Blogger Ref http://www.p2pfoundation.net/Transfinancial_Economics

Finance is a field that deals with the study of investments. It includes the dynamics of assets and liabilities over time under conditions of different degrees of uncertainty and risk. Finance can also be defined as the science of money management. Finance aims to price assets based on their risk level and their expected rate of return. Finance can be broken into three different sub-categories: public finance, corporate finance and personal finance.

Contents

[hide]Areas of finance[edit]

- Frankfurt Stock Exchange, European Center of finance, Frankfurt am Main.

- Wall Street, American centre of finance.

- London Stock Exchange, British centre of finance.

Personal finance[edit]

Questions in personal finance revolve around:- Protection against unforeseen personal events, as well as events in the wider economies

- Transference of family wealth across generations (bequests and inheritance)

- Effects of tax policies (tax subsidies or penalties) management of personal finances

- Effects of credit on individual financial standing

- Development of a savings plan or financing for large purchases (auto, education, home)

- Planning a secure financial future in an environment of economic instability

Warren Buffett is an American investor, business magnate, and philanthropist. He is considered by some to be one of the most successful investors in the world.

Personal finance may also involve paying for a loan, or debt obligations. The six key areas of personal financial planning, as suggested by the Financial Planning Standards Board, are:[1]

- Financial position: is concerned with understanding the personal resources available by examining net worth and household cash flow. Net worth is a person's balance sheet, calculated by adding up all assets under that person's control, minus all liabilities of the household, at one point in time. Household cash flow totals up all the expected sources of income within a year, minus all expected expenses within the same year. From this analysis, the financial planner can determine to what degree and in what time the personal goals can be accomplished.

- Adequate protection: the analysis of how to protect a household from unforeseen risks. These risks can be divided into the following: liability, property, death, disability, health and long term care. Some of these risks may be self-insurable, while most will require the purchase of an insurance contract. Determining how much insurance to get, at the most cost effective terms requires knowledge of the market for personal insurance. Business owners, professionals, athletes and entertainers require specialized insurance professionals to adequately protect themselves. Since insurance also enjoys some tax benefits, utilizing insurance investment products may be a critical piece of the overall investment planning.

- Tax planning: typically the income tax is the single largest expense in a household. Managing taxes is not a question of if you will pay taxes, but when and how much. Government gives many incentives in the form of tax deductions and credits, which can be used to reduce the lifetime tax burden. Most modern governments use a progressive tax. Typically, as one's income grows, a higher marginal rate of tax must be paid. Understanding how to take advantage of the myriad tax breaks when planning one's personal finances can make a significant impact in which it can later save you money in the long term.

- Investment and accumulation goals: planning how to accumulate enough money – for large purchases and life events – is what most people consider to be financial planning. Major reasons to accumulate assets include, purchasing a house or car, starting a business, paying for education expenses, and saving for retirement. Achieving these goals requires projecting what they will cost, and when you need to withdraw funds that will be necessary to be able to achieve these goals. A major risk to the household in achieving their accumulation goal is the rate of price increases over time, or inflation. Using net present value calculators, the financial planner will suggest a combination of asset earmarking and regular savings to be invested in a variety of investments. In order to overcome the rate of inflation, the investment portfolio has to get a higher rate of return, which typically will subject the portfolio to a number of risks. Managing these portfolio risks is most often accomplished using asset allocation, which seeks to diversify investment risk and opportunity. This asset allocation will prescribe a percentage allocation to be invested in stocks (either preferred stock or common stock), bonds (for example mutual bonds or government bonds, or corporate bonds), cash and alternative investments. The allocation should also take into consideration the personal risk profile of every investor, since risk attitudes vary from person to person.

- Retirement planning is the process of understanding how much it costs to live at retirement, and coming up with a plan to distribute assets to meet any income shortfall. Methods for retirement plan include taking advantage of government allowed structures to manage tax liability including: individual (IRA) structures, or employer sponsored retirement plans.

- Estate planning involves planning for the disposition of one's assets after death. Typically, there is a tax due to the state or federal government at one's death. Avoiding these taxes means that more of one's assets will be distributed to one's heirs. One can leave one's assets to family, friends or charitable groups.

