From Wikipedia, the free encyclopedia

For an overview of major global economic issues since 2007, see 2007–2012 global economic crisis and 2008–2012 global recession.

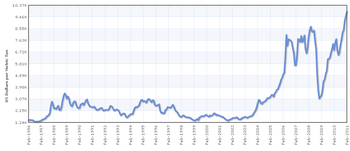

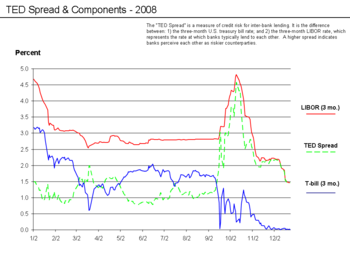

The TED spread (in red) increased significantly during the financial crisis, reflecting an increase in perceived credit risk.

The bursting of the U.S. housing bubble, which peaked in 2006,[6] caused the values of securities tied to U.S. real estate pricing to plummet, damaging financial institutions globally.[7][8] The financial crisis was triggered by a complex interplay of government policies that encouraged home ownership, providing easier access to loans for subprime borrowers, overvaluation of bundled sub-prime mortgages based on the theory that housing prices would continue to escalate, questionable trading practices on behalf of both buyers and sellers, compensation structures that prioritize short-term deal flow over long-term value creation, and a lack of adequate capital holdings from banks and insurance companies to back the financial commitments they were making.[9][10][11][12] Questions regarding bank solvency, declines in credit availability and damaged investor confidence had an impact on global stock markets, where securities suffered large losses during 2008 and early 2009. Economies worldwide slowed during this period, as credit tightened and international trade declined.[13] Governments and central banks responded with unprecedented fiscal stimulus, monetary policy expansion and institutional bailouts. Although there have been aftershocks, the financial crisis itself ended sometime between late-2008 and mid-2009.[14][15][16] In the U.S., Congress passed the American Recovery and Reinvestment Act of 2009. In the EU, the UK responded with austerity measures of spending cuts and tax increases without export growth and it has since slid into a double-dip recession.[17][18]

Many causes for the financial crisis have been suggested, with varying weight assigned by experts.[19] The U.S. Senate's Levin–Coburn Report asserted that the crisis was the result of "high risk, complex financial products; undisclosed conflicts of interest; the failure of regulators, the credit rating agencies, and the market itself to rein in the excesses of Wall Street."[20] The 1999 repeal of the Glass–Steagall Act effectively removed the separation between investment banks and depository banks in the United States.[21] Critics argued that credit rating agencies and investors failed to accurately price the risk involved with mortgage-related financial products, and that governments did not adjust their regulatory practices to address 21st-century financial markets.[22] Research into the causes of the financial crisis has also focused on the role of interest rate spreads.[23]

In the immediate aftermath of the financial crisis palliative fiscal and monetary policies were adopted to lessen the shock to the economy.[24] In July, 2010, the Dodd-Frank regulatory reforms were enacted to lessen the chance of a recurrence. [25]

[edit] Background

Main article: Causes of the late-2000s financial crisis

The immediate cause or trigger of the crisis was the bursting of the United States housing bubble which peaked in approximately 2005–2006.[26][27] Already-rising default rates on "subprime" and adjustable-rate mortgages (ARM) began to increase quickly thereafter. As banks began to give out more loans to potential home owners, housing prices began to rise.Easy availability of credit in the US, fueled by large inflows of foreign funds after the Russian debt crisis and Asian financial crisis of the 1997-1998 period, led to a housing construction boom and facilitated debt-financed consumer spending. Lax lending standards and rising real estate prices also contributed to the Real estate bubble. Loans of various types (e.g., mortgage, credit card, and auto) were easy to obtain and consumers assumed an unprecedented debt load.[28] [29][30]

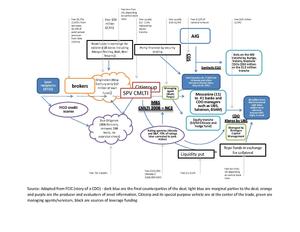

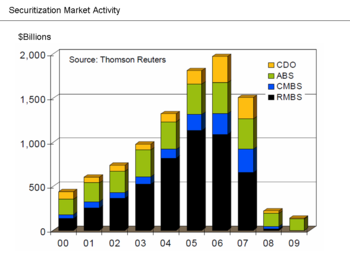

As part of the housing and credit booms, the number of financial agreements called mortgage-backed securities (MBS) and collateralized debt obligations (CDO), which derived their value from mortgage payments and housing prices, greatly increased.[8] Such financial innovation enabled institutions and investors around the world to invest in the U.S. housing market. As housing prices declined, major global financial institutions that had borrowed and invested heavily in subprime MBS reported significant losses.[31]

Falling prices also resulted in homes worth less than the mortgage loan, providing a financial incentive to enter foreclosure. The ongoing foreclosure epidemic that began in late 2006 in the U.S. continues to drain wealth from consumers and erodes the financial strength of banking institutions. Defaults and losses on other loan types also increased significantly as the crisis expanded from the housing market to other parts of the economy. Total losses are estimated in the trillions of U.S. dollars globally.[31]

These institutions, as well as certain regulated banks, had also assumed significant debt burdens while providing the loans described above and did not have a financial cushion sufficient to absorb large loan defaults or MBS losses.[34] These losses impacted the ability of financial institutions to lend, slowing economic activity. Concerns regarding the stability of key financial institutions drove central banks to provide funds to encourage lending and restore faith in the commercial paper markets, which are integral to funding business operations. Governments also bailed out key financial institutions and implemented economic stimulus programs, assuming significant additional financial commitments.

The U.S. Financial Crisis Inquiry Commission reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the tide of toxic mortgages; Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels."[35][36]

[edit] Subprime lending

Main article: Subprime mortgage crisis

Intense competition between mortgage lenders for revenue and market share, and the limited supply of creditworthy borrowers, caused mortgage lenders to relax underwriting standards and originate riskier mortgages to less creditworthy borrowers.[8] Before 2003, when the mortgage securitization market was dominated by regulated and relatively conservative Government Sponsored Enterprises, GSEs policed mortgage originators and maintained relatively high underwriting standards. However, as market power shifted from securitizers to originators and as intense competition from private securitizers undermined GSE power, mortgage standards declined and risky loans proliferated.[8] The worst loans were originated in 2004–2007, the years of the most intense competition between securitizers and the lowest market share for the GSEs.As well as easy credit conditions, there is evidence that competitive pressures contributed to an increase in the amount of subprime lending during the years preceding the crisis. Major U.S. investment banks and government sponsored enterprises like Fannie Mae played an important role in the expansion of lending, with GSEs eventually relaxing their standards to try to catch up with the private banks.[37][38]

Subprime mortgages remained below 10% of all mortgage originations until 2004, when they spiked to nearly 20% and remained there through the 2005–2006 peak of the United States housing bubble.[39]

Some long-time critics of government and the GSEs, like American Enterprise Institute fellow Peter J. Wallison,[40] claim that the roots of the crisis can be traced directly to risky lending by government sponsored entities Fannie Mae and Freddie Mac. Although Wallison's claims have received widespread attention in the media and by policy makers, the majority report of the Financial Crisis Inquiry Commission, several studies by Federal Reserve economists, and the work of independent scholars suggest that Wallison's claims are not supported by data.[8] In fact, the GSEs loans performed far better than loans securitized by private investment banks, and GSE loans performed better than some loans originated by institutions that held loans in their own portfolios.[8]

Wallison has been widely criticized for attempting to politicize the investigation of the Financial Crisis Inquiry Commission, and his critics include fellow Republican Commissioners.[41] Morgenson and Rosner also highlight the role of the GSEs in non-prime lending.[42] Others agree[43][44] and disagree.[45][46]

On September 30, 1999, The New York Times reported that the Clinton Administration pushed for more lending to low and moderate income borrowers, while the mortgage industry sought guarantees for sub-prime loans:

Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits. In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers... In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980s.[47]In the early and mid-2000s (decade), the Bush administration called numerous times[48] for investigation into the safety and soundness of the GSEs and their swelling portfolio of subprime mortgages. On September 10, 2003 the House Financial Services Committee held a hearing at the urging of the administration to assess safety and soundness issues and to review a recent report by the Office of Federal Housing Enterprise Oversight (OFHEO) that had uncovered accounting discrepancies within the two entities.[49] The hearings never resulted in new legislation or formal investigation of Fannie Mae and Freddie Mac, as many of the committee members refused to accept the report and instead rebuked OFHEO for their attempt at regulation.[50] Some believe this was an early warning to the systemic risk that the growing market in subprime mortgages posed to the U.S. financial system that went unheeded.[51]

A 2000 United States Department of the Treasury study of lending trends for 305 cities from 1993 to 1998 showed that $467 billion of mortgage lending was made by Community Reinvestment Act (CRA)-covered lenders into low and mid level income (LMI) borrowers and neighborhoods, representing 10% of all U.S. mortgage lending during the period. The majority of these were prime loans. Sub-prime loans made by CRA-covered institutions constituted a 3% market share of LMI loans in 1998,[52] but in the run-up to the crisis, fully 25% of all sub-prime lending occurred at CRA-covered institutions and another 25% of sub-prime loans had some connection with CRA.[53]

An analysis by the Federal Reserve Bank of Dallas in 2009, however, concluded unequivocally that the CRA was not responsible for the mortgage loan crisis, pointing out that CRA rules have been in place since 1995 whereas the poor lending emerged only a decade later.[54] Furthermore, most sub-prime loans were not made to the LMI borrowers targeted by the CRA, especially in the years 2005–2006 leading up to the crisis. Nor did it find any evidence that lending under the CRA rules increased delinquency rates or that the CRA indirectly influenced independent mortgage lenders to ramp up sub-prime lending.

Economist Paul Krugman argued in January 2010 that the simultaneous growth of the residential and commercial real estate pricing bubbles undermines the case made by those who argue that Fannie Mae, Freddie Mac, CRA or predatory lending were primary causes of the crisis. In other words, bubbles in both markets developed even though only the residential market was affected by these potential causes.[55] Others have pointed out that there were not enough of these loans made to cause a crisis of this magnitude. In an article in Portfolio Magazine, Michael Lewis spoke with one trader who noted that "There weren’t enough Americans with [bad] credit taking out [bad loans] to satisfy investors' appetite for the end product." Essentially, investment banks and hedge funds used financial innovation to enable large wagers to be made, far beyond the actual value of the underlying mortgage loans, using derivatives called credit default swaps, collateralized debt obligations and synthetic CDOs.[56]

As of March 2011 the FDIC has had to pay out $9 billion to cover losses on bad loans at 165 failed financial institutions.[57]

[edit] Growth of the housing bubble

Main article: United States housing bubble

A graph showing the median and average sales prices of new homes sold in the United States between 1963 and 2008 (not adjusted for inflation)[58]

In a Peabody Award winning program, NPR correspondents argued that a "Giant Pool of Money" (represented by $70 trillion in worldwide fixed income investments) sought higher yields than those offered by U.S. Treasury bonds early in the decade. This pool of money had roughly doubled in size from 2000 to 2007, yet the supply of relatively safe, income generating investments had not grown as fast. Investment banks on Wall Street answered this demand with products such as the mortgage-backed security and the collateralized debt obligation that were assigned safe ratings by the credit rating agencies.[61]

In effect, Wall Street connected this pool of money to the mortgage market in the U.S., with enormous fees accruing to those throughout the mortgage supply chain, from the mortgage broker selling the loans, to small banks that funded the brokers and the large investment banks behind them. By approximately 2003, the supply of mortgages originated at traditional lending standards had been exhausted, and continued strong demand began to drive down lending standards.[61]

The collateralized debt obligation in particular enabled financial institutions to obtain investor funds to finance subprime and other lending, extending or increasing the housing bubble and generating large fees. This essentially places cash payments from multiple mortgages or other debt obligations into a single pool from which specific securities draw in a specific sequence of priority. Those securities first in line received investment-grade ratings from rating agencies. Securities with lower priority had lower credit ratings but theoretically a higher rate of return on the amount invested.[62][63]

By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak.[64][65] As prices declined, borrowers with adjustable-rate mortgages could not refinance to avoid the higher payments associated with rising interest rates and began to default. During 2007, lenders began foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006.[66] This increased to 2.3 million in 2008, an 81% increase vs. 2007.[67] By August 2008, 9.2% of all U.S. mortgages outstanding were either delinquent or in foreclosure.[68] By September 2009, this had risen to 14.4%.[69]

[edit] Easy credit conditions

Lower interest rates encouraged borrowing. From 2000 to 2003, the Federal Reserve lowered the federal funds rate target from 6.5% to 1.0%.[70] This was done to soften the effects of the collapse of the dot-com bubble and the September 2001 terrorist attacks, as well as to combat a perceived risk of deflation.[71] As early as 2002 it was apparent that credit was fueling housing instead of business investment as some economists went so far as to advocate that the Fed "needs to create a housing bubble to replace the Nasdaq bubble".[72]Additional downward pressure on interest rates was created by the high and rising U.S. current account deficit, which peaked along with the housing bubble in 2006. Federal Reserve Chairman Ben Bernanke explained how trade deficits required the U.S. to borrow money from abroad, in the process bidding up bond prices and lowering interest rates.[73]

Bernanke explained that between 1996 and 2004, the U.S. current account deficit increased by $650 billion, from 1.5% to 5.8% of GDP. Financing these deficits required the country to borrow large sums from abroad, much of it from countries running trade surpluses. These were mainly the emerging economies in Asia and oil-exporting nations. The balance of payments identity requires that a country (such as the U.S.) running a current account deficit also have a capital account (investment) surplus of the same amount. Hence large and growing amounts of foreign funds (capital) flowed into the U.S. to finance its imports.

All of this created demand for various types of financial assets, raising the prices of those assets while lowering interest rates. Foreign investors had these funds to lend either because they had very high personal savings rates (as high as 40% in China) or because of high oil prices. Ben Bernanke has referred to this as a "saving glut".[74]

A flood of funds (capital or liquidity) reached the U.S. financial markets. Foreign governments supplied funds by purchasing Treasury bonds and thus avoided much of the direct impact of the crisis. U.S. households, on the other hand, used funds borrowed from foreigners to finance consumption or to bid up the prices of housing and financial assets. Financial institutions invested foreign funds in mortgage-backed securities.

