Thanks for sharing this content.

ReplyDeleteApproved Auditor in DAFZA

Approved Auditor in RAKEZ

Approved Auditor in JAFZA

i heard about this blog & get actually whatever i was finding. Nice post love to read this blog

Approved Auditor in DMCC

Virgin Linseed Oil BP

Always look forward for such nice post & finally I got you. Really very impressive post & glad to read this.

ReplyDeleteWeb Development Company in Greater Noida

Software development company In Greater noida

Homoeopathic treatment for Psoriasis in greater noida

Kidney Disease Homoeopathy Doctor In Greater Noida