Corporate finance[edit]

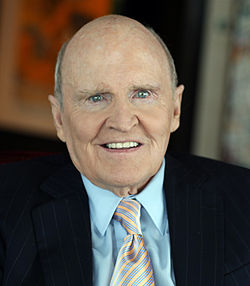

Jack Welch an American retired business executive, author, and chemical engineer. He was chairman and CEO of General Electric between 1981 and 2001. During his tenure at GE, the company's value rose 4,000%.

Corporate finance also includes within its scope business valuation, stock investing, or investment management. An investment is an acquisition of an asset in the hope that it will maintain or increase its value over time that will in hope give back a higher rate of return when it comes to disbursing dividends. In investment management – in choosing a portfolio – one has to use financial analysis to determine what, how much and when to invest. To do this, a company must:

- Identify relevant objectives and constraints: institution or individual goals, time horizon, risk aversion and tax considerations;

- Identify the appropriate strategy: active versus passive hedging strategy

- Measure the portfolio performance

James Harris Simons American mathematician, hedge fund manager, and philanthropist. He is known as a quantitative investor and in 1982 founded Renaissance Technologies, a private hedge fund based in New York City.

Financial risk management, an element of corporate finance, is the practice of creating and protecting economic value in a firm by using financial instruments to manage exposure to risk, particularly credit risk and market risk. (Other risk types include foreign exchange, shape, volatility, sector, liquidity, inflation risks, etc.) It focuses on when and how to hedge using financial instruments; in this sense it overlaps with financial engineering. Similar to general risk management, financial risk management requires identifying its sources, measuring it (see: Risk measure: Well known risk measures), and formulating plans to address these, and can be qualitative and quantitative. In the banking sector worldwide, the Basel Accords are generally adopted by internationally active banks for tracking, reporting and exposing operational, credit and market risks.[citation needed]

Financial services[edit]

An entity whose income exceeds its expenditure can lend or invest the excess income to help that excess income produce more income in the future. Though on the other hand, an entity whose income is less than its expenditure can raise capital by borrowing or selling equity claims, decreasing its expenses, or increasing its income. The lender can find a borrower—a financial intermediary such as a bank—or buy notes or bonds (corporate bonds, government bonds, or mutual bonds) in the bond market. The lender receives interest, the borrower pays a higher interest than the lender receives, and the financial intermediary earns the difference for arranging the loan.A bank aggregates the activities of many borrowers and lenders. A bank accepts deposits from lenders, on which it pays interest. The bank then lends these deposits to borrowers. Banks allow borrowers and lenders, of different sizes, to coordinate their activity.

Finance is used by individuals (personal finance), by governments (public finance), by businesses (corporate finance) and by a wide variety of other organizations such as schools and non-profit organizations. In general, the goals of each of the above activities are achieved through the use of appropriate financial instruments and methodologies, with consideration to their institutional setting.

Finance is one of the most important aspects of business management and includes analysis related to the use and acquisition of funds for the enterprise.

In corporate finance, a company's capital structure is the total mix of financing methods it uses to raise funds. One method is debt financing, which includes bank loans and bond sales. Another method is equity financing – the sale of stock by a company to investors, the original shareholders (they own a portion of the business) of a share. Ownership of a share gives the shareholder certain contractual rights and powers, which typically include the right to receive declared dividends and to vote the proxy on important matters (e.g., board elections). The owners of both bonds (either government bonds or corporate bonds) and stock (whether its preferred stock or common stock), may be institutional investors – financial institutions such as investment banks and pension funds or private individuals, called private investors or retail investors.

Public finance[edit]

Public finance describes finance as related to sovereign states and sub-national entities (states/provinces, counties, municipalities, etc.) and related public entities (e.g. school districts) or agencies. It usually encompasses a long-term, strategic perspective regarding investment decisions that affect public entities.[2] These long-term, strategic periods usually encompass five or more years.[3] Public finance is primarily concerned with:- Identification of required expenditure of a public sector entity

- Source(s) of that entity's revenue

- The budgeting process

- Debt issuance (municipal bonds) for public works projects

Capital[edit]

Capital, in the financial sense, is the money that gives the business the power to buy goods to be used in the production of other goods or the offering of a service. (The capital has two types of resources, Equity and Debt).The deployment of capital is decided by the budget. This may include the objective of business, targets set, and results in financial terms, e.g., the target set for sale, resulting cost, growth, required investment to achieve the planned sales, and financing source for the investment.