The Fed then raised the Fed funds rate significantly between July 2004 and July 2006.[75] This contributed to an increase in 1-year and 5-year adjustable-rate mortgage (ARM) rates, making ARM interest rate resets more expensive for homeowners.[76] This may have also contributed to the deflating of the housing bubble, as asset prices generally move inversely to interest rates, and it became riskier to speculate in housing.[77][78] U.S. housing and financial assets dramatically declined in value after the housing bubble burst.[79][80]

[edit] Weak and fraudulent underwriting practices

Testimony given to the Financial Crisis Inquiry Commission by Richard M. Bowen III on events during his tenure as the Business Chief Underwriter for Correspondent Lending in the Consumer Lending Group for Citigroup (where he was responsible for over 220 professional underwriters) suggests that by the final years of the U.S. housing bubble (2006–2007), the collapse of mortgage underwriting standards was endemic. His testimony stated that by 2006, 60% of mortgages purchased by Citi from some 1,600 mortgage companies were "defective" (were not underwritten to policy, or did not contain all policy-required documents) - this, despite the fact that each of these 1,600 originators were contractually responsible (certified via representations and warrantees) that their mortgage originations met Citi's standards. Moreover, during 2007, "defective mortgages (from mortgage originators contractually bound to perform underwriting to Citi's standards) increased... to over 80% of production".[81]In separate testimony to Financial Crisis Inquiry Commission, officers of Clayton Holdings—the largest residential loan due diligence and securitization surveillance company in the United States and Europe—testified that Clayton's review of over 900,000 mortgages issued from January 2006 to June 2007 revealed that scarcely 54% of the loans met their originators’ underwriting standards. The analysis (conducted on behalf of 23 investment and commercial banks, including 7 "too big to fail" banks) additionally showed that 28% of the sampled loans did not meet the minimal standards of any issuer. Clayton's analysis further showed that 39% of these loans (i.e. those not meeting any issuer's minimal underwriting standards) were subsequently securitized and sold to investors.[82][83]

There is strong evidence that the GSEs — due to their large size and market power — were far more effective at policing underwriting by originators and forcing underwriters to repurchase defective loans. By contrast, private securitizers have been far less aggressive and less effective in recovering losses from originators on behalf of investors.[8]

[edit] Predatory lending

Predatory lending refers to the practice of unscrupulous lenders, enticing borrowers to enter into "unsafe" or "unsound" secured loans for inappropriate purposes.[84] A classic bait-and-switch method was used by Countrywide Financial, advertising low interest rates for home refinancing. Such loans were written into extensively detailed contracts, and swapped for more expensive loan products on the day of closing. Whereas the advertisement might state that 1% or 1.5% interest would be charged, the consumer would be put into an adjustable rate mortgage (ARM) in which the interest charged would be greater than the amount of interest paid. This created negative amortization, which the credit consumer might not notice until long after the loan transaction had been consummated.Countrywide, sued by California Attorney General Jerry Brown for "unfair business practices" and "false advertising" was making high cost mortgages "to homeowners with weak credit, adjustable rate mortgages (ARMs) that allowed homeowners to make interest-only payments".[85] When housing prices decreased, homeowners in ARMs then had little incentive to pay their monthly payments, since their home equity had disappeared. This caused Countrywide's financial condition to deteriorate, ultimately resulting in a decision by the Office of Thrift Supervision to seize the lender.

Former employees from Ameriquest, which was United States' leading wholesale lender,[86] described a system in which they were pushed to falsify mortgage documents and then sell the mortgages to Wall Street banks eager to make fast profits.[86] There is growing evidence that such mortgage frauds may be a cause of the crisis.[86]

[edit] Deregulation

Further information: Government policies and the subprime mortgage crisis

Critics such as economist Paul Krugman and U.S. Treasury Secretary Timothy Geithner have argued that the regulatory framework did not keep pace with financial innovation, such as the increasing importance of the shadow banking system, derivatives and off-balance sheet financing. A recent OECD study[87] suggest that bank regulation based on the Basel accords encourage unconventional business practices and contributed to or even reinforced the financial crisis. In other cases, laws were changed or enforcement weakened in parts of the financial system. Key examples include:- Jimmy Carter's Depository Institutions Deregulation and Monetary Control Act of 1980 (DIDMCA) phased out a number of restrictions on banks' financial practices, broadened their lending powers, allowed credit unions and savings and loans to offer checkable deposits, and raised the deposit insurance limit from $40,000 to $100,000 (thereby potentially lessening depositor scrutiny of lenders' risk management policies.)[88]

- In October 1982, U.S. President Ronald Reagan signed into law the Garn–St. Germain Depository Institutions Act, which provided for adjustable-rate mortgage loans, began the process of banking deregulation,[citation needed] and contributed to the savings and loan crisis of the late 1980s/early 1990s.[89]

- In November 1999, U.S. President Bill Clinton signed into law the Gramm–Leach–Bliley Act, which repealed part of the Glass–Steagall Act of 1933. This repeal has been criticized for reducing the separation between commercial banks (which traditionally had fiscally conservative policies) and investment banks (which had a more risk-taking culture).[90][91] However, the vast majority of failures were at institutions that were created by Glass-Steagall.[92]

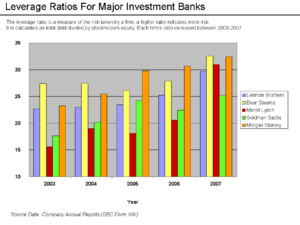

- In 2004, the U.S. Securities and Exchange Commission relaxed the net capital rule, which enabled investment banks to substantially increase the level of debt they were taking on, fueling the growth in mortgage-backed securities supporting subprime mortgages. The SEC has conceded that self-regulation of investment banks contributed to the crisis.[93][94]

- Financial institutions in the shadow banking system are not subject to the same regulation as depository banks, allowing them to assume additional debt obligations relative to their financial cushion or capital base.[95] This was the case despite the Long-Term Capital Management debacle in 1998, where a highly-leveraged shadow institution failed with systemic implications.

- Regulators and accounting standard-setters allowed depository banks such as Citigroup to move significant amounts of assets and liabilities off-balance sheet into complex legal entities called structured investment vehicles, masking the weakness of the capital base of the firm or degree of leverage or risk taken. One news agency estimated that the top four U.S. banks will have to return between $500 billion and $1 trillion to their balance sheets during 2009.[96] This increased uncertainty during the crisis regarding the financial position of the major banks.[97] Off-balance sheet entities were also used by Enron as part of the scandal that brought down that company in 2001.[98]

- As early as 1997, Federal Reserve Chairman Alan Greenspan fought to keep the derivatives market unregulated.[99] With the advice of the President's Working Group on Financial Markets,[100] the U.S. Congress and President allowed the self-regulation of the over-the-counter derivatives market when they enacted the Commodity Futures Modernization Act of 2000. Derivatives such as credit default swaps (CDS) can be used to hedge or speculate against particular credit risks. The volume of CDS outstanding increased 100-fold from 1998 to 2008, with estimates of the debt covered by CDS contracts, as of November 2008, ranging from US$33 to $47 trillion. Total over-the-counter (OTC) derivative notional value rose to $683 trillion by June 2008.[101] Warren Buffett famously referred to derivatives as "financial weapons of mass destruction" in early 2003.[102][103]

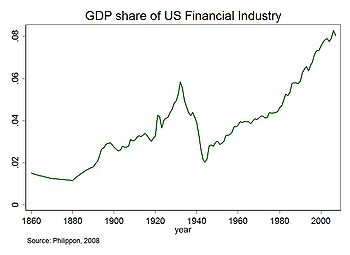

[edit] Increased debt burden or over-leveraging

Prior to the crisis, financial Institutions became highly leveraged, increasing their appetite for risky investments and reducing their resilience in case of losses. Much of this leverage was achieved using complex financial instruments such as off-balance sheet securitization and derivatives, which made it difficult for creditors and regulators to monitor and try to reduce financial institution risk levels.[10] These instruments also made it virtually impossible to reorganize financial institutions in bankruptcy, and contributed to the need for government bailouts.[10]U.S. households and financial institutions became increasingly indebted or overleveraged during the years preceding the crisis.[104] This increased their vulnerability to the collapse of the housing bubble and worsened the ensuing economic downturn.[105] Key statistics include:

Free cash used by consumers from home equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion dollars over the period, contributing to economic growth worldwide.[106][107][108] U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion.[109]

USA household debt as a percentage of annual disposable personal income was 127% at the end of 2007, versus 77% in 1990.[104] In 1981, U.S. private debt was 123% of GDP; by the third quarter of 2008, it was 290%.[110]

From 2004–07, the top five U.S. investment banks each significantly increased their financial leverage (see diagram), which increased their vulnerability to a financial shock. Changes in capital requirements, intended to keep U.S. banks competitive with their European counterparts, allowed lower risk weightings for AAA securities. The shift from first-loss tranches to AAA tranches was seen by regulators as a risk reduction that compensated the higher leverage.[111] These five institutions reported over $4.1 trillion in debt for fiscal year 2007, about 30% of USA nominal GDP for 2007. Lehman Brothers was liquidated, Bear Stearns and Merrill Lynch were sold at fire-sale prices, and Goldman Sachs and Morgan Stanley became commercial banks, subjecting themselves to more stringent regulation. With the exception of Lehman, these companies required or received government support.[112]

Fannie Mae and Freddie Mac, two U.S. Government sponsored enterprises, owned or guaranteed nearly $5 trillion in mortgage obligations at the time they were placed into conservatorship by the U.S. government in September 2008.[113][114]

These seven entities were highly leveraged and had $9 trillion in debt or guarantee obligations; yet they were not subject to the same regulation as depository banks.[95][115]

Behavior that may be optimal for an individual (e.g., saving more during adverse economic conditions) can be detrimental if too many individuals pursue the same behavior, as ultimately one person's consumption is another person's income. Too many consumers attempting to save (or pay down debt) simultaneously is called the paradox of thrift and can cause or deepen a recession. Economist Hyman Minsky also described a "paradox of deleveraging" as financial institutions that have too much leverage (debt relative to equity) cannot all de-leverage simultaneously without significant declines in the value of their assets.[105]

During April 2009, U.S. Federal Reserve Vice Chair Janet Yellen discussed these paradoxes: "Once this massive credit crunch hit, it didn’t take long before we were in a recession. The recession, in turn, deepened the credit crunch as demand and employment fell, and credit losses of financial institutions surged. Indeed, we have been in the grips of precisely this adverse feedback loop for more than a year. A process of balance sheet deleveraging has spread to nearly every corner of the economy. Consumers are pulling back on purchases, especially on durable goods, to build their savings. Businesses are cancelling planned investments and laying off workers to preserve cash. And, financial institutions are shrinking assets to bolster capital and improve their chances of weathering the current storm. Once again, Minsky understood this dynamic. He spoke of the paradox of deleveraging, in which precautions that may be smart for individuals and firms—and indeed essential to return the economy to a normal state—nevertheless magnify the distress of the economy as a whole."[105]

[edit] Financial innovation and complexity

| This section may stray from the topic of the article into the topic of another article, financial innovation. (December 2011) |

CDO issuance grew from an estimated $20 billion in Q1 2004 to its peak of over $180 billion by Q1 2007, then declined back under $20 billion by Q1 2008. Further, the credit quality of CDO's declined from 2000–2007, as the level of subprime and other non-prime mortgage debt increased from 5% to 36% of CDO assets.[116] As described in the section on subprime lending, the CDS and portfolio of CDS called synthetic CDO[dubious ][citation needed] enabled a theoretically infinite amount to be wagered on the finite value of housing loans outstanding, provided that buyers and sellers of the derivatives could be found. For example, buying a CDS to insure a CDO ended up giving the seller the same risk[citation needed] as if they owned the CDO, when those CDO's became worthless.[117]

This boom in innovative financial products went hand in hand with more complexity. It multiplied the number of actors connected to a single mortgage (including mortgage brokers, specialized originators, the securitizers and their due diligence firms, managing agents and trading desks, and finally investors, insurances and providers of repo funding). With increasing distance from the underlying asset these actors relied more and more on indirect information (including FICO scores on creditworthiness, appraisals and due diligence checks by third party organizations, and most importantly the computer models of rating agencies and risk management desks). Instead of spreading risk this provided the ground for fraudulent acts, misjudgments and finally market collapse.[118]

Martin Wolf further wrote in June 2009 that certain financial innovations enabled firms to circumvent regulations, such as off-balance sheet financing that affects the leverage or capital cushion reported by major banks, stating: "...an enormous part of what banks did in the early part of this decade – the off-balance-sheet vehicles, the derivatives and the 'shadow banking system' itself – was to find a way round regulation."[119]

[edit] Incorrect pricing of risk

A protester on Wall Street in the wake of the AIG bonus payments controversy is interviewed by news media.

For a variety of reasons, market participants did not accurately measure the risk inherent with financial innovation such as MBS and CDOs or understand its impact on the overall stability of the financial system.[22] For example, the pricing model for CDOs clearly did not reflect the level of risk they introduced into the system. Banks estimated that $450bn of CDO were sold between "late 2005 to the middle of 2007"; among the $102bn of those that had been liquidated, JPMorgan estimated that the average recovery rate for "high quality" CDOs was approximately 32 cents on the dollar, while the recovery rate for mezzanine CDO was approximately five cents for every dollar.[120]

Another example relates to AIG, which insured obligations of various financial institutions through the usage of credit default swaps. The basic CDS transaction involved AIG receiving a premium in exchange for a promise to pay money to party A in the event party B defaulted. However, AIG did not have the financial strength to support its many CDS commitments as the crisis progressed and was taken over by the government in September 2008. U.S. taxpayers provided over $180 billion in government support to AIG during 2008 and early 2009, through which the money flowed to various counterparties to CDS transactions, including many large global financial institutions.[121][122]

The limitations of a widely-used financial model also were not properly understood.[123][124] This formula assumed that the price of CDS was correlated with and could predict the correct price of mortgage-backed securities. Because it was highly tractable, it rapidly came to be used by a huge percentage of CDO and CDS investors, issuers, and rating agencies.[124] According to one wired.com article:

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril... Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees.[124]As financial assets became more and more complex, and harder and harder to value, investors were reassured by the fact that both the international bond rating agencies and bank regulators, who came to rely on them, accepted as valid some complex mathematical models which theoretically showed the risks were much smaller than they actually proved to be.[125] George Soros commented that "The super-boom got out of hand when the new products became so complicated that the authorities could no longer calculate the risks and started relying on the risk management methods of the banks themselves. Similarly, the rating agencies relied on the information provided by the originators of synthetic products. It was a shocking abdication of responsibility."[126]

Moreover, a conflict of interest between professional investment managers and their institutional clients, combined with a global glut in investment capital, led to bad investments by asset managers in over-priced credit assets. Professional investment managers generally are compensated based on the volume of client assets under management. There is, therefore, an incentive for asset managers to expand their assets under management in order to maximize their compensation. As the glut in global investment capital caused the yields on credit assets to decline, asset managers were faced with the choice of either investing in assets where returns did not reflect true credit risk or returning funds to clients. Many asset managers chose to continue to invest client funds in over-priced (under-yielding) investments, to the detriment of their clients, in order to maintain their assets under management. This choice was supported by a "plausible deniability" of the risks associated with subprime-based credit assets because the loss experience with early "vintages" of subprime loans was so low.[127]

Despite the dominance of the above formula, there are documented attempts of the financial industry, occurring before the crisis, to address the formula limitations, specifically the lack of dependence dynamics and the poor representation of extreme events.[128] The volume "Credit Correlation: Life After Copulas", published in 2007 by World Scientific, summarizes a 2006 conference held by Merrill Lynch in London where several practitioners attempted to propose models rectifying some of the copula limitations. See also the article by Donnelly and Embrechts[129] and the book by Brigo, Pallavicini and Torresetti, that reports relevant warnings and research on CDOs appeared in 2006.[130]

Mortgage risks were underestimated by every institution in the chain from originator to investor by underweighting the possibility of falling housing prices based on historical trends of the past 50 years. Limitations of default and prepayment models, the heart of pricing models, led to overvaluation of mortgage and asset-backed products and their derivatives by originators, securitizers, broker-dealers, rating-agencies, insurance underwriters and investors. [131][132]