A budget may be long term or short term. Long term budgets have a time horizon of 5–10 years giving a vision to the company; short term is an annual budget which is drawn to control and operate in that particular year.

Budgets will include proposed fixed asset requirements and how these expenditures will be financed. Capital budgets are often adjusted annually (done every year) and should be part of a longer-term Capital Improvements Plan.

A cash budget is also required. The working capital requirements of a business are monitored at all times to ensure that there are sufficient funds available to meet short-term expenses.

The cash budget is basically a detailed plan that shows all expected sources and uses of cash when it comes to spending it appropriately. The cash budget has the following six main sections:

- Beginning Cash Balance – contains the last period's closing cash balance, in other words, the remaining cash from last years earnings.

- Cash collections – includes all expected cash receipts (all sources of cash for the period considered, mainly sales)

- Cash disbursements – lists all planned cash outflows for the period such as dividend, excluding interest payments on short-term loans, which appear in the financing section. All expenses that do not affect cash flow are excluded from this list (e.g. depreciation, amortization, etc.)

- Cash excess or deficiency – a function of the cash needs and cash available. Cash needs are determined by the total cash disbursements plus the minimum cash balance required by company policy. If total cash available is less than cash needs, a deficiency exists.

- Financing – discloses the planned borrowings and repayments of those planned borrowings, including interest.

Financial theory[edit]

Financial economics[edit]

Financial economics is the branch of economics studying the interrelation of financial variables, such as prices, interest rates and shares, as opposed to goods and services. Financial economics concentrates on influences of real economic variables on financial ones, in contrast to pure finance. It centres on managing risk in the context of the financial markets, and the resultant economic and financial models. It essentially explores how rational investors would apply risk and return to the problem of an investment policy. Here, the twin assumptions of rationality and market efficiency lead to modern portfolio theory (the CAPM), and to the Black–Scholes theory for option valuation; it further studies phenomena and models where these assumptions do not hold, or are extended. "Financial economics", at least formally, also considers investment under "certainty" (Fisher separation theorem, "theory of investment value", Modigliani–Miller theorem) and hence also contributes to corporate finance theory. Financial econometrics is the branch of financial economics that uses econometric techniques to parameterize the relationships suggested.Although closely related, the disciplines of economics and finance are distinctive. The “economy” is a social institution that organizes a society’s production, distribution, and consumption of goods and services, all of which must be financed.

Economists make a number of abstract assumptions for purposes of their analyses and predictions. They generally regard financial markets that function for the financial system as an efficient mechanism (Efficient-market hypothesis). Instead, financial markets are subject to human error and emotion.[5] New research discloses the mischaracterization of investment safety and measures of financial products and markets so complex that their effects, especially under conditions of uncertainty, are impossible to predict. The study of finance is subsumed under economics as financial economics, but the scope, speed, power relations and practices of the financial system can uplift or cripple whole economies and the well-being of households, businesses and governing bodies within them—sometimes in a single day.

Financial mathematics[edit]

Financial mathematics is a field of applied mathematics, concerned with financial markets. The subject has a close relationship with the discipline of financial economics, which is concerned with much of the underlying theory that is involved in financial mathematics. Generally, mathematical finance will derive, and extend, the mathematical or numerical models suggested by financial economics. In terms of practice, mathematical finance also overlaps heavily with the field of computational finance (also known as financial engineering). Arguably, these are largely synonymous, although the latter focuses on application, while the former focuses on modelling and derivation (see: Quantitative analyst). The field is largely focused on the modelling of derivatives, although other important subfields include insurance mathematics and quantitative portfolio problems. See Outline of finance: Mathematical tools; Outline of finance: Derivatives pricing.Experimental finance[edit]

Experimental finance aims to establish different market settings and environments to observe experimentally and provide a lens through which science can analyze agents' behavior and the resulting characteristics of trading flows, information diffusion and aggregation, price setting mechanisms, and returns processes. Researchers in experimental finance can study to what extent existing financial economics theory makes valid predictions and therefore prove them, and attempt to discover new principles on which such theory can be extended and be applied to future financial decisions. Research may proceed by conducting trading simulations or by establishing and studying the behavior, and the way that these people act or react, of people in artificial competitive market-like settings.Behavioral finance[edit]

Behavioral finance studies how the psychology of investors or managers affects financial decisions and markets when making a decision that can impact either negatively or positively on one of their areas. Behavioral finance has grown over the last few decades to become central and very important to finance.[6]Behavioral finance includes such topics as:

- Empirical studies that demonstrate significant deviations from classical theories.