[edit] Boom and collapse of the shadow banking system

There is strong evidence that the riskiest, worst performing mortgages were funded through the "shadow banking system" and that competition from the shadow banking system may have pressured more traditional institutions to lower their own underwriting standards and originate riskier loans.[8]In a June 2008 speech, President and CEO of the New York Federal Reserve Bank Timothy Geithner—who in 2009 became Secretary of the United States Treasury—placed significant blame for the freezing of credit markets on a "run" on the entities in the "parallel" banking system, also called the shadow banking system. These entities became critical to the credit markets underpinning the financial system, but were not subject to the same regulatory controls. Further, these entities were vulnerable because of maturity mismatch, meaning that they borrowed short-term in liquid markets to purchase long-term, illiquid and risky assets. This meant that disruptions in credit markets would make them subject to rapid deleveraging, selling their long-term assets at depressed prices. He described the significance of these entities:

In early 2007, asset-backed commercial paper conduits, in structured investment vehicles, in auction-rate preferred securities, tender option bonds and variable rate demand notes, had a combined asset size of roughly $2.2 trillion. Assets financed overnight in triparty repo grew to $2.5 trillion. Assets held in hedge funds grew to roughly $1.8 trillion. The combined balance sheets of the then five major investment banks totaled $4 trillion. In comparison, the total assets of the top five bank holding companies in the United States at that point were just over $6 trillion, and total assets of the entire banking system were about $10 trillion. The combined effect of these factors was a financial system vulnerable to self-reinforcing asset price and credit cycles.[33]Paul Krugman, laureate of the Nobel Prize in Economics, described the run on the shadow banking system as the "core of what happened" to cause the crisis. He referred to this lack of controls as "malign neglect" and argued that regulation should have been imposed on all banking-like activity.[95]

The securitization markets supported by the shadow banking system started to close down in the spring of 2007 and nearly shut-down in the fall of 2008. More than a third of the private credit markets thus became unavailable as a source of funds.[133] According to the Brookings Institution, the traditional banking system does not have the capital to close this gap as of June 2009: "It would take a number of years of strong profits to generate sufficient capital to support that additional lending volume." The authors also indicate that some forms of securitization are "likely to vanish forever, having been an artifact of excessively loose credit conditions."[134]

Economist Mark Zandi testified to the Financial Crisis Inquiry Commission in January 2010: "The securitization markets also remain impaired, as investors anticipate more loan losses. Investors are also uncertain about coming legal and accounting rule changes and regulatory reforms. Private bond issuance of residential and commercial mortgage-backed securities, asset-backed securities, and CDOs peaked in 2006 at close to $2 trillion...In 2009, private issuance was less than $150 billion, and almost all of it was asset-backed issuance supported by the Federal Reserve's TALF program to aid credit card, auto and small-business lenders. Issuance of residential and commercial mortgage-backed securities and CDOs remains dormant."[135]

[edit] Commodities boom

Main article: 2000s commodities boom

Rapid increases in a number of commodity prices followed the collapse in the housing bubble. The price of oil nearly tripled from $50 to $147 from early 2007 to 2008, before plunging as the financial crisis began to take hold in late 2008.[136] Experts debate the causes, with some attributing it to speculative flow of money from housing and other investments into commodities, some to monetary policy,[137] and some to the increasing feeling of raw materials scarcity in a fast growing world, leading to long positions taken on those markets, such as Chinese increasing presence in Africa. An increase in oil prices tends to divert a larger share of consumer spending into gasoline, which creates downward pressure on economic growth in oil importing countries, as wealth flows to oil-producing states.[138] A pattern of spiking instability in the price of oil over the decade leading up to the price high of 2008 has been recently identified.[139] The destabilizing effects of this price variance has been proposed as a contributory factor in the financial crisis.In testimony before the Senate Committee on Commerce, Science, and Transportation on June 3, 2008, former director of the CFTC Division of Trading & Markets (responsible for enforcement) Michael Greenberger specifically named the Atlanta-based IntercontinentalExchange, founded by Goldman Sachs, Morgan Stanley and BP as playing a key role in speculative run-up of oil futures prices traded off the regulated futures exchanges in London and New York.[140] However, the IntercontinentalExchange (ICE) had been regulated by both European and U.S. authorities since its purchase of the International Petroleum Exchange in 2001. Mr Greenberger was later corrected on this matter.[141]

Copper prices increased at the same time as the oil prices. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600. The price slump lasted until 2004 which saw a price surge that had copper reaching $7,040 per tonne in 2008.[142]

Nickel prices boomed in the late 1990s, then the price of nickel imploded from around $51,000 /£36,700 per metric ton in May 2007 to about $11,550/£8,300 per metric ton in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then.[143] As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian nickel mining industry.[144]

Coincidentally with these price fluctuations, long-only commodity index funds became popular – by one estimate investment increased from $90 billion in 2006 to $200 billion at the end of 2007, while commodity prices increased 71% – which raised concern as to whether these index funds caused the commodity bubble.[145] The empirical research has been mixed.[145]

[edit] Systemic crisis

Another analysis, different from the mainstream explanation, is that the financial crisis is merely a symptom of another, deeper crisis, which is a systemic crisis of capitalism itself.[146]Ravi Batra's theory is that growing inequality of financial capitalism produces speculative bubbles that burst and result in depression and major political changes. He has also suggested that a "demand gap" related to differing wage and productivity growth explains deficit and debt dynamics important to stock market developments.[147][148]

John Bellamy Foster, a political economy analyst and editor of the Monthly Review, believes that the decrease in GDP growth rates since the early 1970s is due to increasing market saturation.[149]

John C. Bogle wrote during 2005 that a series of unresolved challenges face capitalism that have contributed to past financial crises and have not been sufficiently addressed:

Corporate America went astray largely because the power of managers went virtually unchecked by our gatekeepers for far too long... They failed to 'keep an eye on these geniuses' to whom they had entrusted the responsibility of the management of America's great corporations.Echoing the central thesis of James Burnham's 1941 seminal book, The Managerial Revolution, Bolge cites particular issues, including:[150][151]

- that "Manager's capitalism" has replaced "owner's capitalism", meaning management runs the firm for its benefit rather than for the shareholders, a variation on the principal–agent problem;

- the burgeoning executive compensation;

- the management of earnings, mainly a focus on share price rather than the creation of genuine value; and

- the failure of gatekeepers, including auditors, boards of directors, Wall Street analysts, and career politicians.

Robert Reich has attributed the current economic downturn to the stagnation of wages in the United States, particularly those of the hourly workers who comprise 80% of the workforce. His claim is that this stagnation forced the population to borrow in order to meet the cost of living.[153]

[edit] Role of economic forecasting

The financial crisis was not widely predicted by mainstream economists, who instead spoke of the Great Moderation. A number of heterodox economists predicted the crisis, with varying arguments. Dirk Bezemer in his research[154] credits (with supporting argument and estimates of timing) 12 economists with predicting the crisis: Dean Baker (US), Wynne Godley (UK), Fred Harrison (UK), Michael Hudson (US), Eric Janszen (US), Steve Keen (Australia), Jakob Brøchner Madsen & Jens Kjaer Sørensen (Denmark), Kurt Richebächer (US), Nouriel Roubini (US), Peter Schiff (US), and Robert Shiller (US). Examples of other experts who gave indications of a financial crisis have also been given.[155][156][157] Not surprisingly, the Austrian economic school regarded the crisis as a vindication and classic example of a predictable credit-fueled bubble that could not forestall the disregarded but inevitable effect of an artificial, manufactured laxity in monetary supply,[158] a perspective that even former Fed Chair Alan Greenspan in Congressional testimony confessed himself forced to return to.[159]A cover story in BusinessWeek magazine claims that economists mostly failed to predict the worst international economic crisis since the Great Depression of 1930s.[160] The Wharton School of the University of Pennsylvania's online business journal examines why economists failed to predict a major global financial crisis.[161] Popular articles published in the mass media have led the general public to believe that the majority of economists have failed in their obligation to predict the financial crisis. For example, an article in the New York Times informs that economist Nouriel Roubini warned of such crisis as early as September 2006, and the article goes on to state that the profession of economics is bad at predicting recessions.[162] According to The Guardian, Roubini was ridiculed for predicting a collapse of the housing market and worldwide recession, while The New York Times labelled him "Dr. Doom".[163]

Shiller, an expert in housing markets, wrote an article a year before the collapse of Lehman Brothers in which he predicted that a slowing US housing market would cause the housing bubble to burst, leading to financial collapse.[164] Schiff regularly appeared on television in the years before the crisis and warned of the impending real estate collapse.[165]

Within mainstream financial economics, most believe that financial crises are simply unpredictable,[166] following Eugene Fama's efficient-market hypothesis and the related random-walk hypothesis, which state respectively that markets contain all information about possible future movements, and that the movement of financial prices are random and unpredictable. Recent research casts doubt on the accuracy of "early warning" systems of potential crises, which must also predict their timing.[167]

Lebanese-American trader and financial risk engineer Nassim Nicholas Taleb, author of the 2007 book The Black Swan, spent years warning against the breakdown of the banking system in particular and the economy in general owing to their use of bad risk models and reliance on forecasting, and their reliance on bad models, and framed the problem as part of "robustness and fragility".[168][169] He also took action against the establishment view by making a big financial bet on banking stocks and making a fortune from the crisis ("They didn't listen, so I took their money").[170] According to David Brooks from the New York Times, "Taleb not only has an explanation for what’s happening, he saw it coming."[171]

[edit] Impact on financial markets

[edit] US stock market

The US stock market peaked in October 2007, when the Dow Jones Industrial Average index exceeded 14,000 points. It then entered a pronounced decline, which accelerated markedly in October 2008. By March 2009, the Dow Jones average had reached a trough of around 6,600. It has since recovered much of the decline, exceeding 12,000 during most of 2011, and occasionally reaching 13,000 in 2012. It is probable, but debated, whether the Federal Reserve's aggressive policy of quantitative easing spurred the partial recovery in the stock market.[172][173][174]Market strategist Phil Dow believes distinctions exist "between the current market malaise" and the Great Depression. He says the Dow Jones average's fall of more than 50% over a period of 17 months is similar to a 54.7% fall in the Great Depression, followed by a total drop of 89% over the following 16 months. "It's very troubling if you have a mirror image," said Dow.[175] Floyd Norris, the chief financial correspondent of The New York Times, wrote in a blog entry in March 2009 that the decline has not been a mirror image of the Great Depression, explaining that although the decline amounts were nearly the same at the time, the rates of decline had started much faster in 2007, and that the past year had only ranked eighth among the worst recorded years of percentage drops in the Dow. The past two years ranked third, however.[176]

[edit] Financial institutions

The International Monetary Fund estimated that large U.S. and European banks lost more than $1 trillion on toxic assets and from bad loans from January 2007 to September 2009. These losses are expected to top $2.8 trillion from 2007–10. U.S. banks losses were forecast to hit $1 trillion and European bank losses will reach $1.6 trillion. The International Monetary Fund (IMF) estimated that U.S. banks were about 60% through their losses, but British and eurozone banks only 40%.[177]

One of the first victims was Northern Rock, a medium-sized British bank.[178] The highly leveraged nature of its business led the bank to request security from the Bank of England. This in turn led to investor panic and a bank run[179] in mid-September 2007. Calls by Liberal Democrat Treasury Spokesman Vince Cable to nationalise the institution were initially ignored; in February 2008, however, the British government (having failed to find a private sector buyer) relented, and the bank was taken into public hands. Northern Rock's problems proved to be an early indication of the troubles that would soon befall other banks and financial institutions.

Initially the companies affected were those directly involved in home construction and mortgage lending such as Northern Rock and Countrywide Financial, as they could no longer obtain financing through the credit markets. Over 100 mortgage lenders went bankrupt during 2007 and 2008. Concerns that investment bank Bear Stearns would collapse in March 2008 resulted in its fire-sale to JP Morgan Chase. The financial institution crisis hit its peak in September and October 2008. Several major institutions either failed, were acquired under duress, or were subject to government takeover. These included Lehman Brothers, Merrill Lynch, Fannie Mae, Freddie Mac, Washington Mutual, Wachovia, Citigroup, and AIG.[180]

[edit] Credit markets and the shadow banking system

During September 2008, the crisis hit its most critical stage. There was the equivalent of a bank run on the money market mutual funds, which frequently invest in commercial paper issued by corporations to fund their operations and payrolls. Withdrawal from money markets were $144.5 billion during one week, versus $7.1 billion the week prior. This interrupted the ability of corporations to rollover (replace) their short-term debt. The U.S. government responded by extending insurance for money market accounts analogous to bank deposit insurance via a temporary guarantee[181] and with Federal Reserve programs to purchase commercial paper. The TED spread, an indicator of perceived credit risk in the general economy, spiked up in July 2007, remained volatile for a year, then spiked even higher in September 2008,[182] reaching a record 4.65% on October 10, 2008.In a dramatic meeting on September 18, 2008, Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke met with key legislators to propose a $700 billion emergency bailout. Bernanke reportedly told them: "If we don't do this, we may not have an economy on Monday."[183] The Emergency Economic Stabilization Act, which implemented the Troubled Asset Relief Program (TARP), was signed into law on October 3, 2008.[184]

Economist Paul Krugman and U.S. Treasury Secretary Timothy Geithner explain the credit crisis via the implosion of the shadow banking system, which had grown to nearly equal the importance of the traditional commercial banking sector as described above. Without the ability to obtain investor funds in exchange for most types of mortgage-backed securities or asset-backed commercial paper, investment banks and other entities in the shadow banking system could not provide funds to mortgage firms and other corporations.[33][95]

This meant that nearly one-third of the U.S. lending mechanism was frozen and continued to be frozen into June 2009.[133] According to the Brookings Institution, the traditional banking system does not have the capital to close this gap as of June 2009: "It would take a number of years of strong profits to generate sufficient capital to support that additional lending volume." The authors also indicate that some forms of securitization are "likely to vanish forever, having been an artifact of excessively loose credit conditions." While traditional banks have raised their lending standards, it was the collapse of the shadow banking system that is the primary cause of the reduction in funds available for borrowing.[185]

[edit] Wealth effects

There is a direct relationship between declines in wealth, and declines in consumption and business investment, which along with government spending represent the economic engine. Between June 2007 and November 2008, Americans lost an estimated average of more than a quarter of their collective net worth.[citation needed] By early November 2008, a broad U.S. stock index the S&P 500, was down 45% from its 2007 high. Housing prices had dropped 20% from their 2006 peak, with futures markets signaling a 30–35% potential drop. Total home equity in the United States, which was valued at $13 trillion at its peak in 2006, had dropped to $8.8 trillion by mid-2008 and was still falling in late 2008. Total retirement assets, Americans' second-largest household asset, dropped by 22%, from $10.3 trillion in 2006 to $8 trillion in mid-2008. During the same period, savings and investment assets (apart from retirement savings) lost $1.2 trillion and pension assets lost $1.3 trillion. Taken together, these losses total a staggering $8.3 trillion.[186] Since peaking in the second quarter of 2007, household wealth is down $14 trillion.[187]Further, U.S. homeowners had extracted significant equity in their homes in the years leading up to the crisis, which they could no longer do once housing prices collapsed. Free cash used by consumers from home equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion over the period.[106][107][108] U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion.[109]

To offset this decline in consumption and lending capacity, the U.S. government and U.S. Federal Reserve have committed $13.9 trillion, of which $6.8 trillion has been invested or spent, as of June 2009.[188] In effect, the Fed has gone from being the "lender of last resort" to the "lender of only resort" for a significant portion of the economy. In some cases the Fed can now be considered the "buyer of last resort".