- Models of how psychology affects and impacts trading and prices

- Forecasting based on these methods.

- Studies of experimental asset markets and use of models to forecast experiments.

Professional qualifications[edit]

There are several related professional qualifications, that can lead to the field:- Generalist Finance qualifications:

- Degrees: Master of Science in Finance (MSF), Master of Finance (M.Fin), Master of Financial Economics, Master of Applied Finance, Master of Liberal Arts in Finance (ALM.Fin)

- Certifications: Chartered Financial Analyst (CFA), Certified Treasury Professional (CTP), Certified Valuation Analyst (CVA), Certified Patent Valuation Analyst (CPVA), Chartered Business Valuator (CBV), Certified International Investment Analyst (CIIA), Financial Risk Manager (FRM), Professional Risk Manager (PRM), Association of Corporate Treasurers (ACT), Certified Market Analyst (CMA/FAD) Dual Designation, Corporate Finance Qualification (CF), Chartered Alternative Investment Analyst (CAIA), Chartered Investment Manager (CIM)

- Quantitative Finance qualifications: Master of Financial Engineering (MSFE), Master of Quantitative Finance (MQF), Master of Computational Finance (MCF), Master of Financial Mathematics (MFM), Certificate in Quantitative Finance (CQF).

- Accountancy qualifications:

- Qualified accountant: Chartered Certified Accountant (ACCA, UK certification), Chartered Accountant (ACA – England & Wales certification / CA – certification in Scotland and Commonwealth countries), Certified Public Accountant (CPA, US certification), ACMA/FCMA (Associate/Fellow Chartered Management Accountant) from Chartered Institute of Management Accountant (CIMA), UK.

- Non-statutory qualifications: Chartered Cost Accountant CCA Designation from AAFM

- Business qualifications: Master of Business Administration (MBA), Master of Management (MM), Master of Commerce (M.Comm), Master of Science in Management (MSM), Doctor of Business Administration (DBA)

Unsolved problems in finance[edit]

As the debate to whether finance is an art or a science is still open,[7] there have been recent efforts to organize a list of unsolved problems in finance.See also[edit]

References[edit]

- Jump up ^ "Financial Planning Curriculum Framework". Financial Planning Standards Board. 2011. Archived from the original on 1 February 2012. Retrieved 7 April 2012.

- Jump up ^ Doss, Daniel; Sumrall, William; Jones, Don (2012). Strategic Finance for Criminal Justice Organizations (1st ed.). Boca Raton, Florida: CRC Press. p. 23. ISBN 978-1439892237.

- Jump up ^ Doss, Daniel; Sumrall, William; Jones, Don (2012). Strategic Finance for Criminal Justice Organizations (1st ed.). Boca Raton, Florida: CRC Press. pp. 53–54. ISBN 978-1439892237.

- Jump up ^ Board of Governors of Federal Reserve System of the United States. Mission of the Federal Reserve System. Federalreserve.gov Accessed: 2010-01-16. (Archived by WebCite at Archived 2010-01-16 at WebCite)

- Jump up ^ Berezin, M. (2005). "Emotions and the Economy" in Smelser, N.J. and R. Swedberg (eds.) The Handbook of Economic Sociology, Second Edition. Princeton University Press: Princeton, NJ

- Jump up ^ Shefrin, Hersh (2002). Beyond greed and fear: Understanding behavioral finance and the psychology of investing. New York, NY: Oxford University Press. p. ix. ISBN 978-0195304213. Retrieved 8 May 2017.

- Jump up ^ "Is finance an art or a science?". Investopedia. Retrieved 2015-11-11.

External links[edit]

| Look up finance in Wiktionary, the free dictionary. |

| Wikiquote has quotations related to: Finance |

| Wikisource has the text of the 1921 Collier's Encyclopedia article Finance. |

- Learn Finance Step by step with infographics tools

- OECD work on financial markets Observation of UK Finance Market

- Wharton Finance Knowledge Project – aimed to offer free access to finance knowledge for students, teachers, and self-learners.

- Professor Aswath Damodaran (New York University Stern School of Business) – provides resources covering three areas in finance: corporate finance, valuation and investment management and syndicate finance.