In November, 2008, economist Dean Baker observed: "There is a really good reason for tighter credit. Tens of millions of homeowners who had substantial equity in their homes two years ago have little or nothing today. Businesses are facing the worst downturn since the Great Depression. This matters for credit decisions. A homeowner with equity in her home is very unlikely to default on a car loan or credit card debt. They will draw on this equity rather than lose their car and/or have a default placed on their credit record. On the other hand, a homeowner who has no equity is a serious default risk. In the case of businesses, their creditworthiness depends on their future profits. Profit prospects look much worse in November 2008 than they did in November 2007... While many banks are obviously at the brink, consumers and businesses would be facing a much harder time getting credit right now even if the financial system were rock solid. The problem with the economy is the loss of close to $6 trillion in housing wealth and an even larger amount of stock wealth.[189]

At the heart of the portfolios of many of these institutions were investments whose assets had been derived from bundled home mortgages. Exposure to these mortgage-backed securities, or to the credit derivatives used to insure them against failure, caused the collapse or takeover of several key firms such as Lehman Brothers, AIG, Merrill Lynch, and HBOS.[190][191][192]

[edit] European contagion

The crisis rapidly developed and spread into a global economic shock, resulting in a number of European bank failures, declines in various stock indexes, and large reductions in the market value of equities[193] and commodities.[194]Both MBS and CDO were purchased by corporate and institutional investors globally. Derivatives such as credit default swaps also increased the linkage between large financial institutions. Moreover, the de-leveraging of financial institutions, as assets were sold to pay back obligations that could not be refinanced in frozen credit markets, further accelerated the solvency crisis and caused a decrease in international trade.

World political leaders, national ministers of finance and central bank directors coordinated their efforts[195] to reduce fears, but the crisis continued. At the end of October 2008 a currency crisis developed, with investors transferring vast capital resources into stronger currencies such as the yen, the dollar and the Swiss franc, leading many emergent economies to seek aid from the International Monetary Fund.[196][197]

[edit] Effects on the global economy

Main article: 2008–2012 global recession

[edit] Global effects

A number of commentators have suggested that if the liquidity crisis continues, there could be an extended recession or worse.[198] The continuing development of the crisis has prompted in some quarters fears of a global economic collapse although there are now many cautiously optimistic forecasters in addition to some prominent sources who remain negative.[199] The financial crisis is likely to yield the biggest banking shakeout since the savings-and-loan meltdown.[200] Investment bank UBS stated on October 6 that 2008 would see a clear global recession, with recovery unlikely for at least two years.[201] Three days later UBS economists announced that the "beginning of the end" of the crisis had begun, with the world starting to make the necessary actions to fix the crisis: capital injection by governments; injection made systemically; interest rate cuts to help borrowers. The United Kingdom had started systemic injection, and the world's central banks were now cutting interest rates. UBS emphasized the United States needed to implement systemic injection. UBS further emphasized that this fixes only the financial crisis, but that in economic terms "the worst is still to come".[202] UBS quantified their expected recession durations on October 16: the Eurozone's would last two quarters, the United States' would last three quarters, and the United Kingdom's would last four quarters.[203] The economic crisis in Iceland involved all three of the country's major banks. Relative to the size of its economy, Iceland’s banking collapse is the largest suffered by any country in economic history.[204]At the end of October UBS revised its outlook downwards: the forthcoming recession would be the worst since the early 1980s recession with negative 2009 growth for the U.S., Eurozone, UK; very limited recovery in 2010; but not as bad as the Great Depression.[205]

The Brookings Institution reported in June 2009 that U.S. consumption accounted for more than a third of the growth in global consumption between 2000 and 2007. "The US economy has been spending too much and borrowing too much for years and the rest of the world depended on the U.S. consumer as a source of global demand." With a recession in the U.S. and the increased savings rate of U.S. consumers, declines in growth elsewhere have been dramatic. For the first quarter of 2009, the annualized rate of decline in GDP was 14.4% in Germany, 15.2% in Japan, 7.4% in the UK, 18% in Latvia,[206] 9.8% in the Euro area and 21.5% for Mexico.[207]

Some developing countries that had seen strong economic growth saw significant slowdowns. For example, growth forecasts in Cambodia show a fall from more than 10% in 2007 to close to zero in 2009, and Kenya may achieve only 3–4% growth in 2009, down from 7% in 2007. According to the research by the Overseas Development Institute, reductions in growth can be attributed to falls in trade, commodity prices, investment and remittances sent from migrant workers (which reached a record $251 billion in 2007, but have fallen in many countries since).[208] This has stark implications and has led to a dramatic rise in the number of households living below the poverty line, be it 300,000 in Bangladesh or 230,000 in Ghana.[208]

The World Bank reported in February 2009 that the Arab World was far less severely affected by the credit crunch. With generally good balance of payments positions coming into the crisis or with alternative sources of financing for their large current account deficits, such as remittances, Foreign Direct Investment (FDI) or foreign aid, Arab countries were able to avoid going to the market in the latter part of 2008. This group is in the best position to absorb the economic shocks. They entered the crisis in exceptionally strong positions. This gives them a significant cushion against the global downturn. The greatest impact of the global economic crisis will come in the form of lower oil prices, which remains the single most important determinant of economic performance. Steadily declining oil prices would force them to draw down reserves and cut down on investments. Significantly lower oil prices could cause a reversal of economic performance as has been the case in past oil shocks. Initial impact will be seen on public finances and employment for foreign workers.[209]

[edit] U.S. economic effects

[edit] Real gross domestic product

The output of goods and services produced by labor and property located in the United States—decreased at an annual rate of approximately 6% in the fourth quarter of 2008 and first quarter of 2009, versus activity in the year-ago periods.[210] The U.S. unemployment rate increased to 10.1% by October 2009, the highest rate since 1983 and roughly twice the pre-crisis rate. The average hours per work week declined to 33, the lowest level since the government began collecting the data in 1964.[211][212][edit] Distribution of wealth in the USA

Typical American families did not fare as well, nor did those "wealthy-but-not wealthiest" families just beneath the pyramid's top. On the other hand, half of the poorest families did not have wealth declines at all during the crisis. The Federal Reserve surveyed 4,000 households between 2007 and 2009, and found that the total wealth of 63 percent of all Americans declined in that period. 77 percent of the richest families had a decrease in total wealth, while only 50 percent of those on the bottom of the pyramid suffered a decrease.[213][214][215][edit] Official economic projections

On November 3, 2008, the European Commission at Brussels predicted for 2009 an extremely weak growth of GDP, by 0.1%, for the countries of the Eurozone (France, Germany, Italy, Belgium etc.) and even negative number for the UK (−1.0%), Ireland and Spain. On November 6, the IMF at Washington, D.C., launched numbers predicting a worldwide recession by −0.3% for 2009, averaged over the developed economies. On the same day, the Bank of England and the European Central Bank, respectively, reduced their interest rates from 4.5% down to 3%, and from 3.75% down to 3.25%. As a consequence, starting from November 2008, several countries launched large "help packages" for their economies.The U.S. Federal Reserve Open Market Committee release in June 2009 stated:

...the pace of economic contraction is slowing. Conditions in financial markets have generally improved in recent months. Household spending has shown further signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Businesses are cutting back on fixed investment and staffing but appear to be making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.[216] Economic projections from the Federal Reserve and Reserve Bank Presidents include a return to typical growth levels (GDP) of 2–3% in 2010; an unemployment plateau in 2009 and 2010 around 10% with moderation in 2011; and inflation that remains at typical levels around 1–2%.[217]

[edit] Government responses

[edit] Emergency and short-term responses

Main article: Subprime mortgage crisis#Responses

The U.S. Federal Reserve and central banks around the world have taken steps to expand money supplies to avoid the risk of a deflationary spiral, in which lower wages and higher unemployment lead to a self-reinforcing decline in global consumption. In addition, governments have enacted large fiscal stimulus packages, by borrowing and spending to offset the reduction in private sector demand caused by the crisis. The U.S. executed two stimulus packages, totaling nearly $1 trillion during 2008 and 2009.[218] The U.S. Federal Reserve's new and expanded liquidity facilities were intended to enable the central bank to fulfill its traditional lender-of-last-resort role during the crisis while mitigating stigma, broadening the set of institutions with access to liquidity, and increasing the flexibility with which institutions could tap such liquidity.[219]This credit freeze brought the global financial system to the brink of collapse. The response of the Federal Reserve, the European Central Bank, and other central banks was immediate and dramatic. During the last quarter of 2008, these central banks purchased US$2.5 trillion of government debt and troubled private assets from banks. This was the largest liquidity injection into the credit market, and the largest monetary policy action, in world history. The governments of European nations and the USA also raised the capital of their national banking systems by $1.5 trillion, by purchasing newly issued preferred stock in their major banks.[180] In October 2010, Nobel laureate Joseph Stiglitz explained how the U.S. Federal Reserve was implementing another monetary policy —creating currency— as a method to combat the liquidity trap.[220] By creating $600,000,000,000 and inserting this directly into banks, the Federal Reserve intended to spur banks to finance more domestic loans and refinance mortgages. However, banks instead were spending the money in more profitable areas by investing internationally in emerging markets. Banks were also investing in foreign currencies, which Stiglitz and others point out may lead to currency wars while China redirects its currency holdings away from the United States.[221]

Governments have also bailed out a variety of firms as discussed above, incurring large financial obligations. To date, various U.S. government agencies have committed or spent trillions of dollars in loans, asset purchases, guarantees, and direct spending. For a summary of U.S. government financial commitments and investments related to the crisis, see CNN – Bailout Scorecard. Significant controversy has accompanied the bailout, leading to the development of a variety of "decision making frameworks", to help balance competing policy interests during times of financial crisis.[222]

[edit] Regulatory proposals and long-term responses

Further information: Obama financial regulatory reform plan of 2009, Regulatory responses to the subprime crisis, and Subprime mortgage crisis solutions debate

United States President Barack Obama and key advisers introduced a series of regulatory proposals in June 2009. The proposals address consumer protection, executive pay, bank financial cushions or capital requirements, expanded regulation of the shadow banking system and derivatives, and enhanced authority for the Federal Reserve to safely wind-down systemically important institutions, among others.[223][224][225] In January 2010, Obama proposed additional regulations limiting the ability of banks to engage in proprietary trading. The proposals were dubbed "The Volcker Rule", in recognition of Paul Volcker, who has publicly argued for the proposed changes.[226][227]The U.S. Senate passed a regulatory reform bill in May 2010, following the House which passed a bill in December 2009. These bills must now be reconciled. The New York Times provided a comparative summary of the features of the two bills, which address to varying extent the principles enumerated by the Obama administration.[228] For instance, the Volcker Rule against proprietary trading is not part of the legislation, though in the Senate bill regulators have the discretion but not the obligation to prohibit these trades.

European regulators introduced Basel III regulations for banks.[229] It increased capital ratios, limits on leverage, narrow definition of capital (to exclude subordinated debt), limit counter-party risk, and new liquidity requirements.[230] Critics argue that Basel III doesn’t address the problem of faulty risk-weightings. Major banks suffered losses from AAA-rated created by financial engineering (which creates apparently risk-free assets out of high risk collateral) that required less capital according to Basel II. Lending to AA-rated sovereigns has a risk-weight of zero, thus increasing lending to governments and leading to the next crisis.[231] Johan Norberg argues that regulations (Basel III among others) have indeed led to excessive lending to risky governments (see European sovereign-debt crisis) and the ECB pursues even more lending as the solution.[232]

[edit] United States Congress response

- On December 11, 2009 – House cleared bill H.R.4173 – Wall Street Reform and Consumer Protection Act of 2009.[233]

- On April 15, 2010 – Senate introduced bill S.3217 – Restoring American Financial Stability Act of 2010.[234]

- On July 21, 2010 – the Dodd–Frank Wall Street Reform and Consumer Protection Act was enacted.[235][236]

[edit] Court proceedings

In Iceland in April 2012, the special Landsdómur court convicted former Prime Minister Geir Haarde of mishandling the 2008–2012 Icelandic financial crisis.[edit] Continuation of the financial crisis in the U.S. housing market

As of 2012, in the United States, a large volume of troubled mortgages remained in place. It had proved impossible for most homeowners facing foreclosure to refinance or modify their mortgages and foreclosure rates remained high.[237][edit] Stabilization

The US recession that began in December 2007 ended in June 2009, according to the U.S. National Bureau of Economic Research (NBER)[238] and the financial crisis appears to have ended about the same time. In April 2009 TIME Magazine declared "More Quickly Than It Began, The Banking Crisis Is Over."[14] The United States Financial Crisis Inquiry Commission dates the crisis to 2008.[15][16] President Barack Obama declared on January 27, 2010, "the markets are now stabilized, and we've recovered most of the money we spent on the banks."[239]The New York Times identifies March, 2009 as the "nadir of the crisis" and notes that "Most stock markets around the world are at least 75 percent higher than they were then. Financial stocks, which led the markets down, have also led them up." Nevertheless, the lack of fundamental changes in banking and financial markets, worries many market participants, including the International Monetary Fund.[240]

[edit] Media coverage

The financial crises generated many articles and books outside of the scholarly and financial press, including articles and books by author William Greider, economist Michael Hudson, author and former bond salesman Michael Lewis, Kevin Phillips, and investment broker Peter Schiff.In May 2010 premiered Overdose: A Film about the Next Financial Crisis,[241] a documentary about how the financial crisis came about and how the solutions that have been applied by many governments are setting the stage for the next crisis. The film is based on the book Financial Fiasco by Johan Norberg and features Alan Greenspan, with funding from the libertarian think tank The Cato Institute. Greenspan is responsible for de-regulating the derivatives market while chairman of the Federal Reserve.

In October 2010, a documentary film about the crisis, Inside Job directed by Charles Ferguson, was released by Sony Pictures Classics. It was awarded an Academy Award for Best Documentary of 2010.

Time Magazine named "25 People to Blame for the Financial Crisis".[242]

[edit] Emerging and developing economies drive global economic growth

The financial crisis has caused the "emerging" and "developing" economies to replace "advanced" economies to lead global economic growth. Previously "advanced" economies accounted for only 29% of incremental global nominal GDP while emerging and developing economies accounted for 71% of incremental global nominal GDP from 2007 to 2012 according to International Monetary Fund.[243] In this graph, the names of emergent economies are shown in boldface type, while the names of declining developed economies are in Roman (regular) type.| Economy |

Nominal GDP (billions in USD)

|

|---|---|

| (01) | |

| (02) | |

| (03) | |

| (04) | |

| (05) | |

| (06) | |

| (07) | |

| (08) | |

| (09) | |

| (10) | |

| (11) | |

| (12) | |

| (13) | |

| (14) | |

| (15) | |

| (16) | |

| (17) | |

| (18) | |

| (19) | |

| (20) | |

| The twenty largest economies contributing to global nominal GDP growth (2007 - 2012)[244] | |

[edit] See also

- 2009 G-20 London summit protests

- 2008 Greek riots

- 2009 Icelandic financial crisis protests

- 2008–2011 bank failures in the United States

- 2008–2009 Keynesian resurgence

- 2009 May Day protests

- 2009 Moldova civil unrest

- 2010 United States foreclosure crisis

- 2012 May Day protests

- Crisis (Marxian)

- Europeans for Financial Reform

- Financial Crisis Responsibility Fee

- Kondratiev wave

- List of acquired or bankrupt banks in the late 2000s financial crisis

- List of acquired or bankrupt United States banks in the late 2000s financial crisis

- List of acronyms: European sovereign-debt crisis

- List of economic crises